A pension fund is like a beacon for retirees’ dreams. It represents more than just savings. It is a covenant between the company and its workforce, promising a secure future. But what if, beneath this symbol of stability, a storm is brewing, one that threatens to unsettle the very foundations of their trust and well-being?

The initial tremor is subtle. Interest rates shift unpredictably due to geopolitical tensions. Commodity prices skyrocket, and a corporate scandal sends ripples through the finance world. The fund’s investments in equities start to lose value. Bond yields become erratic. The first domino wobbles, poised to set off an unstoppable chain reaction.

Retirees, once confident in their financial future, now face the prospect of reduced pensions. Simultaneously, the company’s current employees watch in alarm. The trust they placed in their employer’s pension promises begins to erode. Morale drops, productivity suffers, and a wave of concern washes over the workforce. The brightest talent starts to look elsewhere, fearing their retirement plans might also evaporate.

As employee dissatisfaction becomes palpable, the company’s operational stability is threatened. Investors, sensing the unease, start to question the firm’s viability. The stock prices reflect this loss of confidence, dropping sharply.

The broader market takes note. Other firms with similar pension setups come under scrutiny. Investors and analysts comb through pension fund statuses, wary of similar vulnerabilities. A single company’s pension woes become a cautionary tale, sparking fears of a wider systemic issue.

Regulators and policymakers spring into action, propelled by the urgent need to prevent a cascade of similar failures. New regulations are fast-tracked, aiming to shore up pension fund resilience but also imposing new burdens on already struggling companies.

Does this sound familiar? It should – the United Airlines employees have not forgotten.

In our modern interconnected financial web, the failure of one pension fund has the potential to trigger a series of fallouts, echoing far beyond its immediate sphere. The stability of the entire financial system hinges on these interconnected chains of trust and obligation, each link vulnerable to the tremors set off by another’s failure.

This highlights the critical importance of Pension Risk Transfer (PRT). It is not just a tool for financial management – it’s a bulwark against the domino effect of economic consequences. By securing pension promises with PRT, companies can avert the initial wobble that threatens to bring down the entire structure. Let us find out how PRT is safeguarding not only retirees’ futures but also the economic fabric woven around their well-being.

Understanding Pension Risk Transfer

Pension Risk Transfer (PRT) is the financial world’s safety net. It is the strategy companies employ to shift pension responsibilities to someone more equipped to handle them: insurers. Think of it as playing a high-stakes poker game where PRT is your ace up the sleeve. It ensures that retirees receive their pensions reliably, allowing companies to focus on their core business, free from the weight of pension liabilities.

