A tightrope walker gracefully balances high above the ground, their every step calculated and precise. One minor misstep, one gust of wind, could send them plummeting from the slim cable providing their precarious passage. This razor-edge act epitomizes the delicate dance between securing hard-earned retirement futures and maintaining overall financial stability.

Just as the tightrope artist meticulously adheres to rigorous safety protocols, the global Pension Risk Transfer (PRT) industry navigates an intricate tightrope of regulatory frameworks. These frameworks act as guidewires, designed to prevent pension promises from going off-kilter and crashing down into an abyss of insecurity.

With pensioners’ dreams and economic well-being hanging in the balance, the urgency of understanding this tightrope’s regulatory landscape cannot be overstated. Every step taken by companies transferring pension risks must be executed with pinpoint precision, following the guidelines unique to each region.

A minor misstep or oversight could set off tremors that ripple across the interconnected web of financial markets and retiree lives. The stakes are simply too high to stumble blindly without a firm grasp of the rigorous codes and bylaws keeping the pension tightrope taut.

As we traverse this financial highwire act together, we must remain keenly aware of the global regulatory forces at play. Only through a nuanced understanding of their intricate choreography can we enhance retirement security while maintaining the crucial counterbalance of overall economic stability.

Global Overview

The tightrope of pension security spans continents, with certain regions carrying heavier loads than others. The United States, United Kingdom, and European Union collectively form the heavyweight trio walking this financial highwire act.

