Did you know that employee benefits can make up to 30% of an individual’s total compensation package? This staggering figure highlights the immense significance of benefits in the modern workplace. From attracting top talent to retaining loyal employees, benefits play a crucial role in the success of any organization.

But the world of employee and group benefits is not static. It has evolved, shaped by societal changes, legal frameworks, and economic pressures.

In the United States, the concept of employer-provided benefits emerged in the late 19th century, as companies began offering “welfare capitalism” programs to their workers. These early initiatives laid the foundation for the development of modern employee benefits. As the 20th century progressed, the world witnessed a gradual expansion of employer-provided benefits. Today, employers across the globe offer a wide range of benefits – health insurance, retirement plans, and work-life balance programs.

Group benefits, in particular, have become an increasingly important aspect of the overall benefits package. By leveraging the power of collective purchasing, employers can offer their workers access to a variety of insurance products and services at more affordable rates.

At the same time, employers are grappling with the ever-increasing cost of providing benefits and the challenge of designing programs that meet the diverse needs of their workforce. In an era of tight budgets and fierce competition, finding the right balance between cost and value has become a top priority for organizations of all sizes.

From the rise of personalized benefits to the impact of AI and automation, the landscape is shifting in once unimaginable ways. How will these changes affect the way we work and live? What new challenges and opportunities will they bring?

The Evolution of Group and Employee Benefits

The roots of employee and group benefits can be traced back to the late 19th century, a time when the United States was undergoing rapid industrialization and social change. As factories and railroads spread across the country, employers began to recognize the importance of providing for the welfare of their workers. This marked the birth of “welfare capitalism,” a system in which companies took on the responsibility of offering rudimentary benefits to their employees.

Picture a world where workers toiled long hours in dangerous conditions, with little to no safety net in case of injury, illness, or old age. This was the reality for many Americans in the early 20th century. But as the nation grew and evolved, so too did the concept of employee benefits.

The Great Depression of the 1930s was a turning point in the history of benefits. With millions of Americans out of work and struggling to make ends meet, the government stepped in with the Social Security Act of 1935. This groundbreaking legislation laid the foundation for a nationwide system of retirement benefits and catalyzed the expansion of employer-provided pensions.

Meanwhile, on a global scale, Germany had already introduced social insurance programs in the late 19th century under Chancellor Otto von Bismarck, offering health insurance, accident insurance, and old-age pensions. This early model influenced many other countries, including the U.S., in their approach to social welfare.

In the decades that followed, the benefits landscape continued to evolve. World War II played a significant role, as wage controls and labor shortages prompted employers to offer health insurance and other benefits as a way to attract and retain workers. By the 1950s, employer-sponsored health insurance had become a common feature of the American workplace.

Other significant developments included the establishment of the United Kingdom’s National Health Service (NHS) in 1948, providing comprehensive healthcare funded by taxation. This model shifted some responsibility for healthcare from employers to the state and influenced how health benefits were structured in other countries.

The 1960s and 1970s saw a surge in the growth of employee benefits, fueled by the rise of powerful labor unions and the passage of key legislation. The Employee Retirement Income Security Act (ERISA) of 1974, in particular, established important protections for workers’ pension plans and set the stage for the modern era of employee benefits.

But the evolution of benefits was not just about individual employers and their workers. It was also about the power of collective action and the emergence of group benefits. From health insurance and dental plans to life insurance and disability coverage, these benefits provide a vital safety net and help to attract and retain top talent in an increasingly competitive job market.

It is a story that continues to unfold, as new generations of workers bring their unique perspectives and needs to the table.

The Importance of Benefits in the Modern Workplace

Gone are the days when a simple salary and a pat on the back were enough to keep workers happy and motivated. Today’s employees expect more from their employers, and a well-designed benefits package can make all the difference.

Take the case of Google, for example. The tech giant is renowned for its generous employee benefits, including free gourmet meals and on-site fitness centers, generous parental leave policies, and unlimited sick days. As a result, Google consistently ranks among the best places to work, with employee satisfaction rates that are the envy of the industry.

So, what makes a benefits program effective? It’s all about customization and flexibility.

By offering a range of insurance products and services through a group plan, employers can provide their workers with a level of customization and choice that would be difficult to achieve with a one-size-fits-all approach. For example, a group health insurance plan might offer employees the option to choose between different levels of coverage or to add on dental or vision insurance at an affordable rate.

