Sarah’s alarm chimes at 6:30 AM. She stretches, knowing a busy day lies ahead. But there’s no panic in her movements. No frantic mental math about doctor’s bills or retirement savings. Sarah, like millions of Canadians, starts her day wrapped in an invisible safety net.

She checks her phone. A notification reminds her of a dentist appointment next week. No worries – her employer’s supplemental health plan covers it. As she sips her morning coffee, Sarah glances at the financial app tracking her retirement savings. The steady growth brings a smile to her face.

On her commute, Sarah overhears a colleague discussing parental leave plans. Canada’s generous policies mean growing a family won’t derail a career. At lunch, she books a massage, grateful for the wellness account that makes self-care accessible.

These seemingly mundane moments showcase the profound impact of Canadian employee benefits. They shape daily routines, life decisions, and the very culture of work itself. But how did this intricate system come to be? What challenges does it face? And where is it headed?

In this article, we will journey through Canada’s unique benefits landscape. From coast to coast, we’ll uncover how these benefits weave a social fabric that defines the Canadian working experience.

The Evolution of Employee Benefits in Canada

In the 1940s, Canada was emerging from the Great Depression, still reeling from economic upheaval. Unemployment Insurance was introduced as a safety net for workers in uncertain times. It was a collective agreement that no Canadian should fall through the cracks.

Fast-forward to 1965. The Beatles are on the radio, and Canada is thinking about the long game. Thus, the Canada Pension Plan (CPP) was started. Suddenly, retirement wasn’t a privilege for the few but a right for the many. Workers could now look to their golden years with hope, not fear.

But what about health? 1984 brought the Canada Health Act, enshrining the principle of universal healthcare. No more choosing between rent and medical bills.

As the new millennium dawned, so did a new perspective. Work-life balance entered the conversation. Flexible hours, extended parental leave, mental health support – these become the new frontier of benefits.

Each of these milestones represents more than policy. They’re chapters in Canada’s story, reflecting evolving values and aspirations. From basic security to holistic well-being, the journey of Canadian benefits mirrors the nation’s growth.

Yet, this evolution isn’t a simple upward trajectory. It’s a complex dance of progress and challenge, of federal initiatives and provincial variations. As we step into the present, the landscape becomes even more intricate.

Today’s Canadian Benefits Ecosystem

Canada’s employee benefits system is a complex interplay of mandatory and voluntary elements. At its foundation are the statutory benefits, non-negotiable protections that form the core of social security.

Mandatory benefits:

- Provincial healthcare coverage: Universal access to essential medical services.

- Canada Pension Plan (CPP)/Quebec Pension Plan (QPP): Retirement income based on career-long contributions.

- Employment Insurance (EI): Temporary financial support for unemployed workers.

- Survivor insurance: Financial protection for families of deceased contributors.

- Workers’ compensation: Coverage for work-related injuries or illnesses.

For a typical Canadian employer, a comprehensive benefits package runs between 5,000 to 7,000 Canadian Dollars per employee annually, or about 420-580 Canadian Dollars monthly. Smaller companies typically spend about 15% of their payroll on benefits, while larger businesses may invest up to 30%. This disparity is driven by several factors, including the company’s bargaining power with insurance providers, the level of coverage offered, industry norms, and employee demographics.

This combination creates a comprehensive safety net. It’s a system that balances public and private involvement, setting Canada apart from nations with purely public or heavily privatized approaches.

What do Canadian employees value most? The priorities are clear:

- Healthcare coverage, especially for prescriptions

- Disability protection

- Retirement benefits

- Life insurance

- Wellness programs

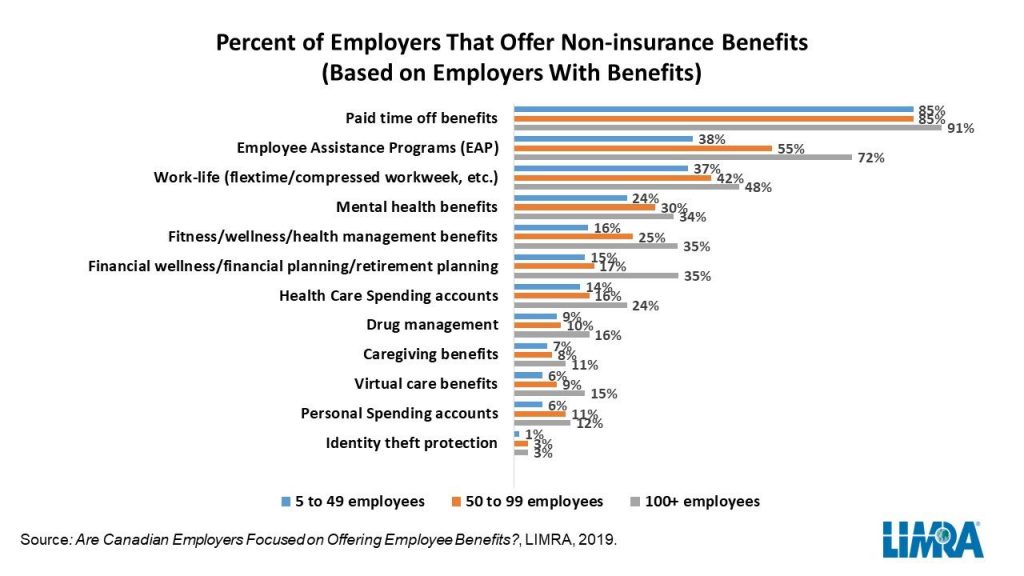

In recent years, we’ve seen a shift towards modern, lifestyle-oriented perks. Virtual healthcare services, mental health support, and digital fitness platforms are becoming increasingly common.