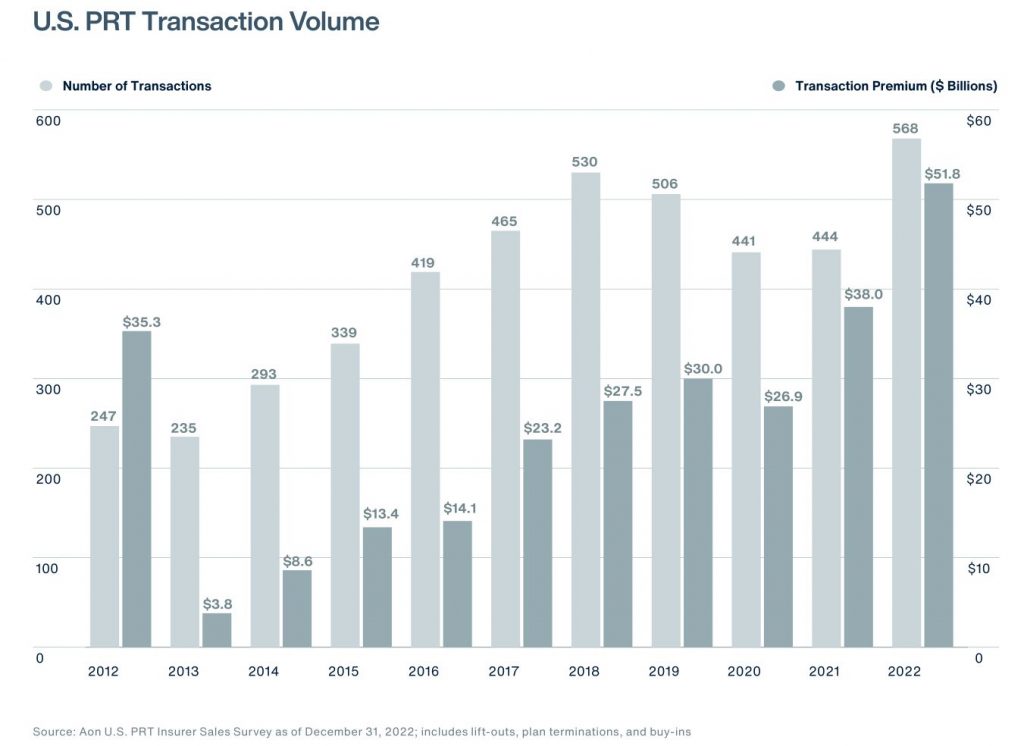

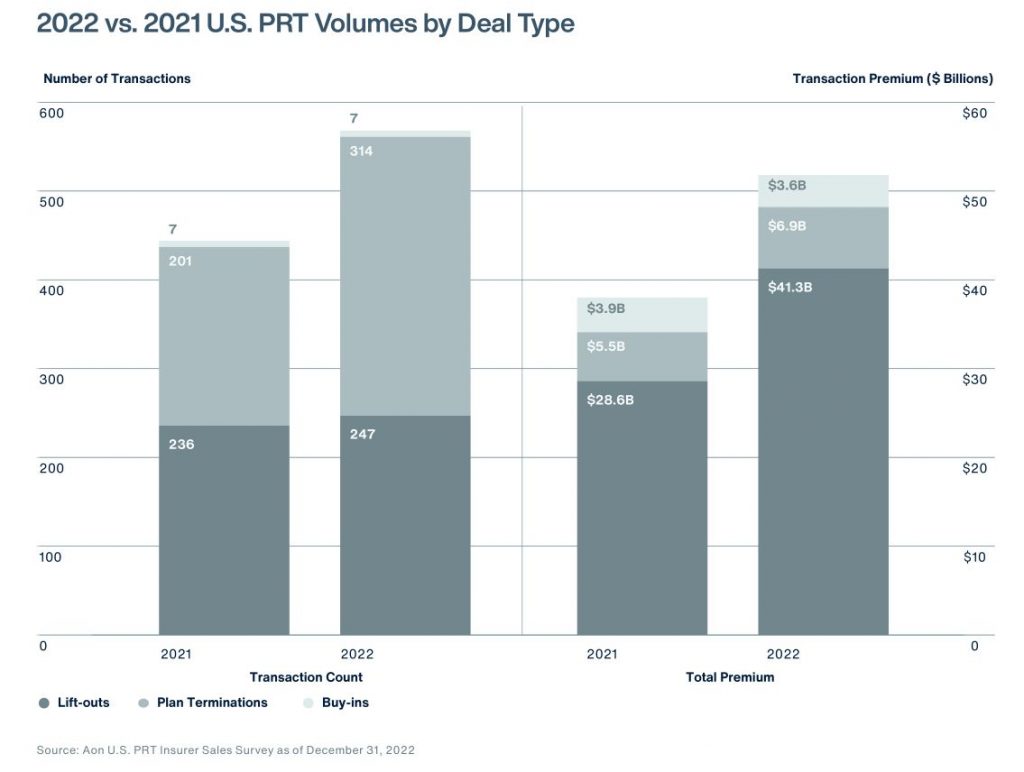

In the U.S., the PRT market eclipsed $52 billion in bulk annuity sales in 2022, a remarkable 28% increase from the prior year and the highest volume recorded in a decade. Landmark deals like IBM’s $16 billion retiree lift-out, alongside rising interest rates catalyzing increased activity from plan sponsors seeking risk mitigation strategies.

The market’s momentum continued into 2023, making it potentially the second-largest year on record.

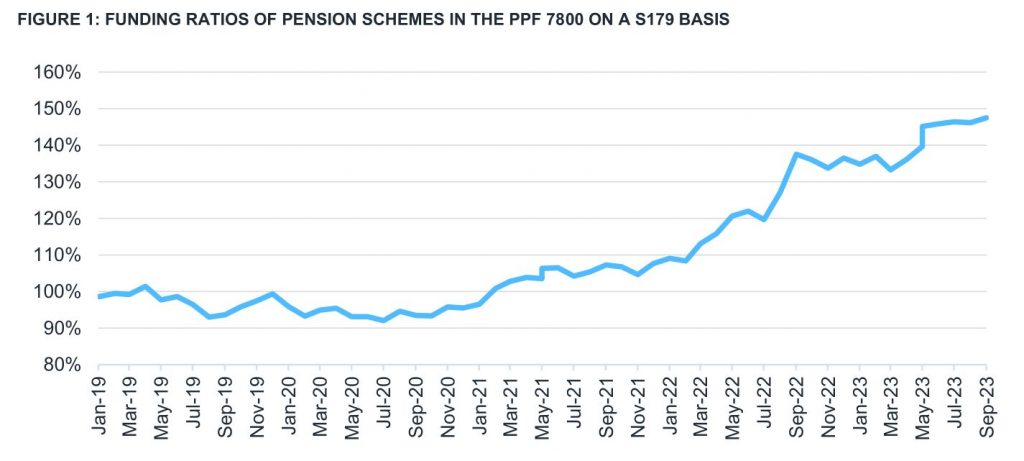

Across the Atlantic, the UK witnessed a record-breaking £50 billion in PRT volumes for 2023 alone, after a slight dip to £26 billion in 2022.