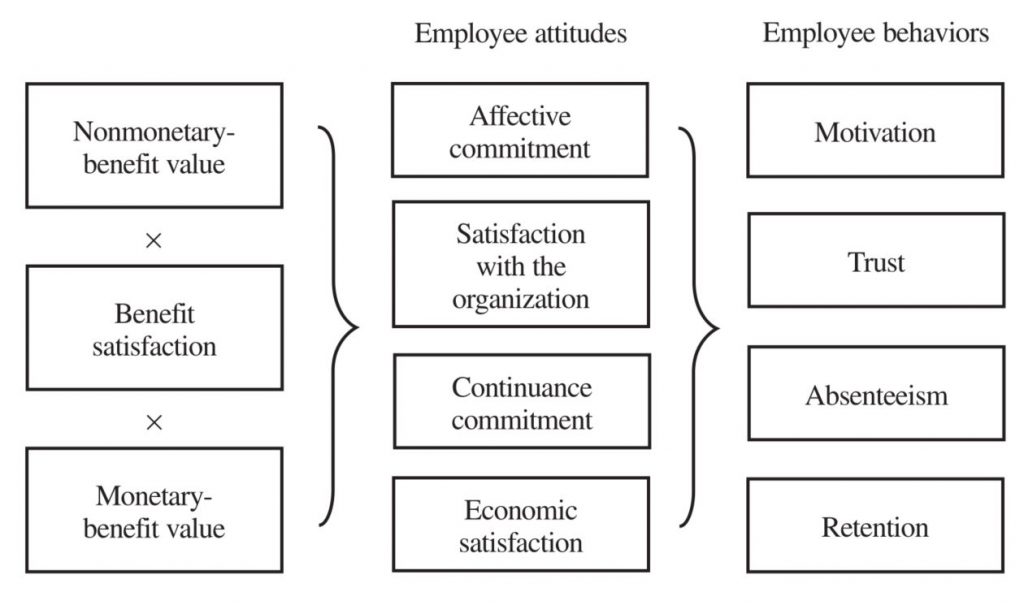

Relation between benefit satisfaction and benefit value with employee attitudes and behaviors

But the benefits of group plans go beyond just choice and affordability. They also help to foster a sense of community and shared purpose among employees.

This sense of community is particularly important in today’s diverse and multigenerational workforce. Millennials and Gen Z workers are looking for more than just a paycheck. They want to work for companies that share their values and provide a sense of purpose and belonging.

Long story short – take care of your employees, and they will take care of your customers.

Navigating the Benefits Labyrinth

Navigating the world of employee and group benefits can feel like entering a labyrinth – a complex network of paths and passages that can be difficult to parse without a clear map or guide.