The Role of Labor Unions in Canadian Employee Benefits

Labor unions have played a significant role in shaping the landscape of employee benefits in Canada. Through collective bargaining, unions have consistently advocated for better working conditions, fair wages, and comprehensive benefits packages for their members.

Major Canadian labor unions, such as the Canadian Labour Congress (CLC), Unifor, and the Canadian Union of Public Employees (CUPE), have been at the forefront of negotiating enhanced benefit packages.

The Public Service Alliance of Canada (PSAC), representing federal government workers, has been instrumental in securing comprehensive benefits for public sector employees. They’ve advocated for benefits that extend beyond the workplace, such as education allowances and relocation assistance.

In the healthcare sector, unions like the Canadian Federation of Nurses Unions (CFNU) have fought for better working conditions and benefits that address the unique challenges faced by healthcare workers, including improved mental health support and protection against workplace violence.

The Canadian benefits model is neither fully socialized nor entirely market-driven. Instead, it’s a careful balance, leveraging the strengths of both public and private sectors.

Detailed Look at Canadian Employee Benefits

Let’s examine in detail the key components of Canada’s employee benefits system.

Canada Pension Plan (CPP): The CPP forms the backbone of retirement planning for most Canadians. Mandatory for workers outside Quebec, it ensures a basic level of income in retirement. In 2024, the Yearly Maximum Pensionable Earnings (YMPE) is set at $68,500.

For 2023, the contribution rate stands at 5.95%, with a maximum annual contribution of $3,754. Eligibility for CPP retirement pension begins at age 60, though benefits increase if delayed until age 70.

Quebec Pension Plan (QPP): Quebec residents participate in the QPP instead of the CPP. While similar in many respects, the QPP has a higher contribution rate of 12.8% for 2023, applying to earnings between $3,500 and $64,900.

Old Age Security (OAS): OAS provides additional retirement income, funded from general tax revenues. Unlike CPP/QPP, it’s not based on work history but on years of residency in Canada after age 18.

Beyond the CPP/QPP, Canadians have several options to enhance their retirement savings:

- Registered Pension Plans (RPP): Employer-sponsored plans with tax advantages.

- Group Registered Retirement Savings Plans (GRRSP): Employer-facilitated plans where contributions are made through payroll deductions.

- Deferred Profit Sharing Plans (DPSP): Employers share profits with employees in a tax-advantaged manner.

- Tax-Free Savings Accounts (TFSA): Flexible savings option with tax-free growth.

- Non-Registered Savings Plans: Additional savings without tax advantages but with more flexibility.

Employment Insurance (EI): EI provides temporary financial support during periods of unemployment. It covers 55% of average insurable weekly earnings, up to a maximum of C$668 per week in 2024. The maximum yearly insurable earnings for 2024 is set at C$63,200.

EI isn’t just for job loss. It also provides support during illness, pregnancy, while caring for a newborn or adopted child, or when caring for a critically ill or injured person.

Legislated Leaves: Canada boasts one of the highest counts of legislated leaves globally. These leaves, governed by both federal and provincial mandates, ensure job protection during significant life events. They include maternity and parental leave, compassionate care leave, and leaves for personal or family responsibilities.

Maternity and Parental Benefits: Maternity benefits provide up to 15 weeks of financial support for biological mothers, including surrogate mothers. Parental benefits offer two options:

- Standard parental leave: 55% of income for up to 40 weeks (shared between parents)

- Extended parental leave: 33% of income for up to 69 weeks (shared between parents)

These benefits, administered through the EI system, allow parents to focus on their new family members without financial stress.

Provincial Healthcare Insurance: Canada’s universal healthcare system is primarily funded by government tax revenue from the 13 provinces and territories. While the Canada Health Act sets national standards, coverage can vary by province or territory. This system ensures that all residents have access to medically necessary hospital and physician services without direct charges at the point of service.

Extended Health Care: To complement the public system, 91% of Canadian employers offer extended health care to salaried employees, with 77% paying the full premium. These plans typically cover:

- Prescription drugs

- Dental care

- Vision care

- Paramedical services (e.g., physiotherapy, massage therapy)

- Supplemental hospital coverage

- Out-of-country medical coverage

This combination of public and private coverage ensures comprehensive health protection for most Canadian workers.