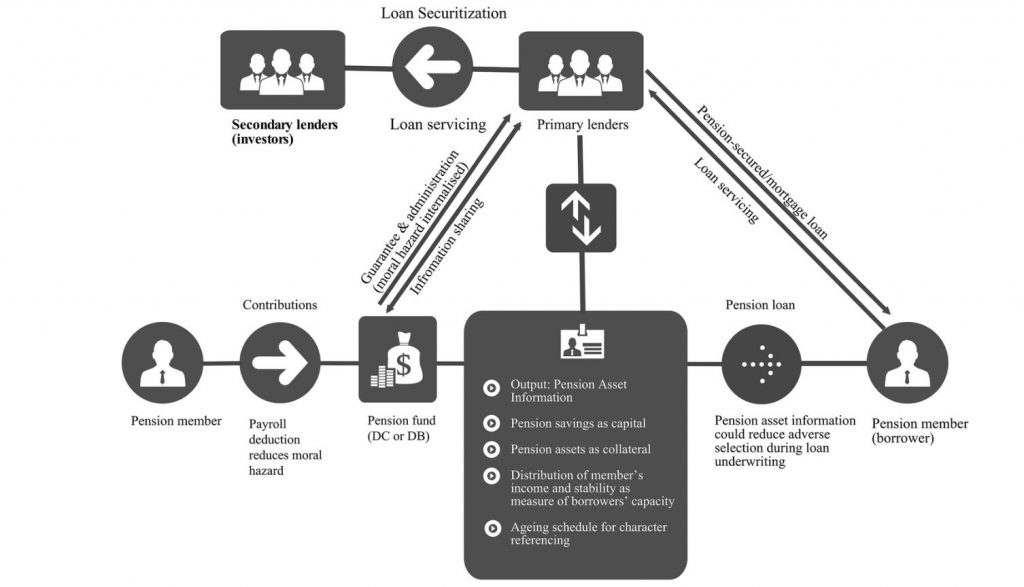

Pension asset-backed risk mitigation model

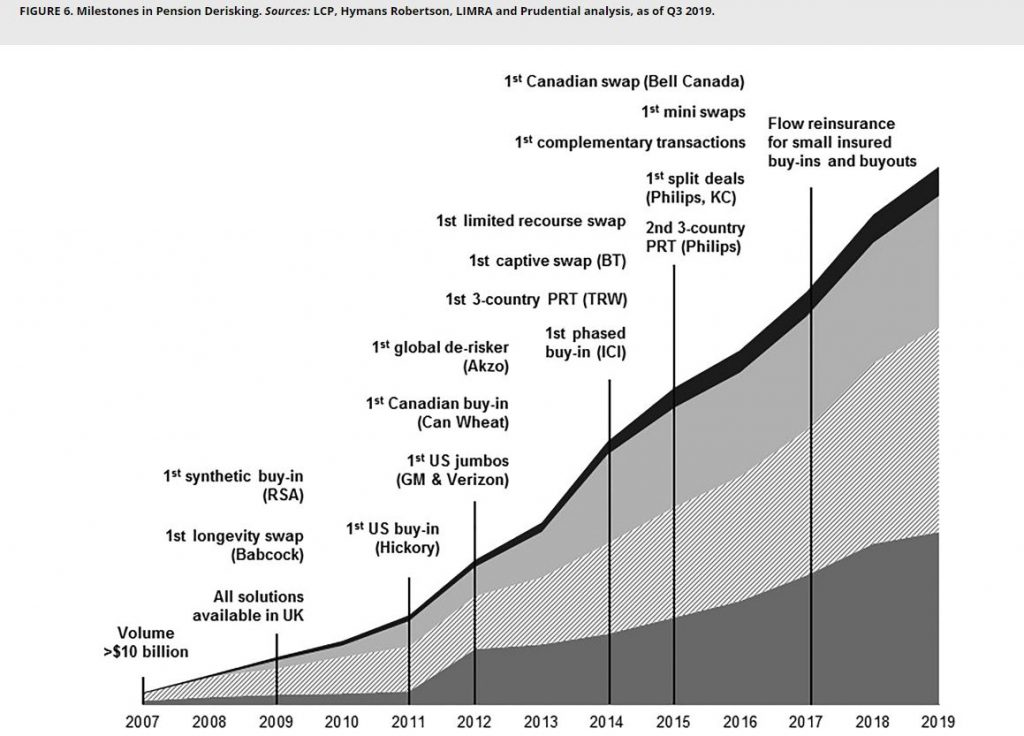

PRT was not always the go-to strategy it is today. Its story begins in the late 20th century when companies started realizing that the pensions, they promised were becoming a financial behemoth. Pension funds were hard to tame with the market’s unpredictability and the increasing longevity of retirees.

The 1980s and 1990s marked the early stages of PRT’s history, where the concept began to take shape. Initially, these were tentative steps, with companies exploring reinsurance contracts to offload some of their pension risks. But as the new millennium dawned, the landscape had shifted dramatically.

The dot-com bubble burst, followed by the financial crisis of 2008, which underscored the vulnerability of pension funds to market shocks. These events were pivotal, serving as wake-up calls for corporations to seek more robust solutions for pension risk.

PRT began to gain traction as a strategic solution, not just for mitigating risks but also for transforming them into opportunities for stability and growth.

Types of Pension Risk Transfers

In the PRT toolkit, several tools stand out for their popularity and effectiveness:

- Annuity Buy-ins and Buy-outs: In a buy-in, the company buys a policy from an insurer who takes on the pension payments, but the company holds onto the pension liabilities. It is like hiring a substitute teacher while still keeping an eye on the class. A buy-out, on the other hand, is when the company hands over the entire pension scheme to the insurer, washing its hands clean of future obligations – a full-on teacher replacement.

- Longevity Swaps: This is where companies play a game of ‘hot potato’ with the risk of retirees living longer than expected. They pass this risk to an insurer or a financial entity, agreeing on a fixed stream of payments in exchange for coverage against the cost of increased longevity. Just like swapping a roller-coaster ride for a slightly bumpy one, ensuring no surprises down the road.

- Lift-outs: This is a transaction where only a portion of the pension plan’s participants is transferred to an insurance company, which can be done through either a buy-in or buyout.

- Plan Terminations: This is a complete transfer where the insurance company takes over all of the plan sponsor’s pension obligations, and the existing plan is closed from the plan sponsor’s perspective.

Key Players in the PRT Market

The PRT market features several crucial participants.