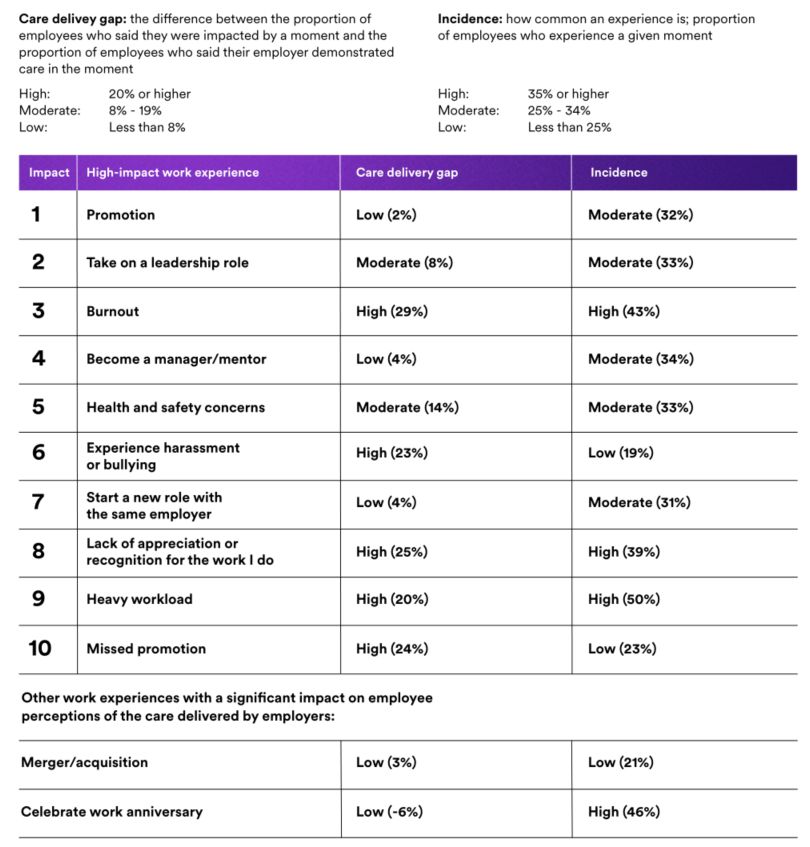

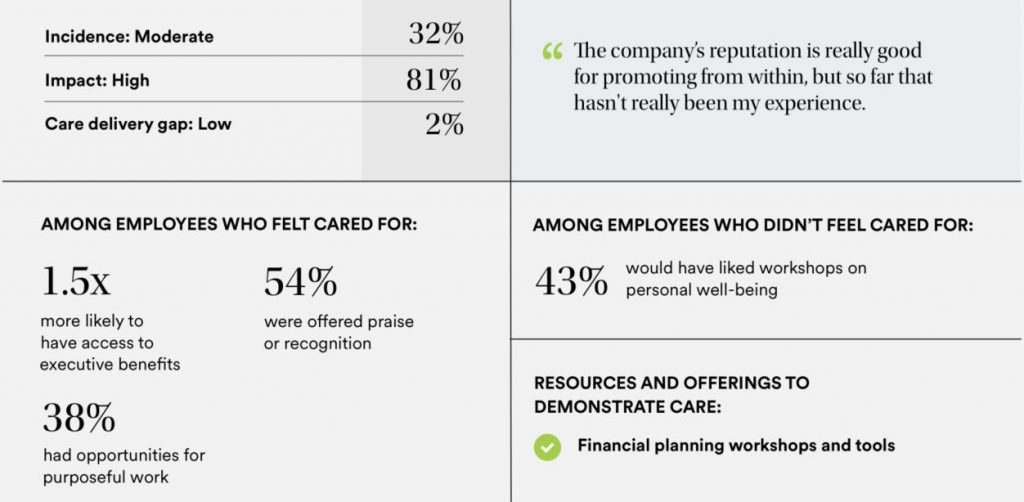

The top 10 work experiences impacting employees

To clarify things, let’s explore the four major benefit areas: employee benefit satisfaction, pensions, healthcare, and work-family benefits.

Employee Benefit Satisfaction

At the heart of any successful benefits program is employee satisfaction. After all, what good are benefits if employees don’t value or appreciate them?

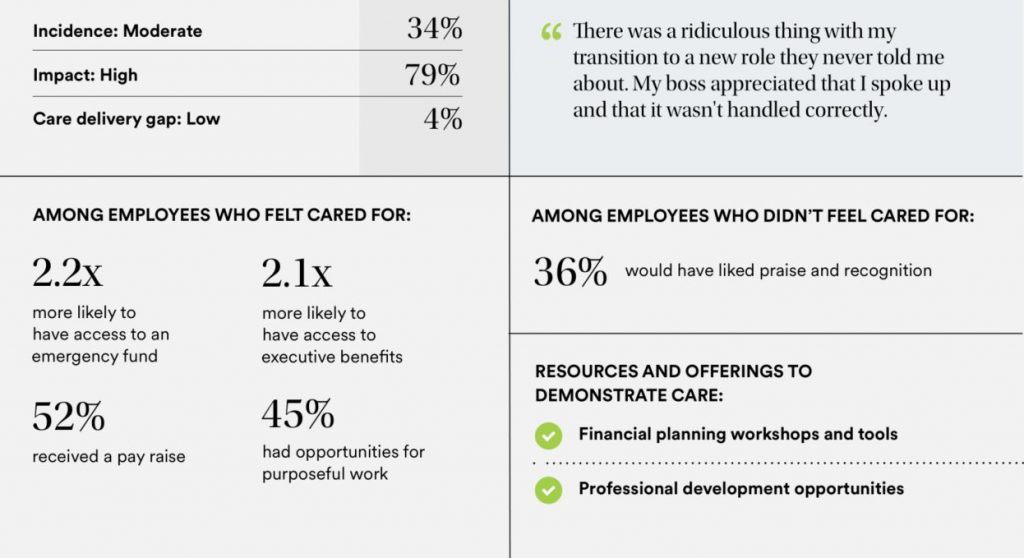

Becoming a manager/mentor: Adding new skills for the next step

Benefit satisfaction is a multi-dimensional construct that captures both the perceived value and the effectiveness of the benefits an employee receives. It is influenced by a range of factors, from the level and type of benefits offered to how those benefits are communicated and administered.