This surge included landmark deals like insuring the British Steel Pension Scheme’s benefits. The UK’s annual volumes are projected to stay robust between £50-60 billion going forward.

Meanwhile, continental European nations like the Netherlands and Ireland are rapidly evolving into PRT powerhouses as well.

However, the weight borne by this tightrope is not merely monetary. A confluence of economic undercurrents, demographic shifts, and market dynamics exert constant pressure that shapes the regulatory landscape.

Low interest rates and volatility in investment returns make pension funding commitments increasingly challenging for sponsors to shoulder alone. This economic climate whips up strong winds of demand for PRT solutions to offload risks.

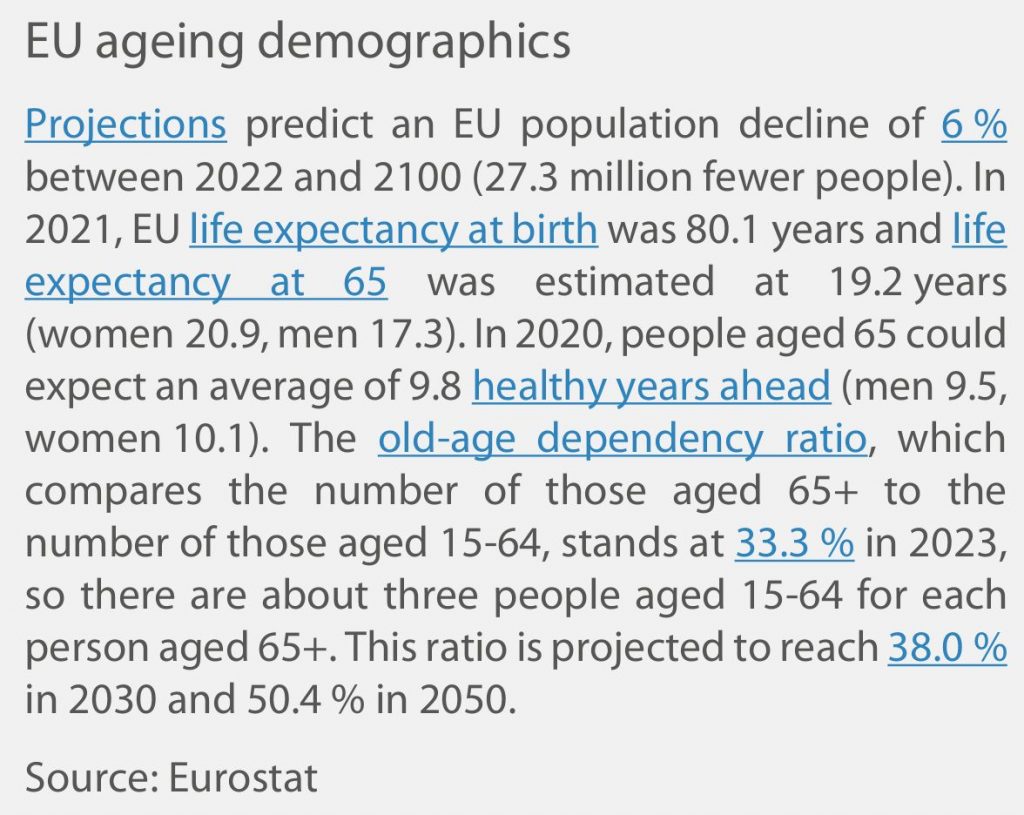

Simultaneously, the graying of populations in Western nations adds a heavy demographic counterweight. As more workers retire, pension obligations rapidly accumulate on the rope, straining its tensile strength without robust PRT regulation.

Market dynamics also play a pivotal role. An influx of institutional investors eager to assume pension risks for a premium, exemplified by three new U.S. insurers (Global Atlantic, Reinsurance Group of America (RGA), and American National) entering the space in 2022, has transformed PRT from a niche tool into a booming global industry.