Insurers: They take on the pension obligations. Their expertise in risk and capital management makes them ideal for this role.

Pension Schemes: These are the plans looking to secure their futures. They aim to fulfill their promises to retirees.

Advisors: They guide the process, offering strategic insights. Their expertise ensures that pension schemes find the best PRT solutions.

The Need for Pension Risk Transfer

Imagine a snowball rolling down a hill, gathering more snow and momentum with each turn. This snowball is a foreshadowing of the pension liabilities that many companies face today – growing larger and more daunting over time. As people live longer and retirement periods extend, the snowball becomes a potential avalanche, threatening to overwhelm the financial stability of pension schemes.

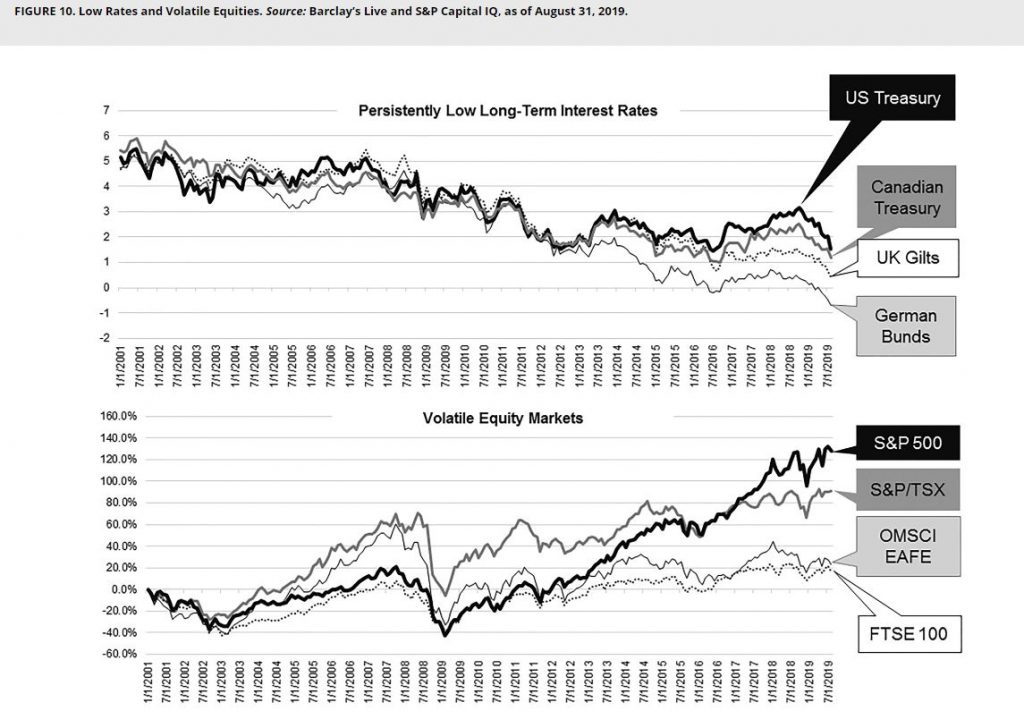

Market Volatility and Its Impact on Pension Funds

The seas of the financial markets are notorious for their unpredictability. Just like a vessel on the high seas, pension funds must navigate through calm and stormy weather, where sudden squalls can be just as challenging as the prevailing winds. Consider the 2008 financial crisis, a perfect storm that left pension funds reeling, their assets plummeting in value just as their liabilities spiked. In the wake of such turbulence, companies like Ford Motor Company took decisive action. In 2012, amidst ongoing market fluctuations, Ford embarked on a PRT transaction to offload billions in pension liabilities, a move aimed at reducing their financial uncertainty and securing retiree benefits against the backdrop of an unpredictable market.

Another illustrative example is the 2020 market downturn triggered by the COVID-19 pandemic, which saw a significant drop in interest rates along with volatile equity markets. This environment heightened the pension funding gap for many organizations, prompting a renewed interest in PRT solutions as a hedge against such volatility.

Regulatory Changes and Their Implications for Pension Schemes

Navigating the regulatory waters of pension schemes is like sailing in shifting seas. The landscape is constantly evolving, with new regulations often introducing more stringent funding requirements and heightened scrutiny. For instance, the introduction of the Pension Protection Fund in the UK following the Pensions Act 2004 reshaped the funding strategies for many British pension schemes, compelling them to seek more secure funding solutions like PRT. Similarly, in the United States, the Pension Benefit Guaranty Corporation (PBGC) operates under legislative frameworks like ERISA, which have evolved over the years, influencing the pension risk landscape significantly.