Employees who were satisfied with their benefits are more likely to report high levels of job satisfaction and less likely to leave their employer.

Being promoted: Preparing for new responsibilities

But what drives benefit satisfaction? Here are some of the key factors:

- Communication: Employees who feel that their benefits are clearly and effectively communicated are more likely to be satisfied with those benefits.

- Flexibility: Benefits that offer employees a degree of choice and customization tend to be more highly valued than one-size-fits-all packages.

- Perceived Value: The extent to which employees believe that their benefits are worth the cost (both to themselves and their employer) is a key driver of satisfaction.

- Ease of Use: Benefits that are easy to access and utilize tend to be more highly valued by employees.

The top 10 life experiences impacting employees

By understanding these key drivers of benefit satisfaction, employers can design and implement benefits programs that truly meet the needs and preferences of their workforce.

Pensions

Pensions are one of the most common and well-known retirement benefit options.

Historically, pensions were the primary retirement benefit offered by employers, particularly in industries such as manufacturing and the public sector. However, in recent years, there has been a shift away from traditional defined benefit pension plans and towards defined contribution plans such as 401(k)s.

This shift has been driven by several factors, including the increasing cost of providing defined benefit pensions, the desire for greater portability and flexibility among employees, and regulatory changes such as the Pension Protection Act of 2006.

However, the move away from traditional pensions has not been without its challenges.

Some of the key issues and challenges facing pension research and practice today include:

- Funding and Solvency: Ensuring that pension plans are adequately funded and able to meet their obligations to retirees is an ongoing challenge, particularly in an era of economic uncertainty and market volatility.

- Portability and Flexibility: As the workforce becomes increasingly mobile, there is a growing need for retirement benefits that are portable and flexible, allowing employees to take their benefits with them as they move from one employer to another.

- Regulatory Compliance: Pension plans are subject to a complex web of regulations and compliance requirements, which can be costly and time-consuming for employers to navigate.

- Employee Engagement and Education: Helping employees understand and engage with their retirement benefits is critical to making informed decisions and achieving their retirement goals.

Healthcare

When it comes to employee benefits, healthcare is often the 800-pound gorilla in the room. It is one of the most expensive and complex benefits that employers offer, and it is also one of the most highly valued by employees.

The history of employer-sponsored healthcare in the United States is a long and complicated one, dating back to the early 20th century. Initially, healthcare benefits were offered as a way to attract and retain workers during wartime labor shortages. Over time, however, they became an increasingly important part of the overall compensation package, particularly as the cost of healthcare began to rise.

Today, healthcare benefits are a major expense for employers, with the average cost of employer-sponsored health insurance hovering around $22,000 per family per year. At the same time, they are also a major source of anxiety and concern for employees, who worry about the affordability and accessibility of healthcare for themselves and their families.

One of the key challenges facing employers today is balancing the need to manage healthcare costs with the need to provide high-quality, comprehensive coverage to their employees. This has led to a range of emerging initiatives and strategies, including:

- Consumer-Driven Health Plans: These plans, including high-deductible health plans and health savings accounts, aim to give employees more control over their healthcare spending while incentivizing them to be more cost-conscious consumers.

- Wellness Programs: Many employers are investing in wellness programs and initiatives that aim to promote healthy behaviors and reduce healthcare costs over the long term.