It is amidst this swirling gale of economic forces, demographic headwinds, and rapid market evolution that regulatory bodies take on a crucial role. Their oversight aims to provide governance and stability for the PRT market.

With the stakes so high, a deeper look into each key region’s regulatory nuances becomes essential. Only through a nuanced understanding of these regulations can companies effectively navigate the PRT landscape.

PRT Regulatory Frameworks

United States

As the global heavyweight with the largest PRT market, the United States has constructed an extensive regulatory scaffolding around this critical sector. Forming the bedrock is ERISA (Employee Retirement Income Security Act of 1974) – the preeminent federal law that governs employee benefit plans like pensions.

ERISA establishes stringent fiduciary standards that are paramount when executing PRT transactions. Plan fiduciaries must act solely in the best interests of plan participants and beneficiaries, exercising the utmost prudence in decision-making. This “exclusive benefit” rule extends to the rigorous process of selecting an annuity provider and negotiating terms.

Specific fiduciary obligations include conducting thorough due diligence on insurers’ claims-paying abilities, credit ratings, capitalization levels, and long-term financial viability. Fiduciaries must meticulously evaluate the annuity contract’s safety, underlying asset portfolio, crediting rates, and overall economic value to the plan.

Pricing is another key consideration – ERISA mandates fiduciaries to scrutinize whether premium quotes are commercially reasonable by soliciting bids from multiple providers and expert advisors. Overpaying could constitute an imprudent use of plan assets.

Missteps can expose fiduciaries to personal monetary liabilities, excise taxes, and regulatory penalties from government agencies. ERISA’s “procedural prudence” standards thus form a vital guardrail, requiring fiduciaries to document decision-making processes, benchmarking analyses, and economic justifications for actions.

ERISA also upholds transparency through its extensive disclosure and reporting requirements around annuities. Plan participants must receive comprehensive details on their annuity rates, the insurer’s ratings, and potential impacts to their benefit amounts and payment forms pre- and post-annuitization. These measures prevent conflicts of interest while keeping beneficiaries fully informed.

Enforcement of ERISA’s intricate provisions falls under the jurisdiction of the Department of Labor (DOL). Through audits, investigations, and regulatory guidance, the DOL continuously clarifies uncertainties around evolving PRT practices and fiduciary conduct.

For example, the DOL has issued prohibited transaction exemptions that permit otherwise disallowed transactions if specific conditions are met, providing a compliance pathway for certain PRT deals. The DOL also fields questions and issues interpretive bulletins to help plans remain compliant.

Complementing the DOL’s oversight, the Internal Revenue Service (IRS) plays a pivotal role in regulating the tax implications of PRT transactions to preserve plans’ coveted tax-qualified status.

Failure to satisfy the IRS’s stringent standards can lead to disqualification and trigger punitive taxation of plan assets transformed into currently taxable income. To avoid this, the IRS mandates rigorous procedures that pension plans must follow meticulously.

Key requirements include ensuring the annuity purchase benefits a non-discriminatory pool of participants, providing exhaustive documentation of decision processes to substantiate prudence, scrutinizing the pricing to confirm arms-length market terms, and instituting safeguards against impermissible inurement benefiting parties with a private interest.

Together, ERISA’s substantive rules governing fiduciary conduct, the DOL’s robust enforcement mechanisms, and IRS’s tax compliance oversight create multiple concentric rings of regulatory governance encircling U.S. PRT activities.

This comprehensive, multi-layered framework strives to uphold the highest standards of fiduciary integrity while injecting vital stability into the pension system. By codifying prudence and transparency, it provides a stable base supporting not just retirees’ futures but the entire interconnected financial ecosystem.

United Kingdom

Across the Atlantic, the United Kingdom has developed a comprehensive regulatory apparatus governing its rapidly growing PRT market. At the center is The Pensions Regulator (TPR), tasked with overseeing occupational pension schemes and safeguarding members’ interests.

When it comes to PRT, TPR’s primary focus is ensuring pension trustees execute buyout and buy-in transactions in a manner aligned with their fiduciary duties. Conducting thorough due diligence on insurers’ financial strength, evaluating the transaction’s value for money, and receiving appropriate advice from qualified professionals are non-negotiable requirements.