Companies such as Verizon Communications responded to these regulatory evolutions by engaging in massive PRT transactions, like its $7.5 billion annuity purchase in 2012 to secure its management pension plan. These moves are often strategic responses to the regulatory environment, aiming to mitigate risks while aligning with the latest pension funding standards. Through PRT, organizations can navigate these regulatory shifts, ensuring they remain compliant, and their pension promises are secure.

Another notable example is the landmark deal by General Motors in 2012, which transferred a whopping $29 billion in pension obligations to Prudential, showcasing the scale and impact of PRT solutions. Or consider British Airways’ multi-billion-pound pension insurance buy-in, one of the UK’s largest deals, which fortified the retirement futures of thousands of its employees. These case studies illuminate the tangible benefits of PRT—securing retiree benefits, stabilizing pension plans, and allowing companies to focus on their core business without the looming shadow of pension liabilities.

How Pension Risk Transfer Works

Navigating the world of Pension Risk Transfer (PRT) is like embarking on a strategic journey, from the initial planning to the final handshake. Let’s break down this voyage into clear, manageable steps:

Step 1: The PRT Process – From Decision-Making to Execution

- Initial Assessment: The journey begins with a comprehensive review of the company’s current pension landscape. It’s like taking stock of your supplies before a sea voyage, understanding what you have, where you need to go, and what it might take to get there.

- Feasibility Study: Here, companies analyze whether PRT is the right fit for their needs. This phase involves detailed actuarial studies, risk assessments, and financial forecasting, like charting the course and preparing for all possible conditions.

- Strategy Development: The company crafts a tailored PRT strategy, deciding on the scope, timing, and specific goals of the transfer. It’s like plotting your route on the map, marking key waypoints, and setting clear objectives.

Step 2: Assessing the Pension Scheme’s Readiness for PRT

- Financial Health Check: Evaluating the scheme’s funding status is crucial. Is the pension fully funded, or are there deficits to address? This step is like ensuring your ship is seaworthy before setting sail.

- Risk Analysis: Understanding the risks involved, such as longevity risk, interest rate risk, and market risk, helps in shaping the PRT approach. It’s about knowing the waters ahead and preparing for any storms that might arise.

Step 3: Selecting the Right Insurer – Criteria and Considerations

- Financial Strength: Choosing an insurer with robust financial health ensures they can meet long-term obligations. It is like selecting the best possible crew for your journey, ensuring they are capable and reliable.

- Experience and Reputation: The insurer’s track record in handling PRT deals is vital. You want a seasoned navigator, someone who has charted these waters before and knows all the hidden shoals and currents.

Step 4: Pricing and Funding of PRT Deals

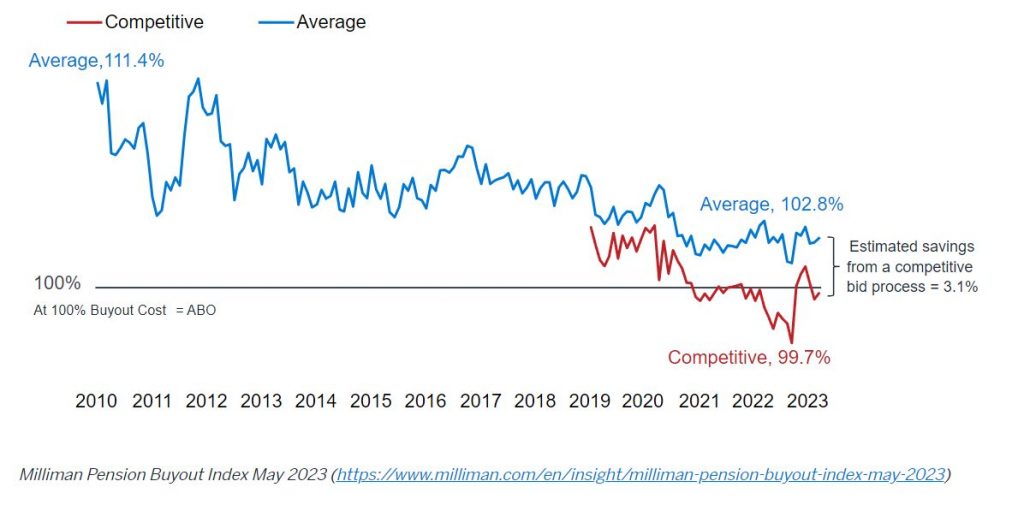

- Negotiating Terms: Like any major transaction, PRT involves negotiating the price and terms of the deal. This stage is where the detailed financial analysis pays off, helping to secure favorable terms.