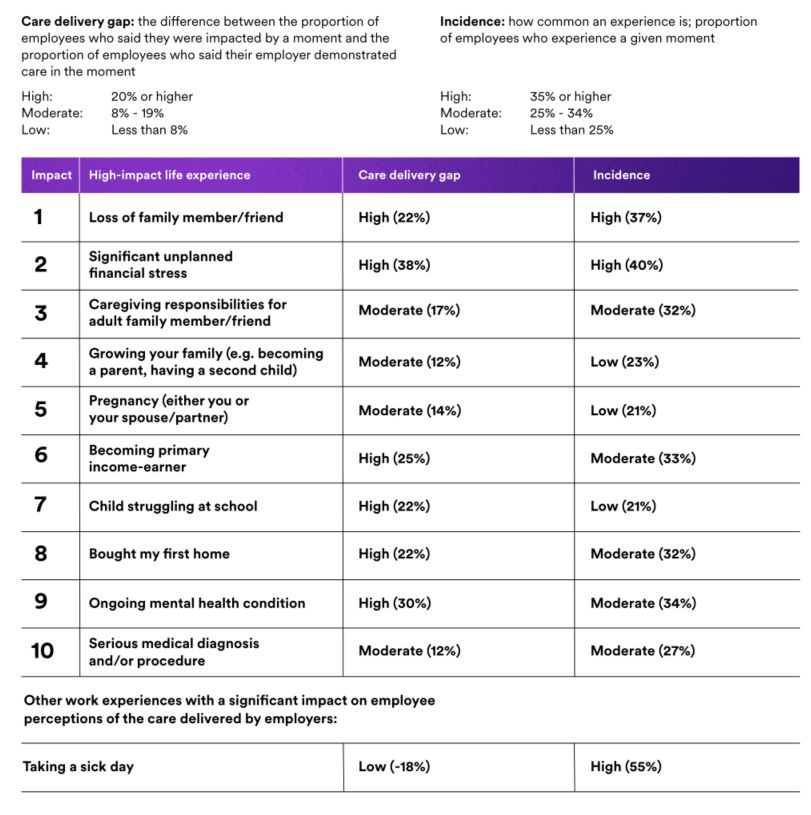

Ongoing mental health condition (e.g., depression, anxiety): Finding help when it’s needed

- Value-Based Care: There is a growing interest in value-based care models, which tie provider reimbursement to patient outcomes and cost-effectiveness rather than simply the volume of services provided.

- Telemedicine: The COVID-19 pandemic has accelerated the adoption of telemedicine and virtual care options, which can help to reduce costs and improve access to care for employees.

Work-Family Benefits

In recent years, there has been a growing recognition of the importance of work-family benefits in helping employees balance the demands of their personal and professional lives. These benefits, which can include everything from flexible work arrangements to paid parental leave, are increasingly seen as a key factor in attracting and retaining top talent.

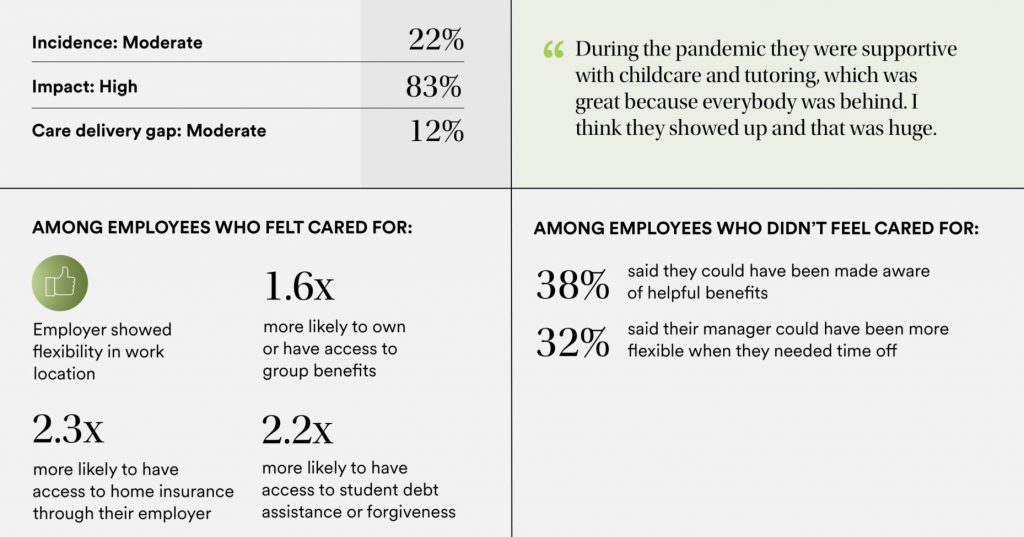

Workplace life experiences: Growing a family – having or adopting a child

Some work-family benefits, such as unpaid family and medical leave, are mandated by federal law under the Family and Medical Leave Act (FMLA). However, many employers choose to go beyond these minimum requirements and offer more generous work-family benefits as part of their overall compensation package.