TPR provides extensive guidance on critical considerations like longevity assumptions, data accuracy, investment strategy transitions during buyouts, and member communications. It outlines best practices aimed at protecting members and holding trustees accountable.

Complementing TPR’s oversight of pension schemes are two regulatory bodies governing insurers facilitating PRT deals – the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA).

The FCA is responsible for ensuring insurers maintain appropriate standards of conduct, transparency, and fair treatment of customers throughout the PRT transaction lifecycle. Its regulations cover areas like sales practices, disclosure requirements on pricing methodologies, and standardized data templates to enable competitive quotes.

Meanwhile, the PRA – a part of the Bank of England – focuses on the prudential regulation of insurers. Its primary mandate is monitoring their financial safety and soundness to safeguard policyholders. This includes scrutinizing capital adequacy, reserving, risk management, and stress testing insurers’ ability to withstand severe economic shocks.

PRA regulations dictate extensive requirements on asset portfolios, investment strategies, and reporting that insurers must satisfy when taking on PRT deals. Stringent solvency standards aim to ensure promised benefits can be paid even in adverse scenarios.

Together, TPR’s oversight of pension plans, the FCA’s conduct regulations, and the PRA’s prudential governance create a comprehensive framework enhancing security for UK PRT transactions. This coordinated effort balances facilitating market growth while mitigating risks through rigorous oversight of all stakeholders.

By setting uniform standards and fostering transparency, the UK’s regulatory infrastructure injects stability and builds confidence in this critical risk transfer mechanism for retirement security. As the market expands rapidly, this governance provides guideposts for sustainable, member-focused growth.

European Union

Extending our regulatory landscape tour, we cross into continental Europe where the PRT market is rapidly blossoming, particularly in nations like the Netherlands and Ireland. While each adheres to overarching EU directives, their distinct national regimes offer insightful contrasts.

The Netherlands is home to one of the region’s most mature PRT markets. At its core lies the robust Dutch Central Bank (DNB) which regulates financial institutions facilitating these transactions, including insurers and pension funds.

Like the UK’s PRA, the DNB applies stringent solvency requirements and stress tests to ensure PRT providers can withstand severe market shocks. It meticulously scrutinizes their balance sheets, asset mixes, risk management, and financial reporting.

Additionally, the DNB oversees conduct of business rules governing insurers’ sales practices and disclosure standards when transacting with pension funds – analogous to the FCA’s role across the North Sea.

On the pension fund side, De Nederlandsche Bank works in tandem with the Authority for the Financial Markets (AFM) to uphold trustees’ fiduciary duties when executing PRT deals. This collaborative oversight closely mirrors the UK’s TPR in safeguarding member interests.

Meanwhile, Ireland has swiftly emerged as a burgeoning PRT hub, aided by an agile regulatory environment and tax regime attractive to multinational employers. The Central Bank of Ireland and Pensions Authority jointly govern this space through prudential oversight of insurers and conduct regulation of pension schemes respectively.

A key distinction is Ireland’s principles-based regulatory approach compared to the more prescriptive rules seen in the UK and Netherlands. This flexibility allows faster evolution to facilitate new PRT deal structures and innovations.

However, this agility is counterbalanced by robust risk-based supervisory programs. Stringent governance, capital, and risk management requirements are enforced through ongoing monitoring and on-site inspections by the regulators.

What emerges is a European patchwork of regulatory frameworks – each distinctive yet underscored by common threads. Prudential safeguards aim to support insurer solvency, while conduct oversight upholds pension trustee duties and member protection across PRT transactions.

As PRT proliferates, this evolving regulatory landscape strives to keep pace, fostering growth while injecting vital guardrails. National authorities collaborate, pooling best practices to harmonize governance across EU markets.

Comparative Analysis & Global Trends Shaping the Landscape

While distinct regional approaches emerge, an examination of the U.S., U.K., and European regulatory frameworks for pension risk transfer (PRT) reveals some unifying threads interwoven across borders:

Prudential Oversight of Insurers

- In the U.S., the DOL and IRS enforce stringent capital, reserving, and stress testing requirements for insurers conducting PRT deals.