- Funding Strategies: Companies need to plan how they will fund the transaction, whether from existing assets, raising new capital, or a combination of both. It’s like ensuring you have enough provisions for the trip and adjusting your load to maintain balance.

Real-World Examples: Successful PRT Strategies and Their Impact

British Telecom (BT)

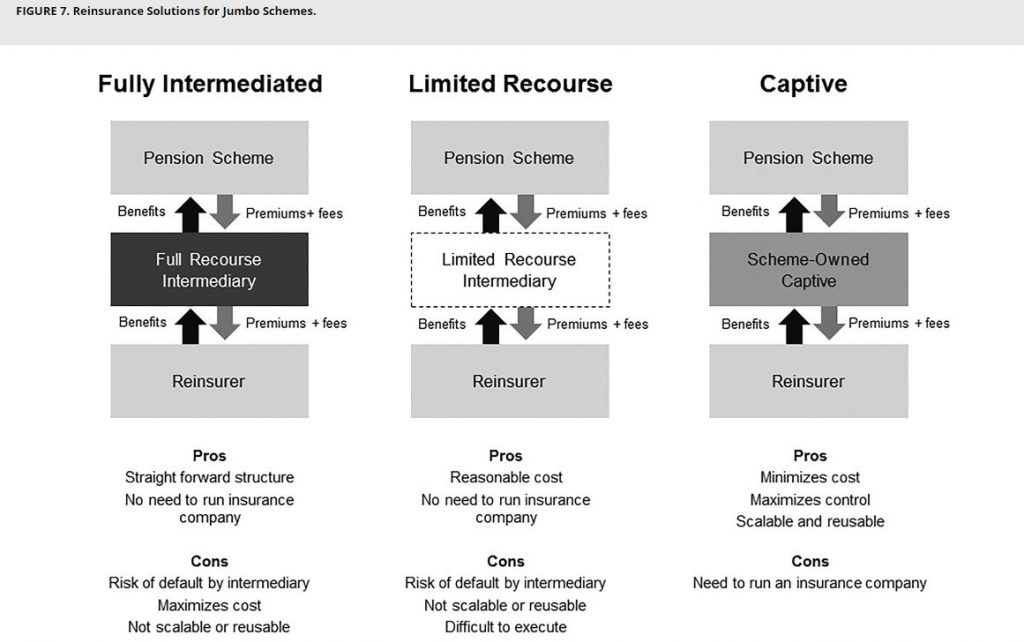

BT executed a significant PRT strategy through a longevity swap rather than buy-in transactions. In 2014, BT entered into a record £16 billion longevity swap transaction for its pension scheme. This deal was structured by setting up a wholly-owned insurance company by BT, through which the pension scheme trustee transferred the longevity risk to this insurer. This insurer, in turn, reinsured the longevity risk with The Prudential Insurance Company of America. This transaction was notable for its size and for BT’s innovative approach to directly accessing global insurance and reinsurance market capacity, bypassing investment banks usually involved in such transactions.

JCPenney

JCPenney’s approach to reducing its pension obligations involved a combination of lump-sum offers to retirees and a significant pension risk transfer transaction. In 2015, JCPenney made a lump-sum offer to retirees and was considering annuitization as part of its strategy to manage pension liabilities. Subsequently, in 2021, JCPenney completed a significant PRT transaction with Athene, transferring $2.8 billion in pension obligations. This transaction involved providing annuity benefits for approximately 30,000 participants of JCPenney’s pension plan, ensuring that retirees would continue to receive their benefits as expected despite the company’s restructuring activities.

Bell Canada

Bell Canada entered into a longevity insurance deal with Sun Life Financial in 2015 to cover the longevity risk associated with $5 billion of pension liabilities. This was one of the largest longevity insurance transactions globally and the first of its kind in Canada. The deal was designed to protect Bell Canada’s pension plan from the financial risk of pensioners living longer than expected.