The adoption and diffusion of work-family benefits has been driven by a range of factors, including changing demographics (such as the increasing number of dual-earner households), evolving social norms and expectations, and the growing recognition of the business case for supporting work-family balance.

However, the utilization and effectiveness of work-family benefits can vary widely depending on factors such as organizational culture, manager support, and individual employee needs and preferences. Here are some key considerations for employers looking to maximize the impact of their work-family benefits:

- Communication and Education: Ensuring that employees are aware of and understand the work-family benefits available to them is critical to driving utilization and impact.

- Manager Training and Support: Managers play a key role in supporting and encouraging the use of work-family benefits and may need training and resources to effectively do so.

- Flexibility and Customization: One-size-fits-all approaches to work-family benefits are often less effective than more flexible and customizable options that can be tailored to individual employee needs and preferences.

- Measurement and Evaluation: Regularly assessing the utilization and impact of work-family benefits can help employers identify areas for improvement and make data-driven decisions about their benefits strategy.

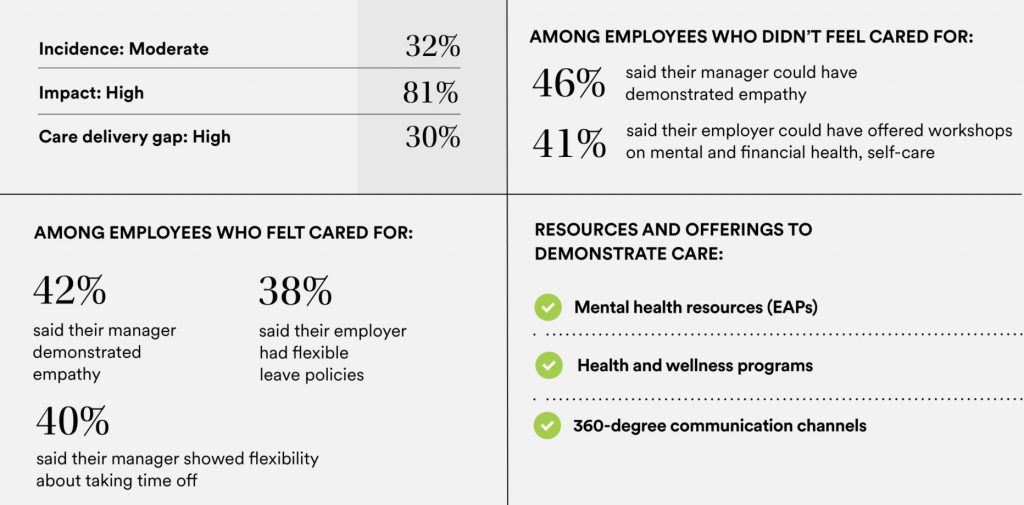

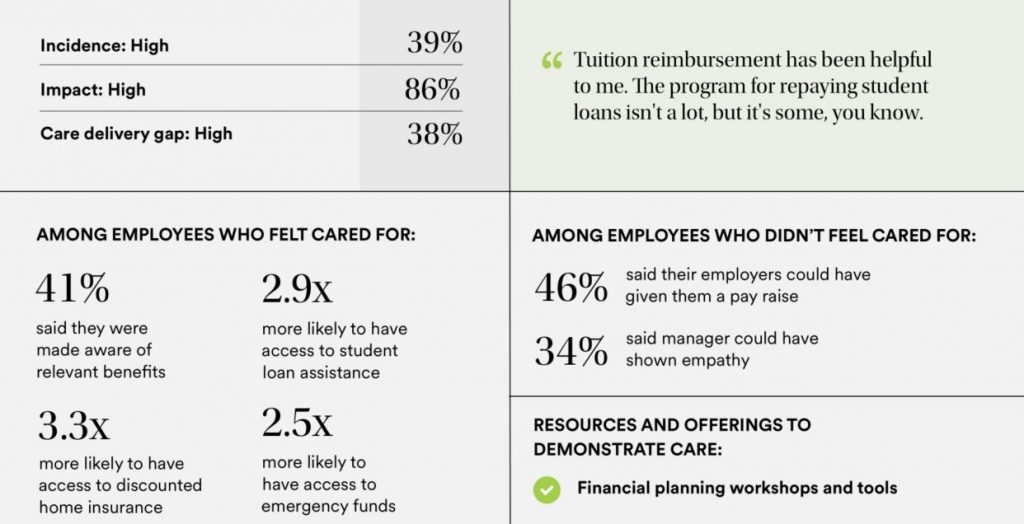

Workplace life experiences: Significant unplanned financial stress

Offering various types of paid time off, including holidays, sick leave, vacations, family leave, bereavement leave, and sabbaticals, is essential. These types of leave help employees recharge and maintain a healthy work-life balance.