- The U.K.’s Prudential Regulation Authority (PRA) plays a similar role of ensuring PRT providers maintain adequate financial resources and risk management to remain solvent.

- EU member states like the Netherlands (Dutch Central Bank) and Ireland (Central Bank of Ireland) also apply robust prudential regulations and supervision over insurers’ safety and soundness.

- These oversight measures aim to protect pensioners by mandating PRT insurers hold sufficient assets and reserves to pay out promised benefits, even under adverse scenarios.

- Regulatory regimes are also evolving to provide clarity around newer insurer structures like captives utilized in some PRT transactions.

Pension Fiduciary Standards

- The U.S. ERISA legislation establishes strict fiduciary duties that pension plan sponsors must uphold when evaluating and executing PRT deals.

- In the U.K., The Pensions Regulator (TPR) enforces similar standards requiring trustees to act prudently, impartially, and transparently in assessing a PRT transaction’s value.

- EU authorities like the Dutch AFM and Irish Pensions Authority collaborate to ensure trustees meet fiduciary obligations and prevent conflicts when transferring risks.

- These measures safeguard pension members’ interests by mandating robust decision-making processes centered on their benefit.

Conduct of Business Rules

- The U.S. DOL scrutinizes PRT deals for prohibited transactions that may unduly benefit certain parties over plan participants.

- The U.K.’s Financial Conduct Authority (FCA) oversees insurer practices like sales, pricing transparency, and disclosure when transacting with pension schemes.

- Regulators like the Dutch DNB also enforce conduct standards governing how insurers treat pension fund ‘customers’ during the PRT lifecycle.

- These conduct regulations promote a fair, ethical, and transparent market benefiting pension plans and members.

However, divergences persist across regulatory philosophies and allowable PRT deal specifics:

- The U.S. relies more on a prescriptive, rules-based approach versus the U.K.’s hybrid model and more principles-based stances seen in some EU states like Ireland.

- Documentation requirements and the PRT transaction structures permitted can vary, reflecting each jurisdiction’s administrative heritage.

These multi-layered regulatory frameworks face escalating pressure from powerful global forces reshaping the PRT landscape:

Economic & Market Dynamics

- Persistently low interest rates have strained pension funding levels, fueling rising PRT demand to offload risks.

- The growth of institutional investors seeking to assume pension liabilities has created market incentives for regulators to facilitate PRT transactions.

- Innovations like insurers’ use of captive structures for PRT necessitate new regulatory guidance and oversight models.

Demographic Shifts

- Aging populations in developed economies are exacerbating pension funding gaps, intensifying the need for risk transfer mechanisms like PRT.

- Evolving longevity risk pricing and modeling impacts the pricing and relative attractiveness of PRT deals versus alternatives.

Technological Disruption

- Advances in big data analytics and computing enable enhanced risk monitoring and financial modeling for regulators overseeing PRT transactions.

- Automated processes can streamline regulatory reporting and compliance activities required from market participants.

- Emerging cybersecurity risks associated with systems managing sensitive pension data are spurring new data protection rules.

To keep pace with this sea change, regulatory regimes must proactively adapt – balancing the dual mandates of facilitating sustainable PRT market growth while enforcing robust oversight and consumer protection.

Conclusion

The global regulatory landscape surrounding pension risk transfer is a complex tapestry, woven with commonalities yet enriched by distinct regional patterns. While unified in aims like financial stability, consumer protection, and sustainable market growth, the specifics of oversight regimes can diverge.

For companies navigating this arena, a nuanced understanding of not just the rules, but the philosophies and market forces shaping them, is imperative. Failing to harmonize activities with the regulatory refrains unique to each geography risks striking dissonant chords that reverberate across the interconnected financial ecosystem.

However, this intricate regulatory choreography is not a static composition. The onus remains on authorities and market participants alike to proactively adapt their arrangements to the shifting dynamics of the new economic age. Technological innovation, demographic shifts, and evolving retirement norms necessitate continuous regulatory retuning.

Those who stay sensitized to these rhythms and poised for regulatory evolutions will find themselves conducting a sustainable, synchronized financial symphony. One that generates stability and security to ensure pension promises remain unbroken well into the future.