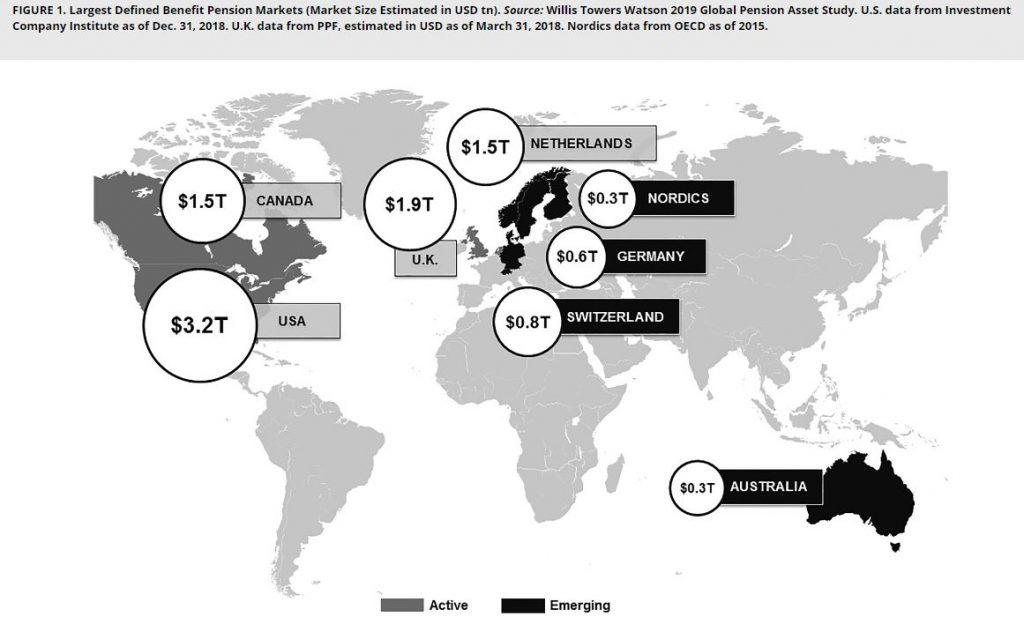

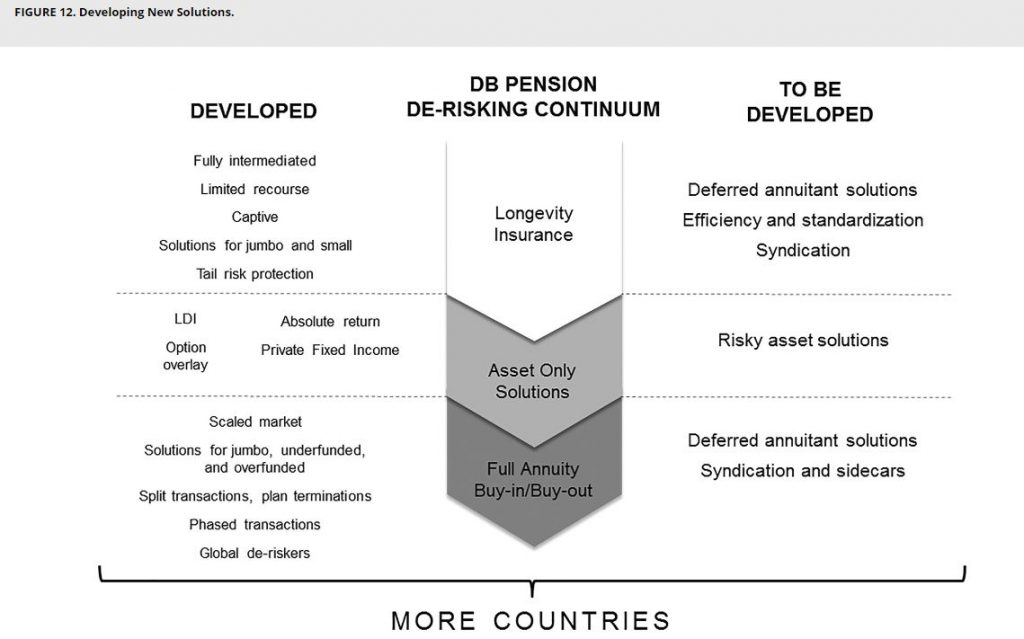

Global Trends in Pension Risk Transfer

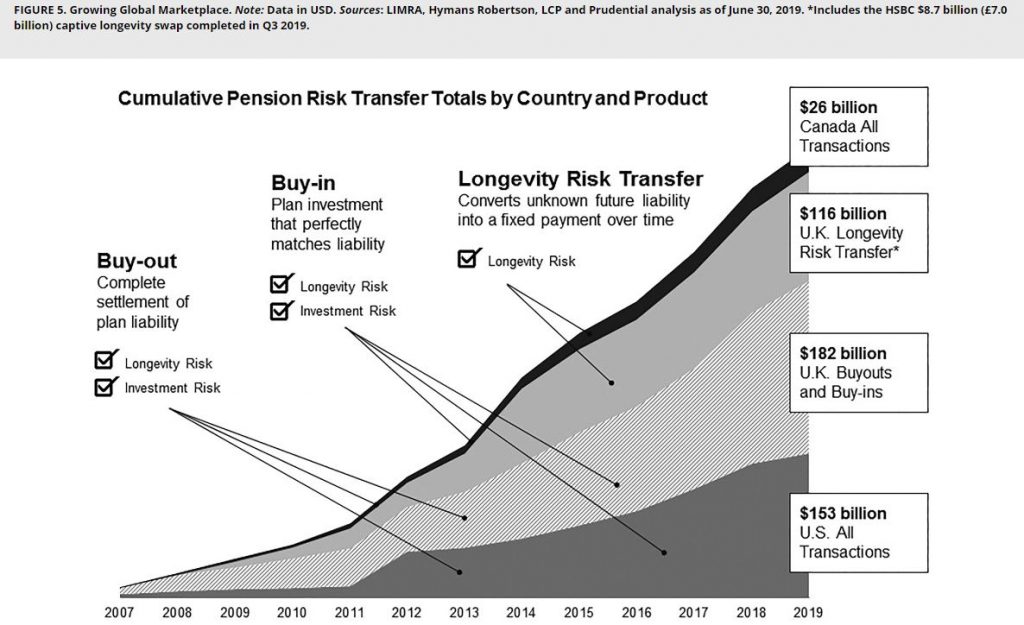

PRT markets vary globally, each with unique characteristics influenced by local regulations, economic conditions, and pension frameworks. In the United States, the PRT market is mature, with large-scale transactions frequently making headlines, such as Verizon’s monumental $7.5 billion annuity purchase. The United Kingdom follows closely, known for its innovative approaches to de-risking pensions, exemplified by British Airways’ extensive buy-in strategy. Canada is emerging as a PRT powerhouse, with its market expanding rapidly, marked by Sun Life Financial’s significant deals in recent years.