Beyond the standard benefits, additional incentives can play a significant role in enhancing the overall compensation package.

- Commissions: Extra earnings for employees based on sales or performance metrics.

- Bonuses: One-time or recurring financial rewards for meeting or exceeding specific goals.

- Performance Awards: Recognitions and rewards for outstanding work or achievements.

- Profit-sharing: A system where employees receive a share of the company’s profits, aligning their interests with the company’s success.

- Stock Options: Opportunities for employees to purchase company stock at a set price, providing potential long-term financial benefits.

The Changing Face of Benefits

Like a chameleon adapting to its environment, the benefits landscape is constantly shifting and evolving in response to a range of forces – from technological advances and demographic shifts to economic pressures and global events.

The Rise of Personalization

One of the most significant trends shaping the future of benefits is the rise of personalization. Just as consumers have come to expect personalized experiences in every aspect of their lives – from their Netflix recommendations to their Starbucks orders – employees are increasingly looking for benefits that are tailored to their unique needs and preferences.

This trend is being driven in part by the increasing diversity of the workforce, with employees spanning multiple generations, life stages, and cultural backgrounds. A one-size-fits-all approach to benefits simply won’t cut it in this environment.

Today’s employees need a benefits package that is as unique as a fingerprint – one that takes into account your age, your health status, your family situation, and your personal goals and aspirations.

Employers who want to stay ahead of the curve will need to embrace this trend by offering more flexible and customizable benefits options. This could include everything from modular benefit plans that allow employees to pick and choose the coverage they need, to AI-powered tools that help employees navigate their benefits and make informed decisions.

The Digital Revolution

From telemedicine and wearable devices to mobile apps and online portals, technology is transforming the way employees access and engage with their benefits.

With the COVID-19 pandemic accelerating the adoption of virtual care, more and more employees are turning to telemedicine as a convenient and cost-effective alternative to traditional in-person doctor visits.

But the digital revolution isn’t just about telemedicine. It’s also about using technology to streamline and simplify the benefits experience for employees. Like being able to access all of your benefits information and resources through a single, user-friendly online portal. Or being able to easily compare different plan options and costs using interactive decision-support tools.

The Wellness Revolution

With burnout and stress on the rise, particularly in the wake of the pandemic, employers are recognizing the importance of supporting their employees’ physical, mental, and emotional health.

According to the 2024 State of Work-Life Wellness report from Gympass, 93% of employees consider workplace well-being as important as salary.

But the wellness revolution is not just about offering a few perks or programs. It is about creating a culture of well-being that permeates every aspect of the employee experience. It’s about building a workplace where employees feel supported, energized, and empowered to bring their best selves to work every day. Where taking care of oneself is not just encouraged but celebrated.

Conclusion – The Future of Employee and Group Benefits

So, what does the future of benefits look like? While it is impossible to predict with certainty, one thing is clear – the benefits landscape will continue to evolve and change in response to the needs and expectations of employees.

We may see a continued shift towards more personalized and flexible benefit options, with employees having greater control over how they allocate their benefit dollars. We may see a greater emphasis on holistic well-being, with benefits that support not just physical health but also mental, emotional, and financial wellness.

We may also see a blurring of the lines between work and life, with benefits that support employees both on and off the job. This could include everything from flexible work arrangements and paid time off to caregiving support and financial planning services.

To stay ahead of the curve, employers should be proactive, agile, and responsive. They will need to stay attuned to the changing needs and preferences of their workforce and be willing to adapt and innovate in response. The businesses that can navigate this shifting landscape with creativity, empathy, and a commitment to their employees’ well-being will be the ones who thrive in the years ahead.

Do check out Carver Agents’ RegWatch – our new AI solution for real-time contextual regulatory risk intelligence, built for risk and strategy executives. Think of it as agentized mid-market LexisNexis. Visit https://carveragents.ai/.