The PRT market is on an upward trajectory, with recent data highlighting a surge in deal sizes and frequencies. The last decade has seen a consistent increase in the volume of PRT transactions, with billions of dollars in pension liabilities being transferred annually. Analysts project continued growth, fueled by aging populations and the increasing need for pension scheme de-risking. The average deal size has been escalating, indicating growing confidence in PRT as a strategic risk management tool.

Impact of Economic and Demographic Trends on the PRT Landscape

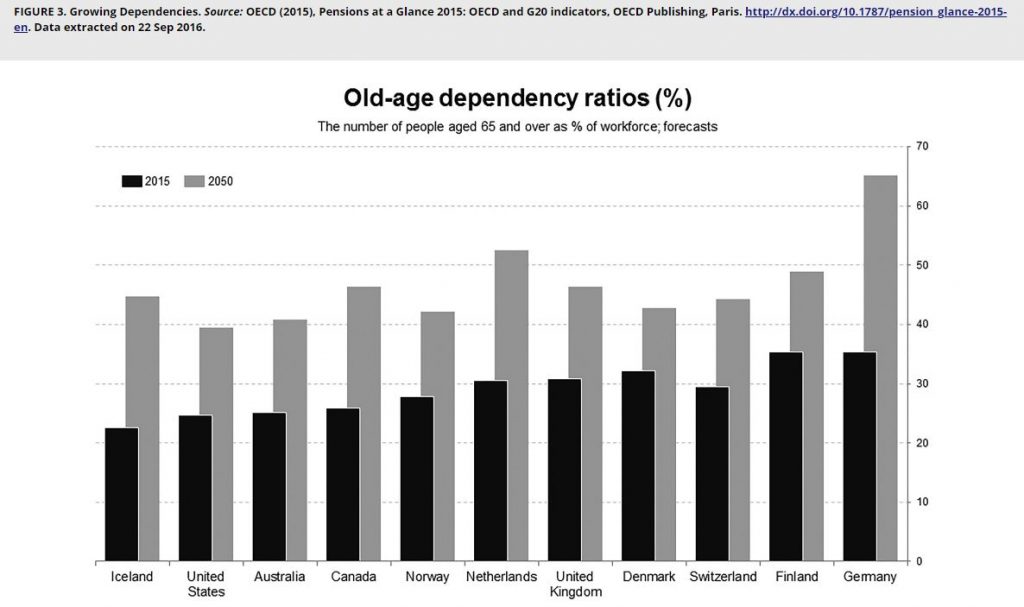

Economic fluctuations and demographic shifts play pivotal roles in shaping the PRT market. Low-interest-rate environments, increasing life expectancies, and the uncertain landscape of global economies drive pension funds toward PRT solutions. These factors compel companies to offload pension risks to secure their balance sheets and ensure pension promise sustainability.

Several social and macroeconomic developments are notably influencing the PRT landscape:

- Longevity Risk Concerns: At the forefront of PRT drivers is the concern over longevity risk. Trustees and plan sponsors are acutely aware that if plan members outlive projections, the resultant extended pension payouts can significantly inflate costs. This risk, highlighted as a primary concern in Aon’s Global Pension Risk Survey, has spurred many to reconsider their long-term pension strategies, turning to PRTs as a viable solution to mitigate unforeseen longevity costs.

- The Catalyst of Rising Interest Rates: The recent sharp uptick in interest rates has acted as a powerful impetus for PRT adoption. In regions experiencing these increases, the resultant reduction in pension liabilities has left pensions better funded, thereby decreasing the cost of individual PRT transactions and making them more financially attractive.

- Well-Funded Pension Positions: A notable trend is the achievement of well-funded pension statuses. For instance, Aon’s Pension Risk Tracker reported in October 2023 that the aggregate pension-funded status of S&P 500 companies hit a peak at 104.3 percent, the highest since its inception in 2011. The UK mirrors this trend, with DB schemes also seeing improved funding levels. This financial upswing, coupled with rising interest rates, has prepared many sponsors to actively pursue PRT transactions.

The Future of PRT and Technological Innovations

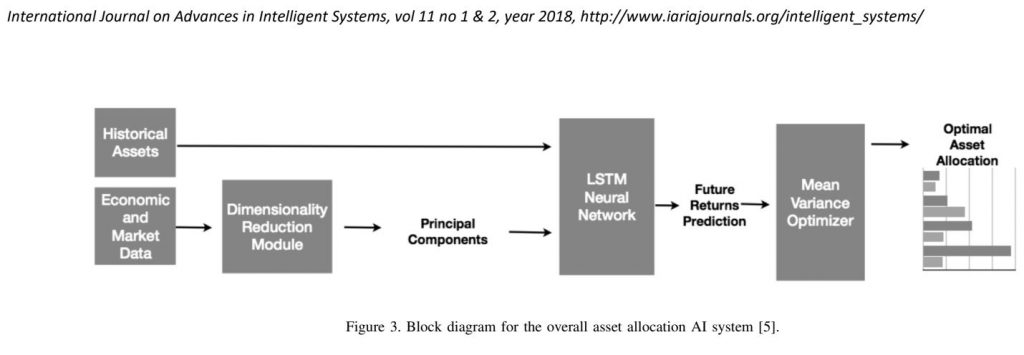

The horizon of PRT is expanding, with technology playing a crucial role. Innovations in AI and machine learning are set to transform PRT transactions, enhancing efficiency, accuracy, and speed.

- Technological sea change: The integration of technology in PRT processes is inevitable, promising more precise risk assessments and streamlined transaction mechanisms. The industry is poised to become more dynamic, with predictive analytics offering deeper insights into longevity and financial risks.

- The Role of AI/ML in Enhancing PRT Transactions: AI algorithms can revolutionize the way insurers assess risk, price policies, and monitor pension liabilities. Machine learning models can analyze vast datasets, identifying trends that humans may overlook, and forecasting potential future scenarios with remarkable accuracy.

- LLMs in Decision-Making and Customer Service: Large Language Models (LLMs) are enhancing decision-making processes, offering new ways to interact with data, generate insights, and improve customer engagement. They can process complex queries, provide detailed analyses, and even predict the implications of certain PRT strategies.

- Challenges and Ethical Considerations: While the benefits are substantial, the integration of AI and ML in PRT comes with challenges. Ensuring data privacy, managing bias in AI algorithms, and maintaining transparency in automated decision-making are crucial ethical considerations that must be addressed as technology advances.

Conclusion

PRT is more than a transaction. It symbolizes trust and stability in today’s fast-evolving financial landscape. Companies embracing PRT reinforce their dedication to their workforce’s long-term prosperity. They send a clear message of dependability.

The integration of AI and Large Language Models (LLMs) is reshaping PRT. These technologies offer groundbreaking ways to enhance accuracy, efficiency, and insight. They are transforming how we manage, assess, and execute pension risk strategies.

Now is the moment for action. Trustees, corporate sponsors, and stakeholders, the future is in your hands. Embrace PRT’s potential. Let it be your guide to financial resilience and a beacon for secure retirements. The journey towards a safeguarded tomorrow starts today.