Survivor Insurance: Provided through the CPP or QPP, survivor benefits offer financial support to the family members of deceased contributors. All employees between 18 and 70 are eligible, providing peace of mind that loved ones will be cared for in the event of their passing.

Workers’ Compensation: This crucial benefit ensures that employees are protected if they’re hurt on the job, covering medical expenses and providing income replacement during recovery.

Life Coverage: This coverage helps survivors handle the financial impact of an employee’s passing, providing a lump sum payment to designated beneficiaries.

Long-term Disability Benefits: Fully funded by employers, long-term disability benefits provide a percentage of an employee’s income when they’re ill, injured, or disabled for an extended period. This benefit ensures financial stability during challenging times, typically kicking in after short-term disability coverage ends.

Taxable Benefits

- Most cash benefits like bonuses, commissions, and overtime pay are considered taxable income and subject to federal/provincial income taxes, as well as CPP and EI premiums.

- Employer-provided vehicles for personal use are a taxable benefit – the employee must report a standby charge and operating cost benefit.

- Discounts on merchandise or services provided by the employer are generally taxable benefits.

Non-Taxable Benefits

- Employer contributions to registered pension plans (RPPs) or deferred profit-sharing plans (DPSPs) are not taxable.

- Private health plan premiums paid by the employer for supplementary coverage (e.g., dental, vision, drugs) are not taxable benefits.

- Employer-provided parking at or near the workplace is generally not a taxable benefit.

- Reasonable amounts reimbursed for eligible home office expenses due to the pandemic are non-taxable.

Regulatory Landscape of Canadian Employee Benefits

The Canadian employee benefits system operates within a complex regulatory framework. Understanding this landscape is crucial for all stakeholders.

Federal Regulations: The Canada Labour Code governs labor standards for federally regulated industries. The Income Tax Act determines the tax treatment of various benefits. The Pension Benefits Standards Act regulates private pension plans in federal jurisdictions.

Provincial Regulations: Each province has its own Employment Standards Act. These acts set minimum requirements for employment conditions. Provincial pension legislation complements federal laws. Health insurance acts govern the administration of provincial health plans.

Key Regulatory Bodies: The Canada Revenue Agency (CRA) oversees the tax implications of benefits. The Office of the Superintendent of Financial Institutions (OSFI) regulates federally registered pension plans. Provincial bodies like Ontario’s Financial Services Regulatory Authority (FSRA) supervise provincially regulated plans. The Canadian Life and Health Insurance Association (CLHIA) represents life and health insurers.

Emerging issues like data privacy and virtual healthcare are likely to prompt new regulations. The gig economy may necessitate updates to existing labor laws. Climate change considerations could impact investment regulations for pension funds.

Challenges in the Canadian Benefits Landscape

The specter of escalating healthcare costs looms large over the benefits landscape. This relentless climb outpaces both inflation and wage growth, putting pressure on employers and employees alike.

However, the challenge extends beyond just employer-provided benefits. The true cost of Canada’s public healthcare system is often misunderstood by citizens, primarily because they don’t incur direct expenses for health services and can’t easily determine their individual contributions to the system.

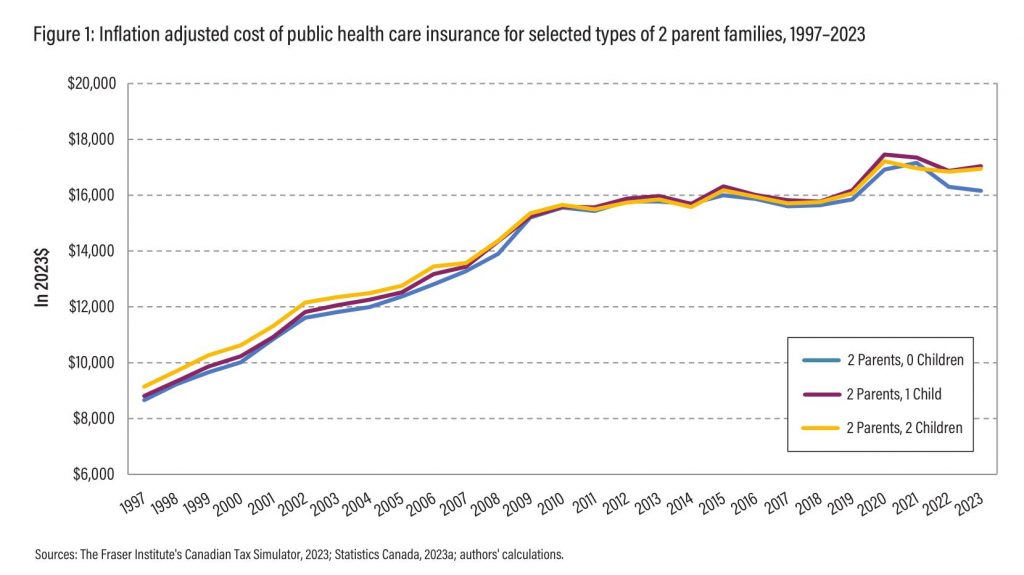

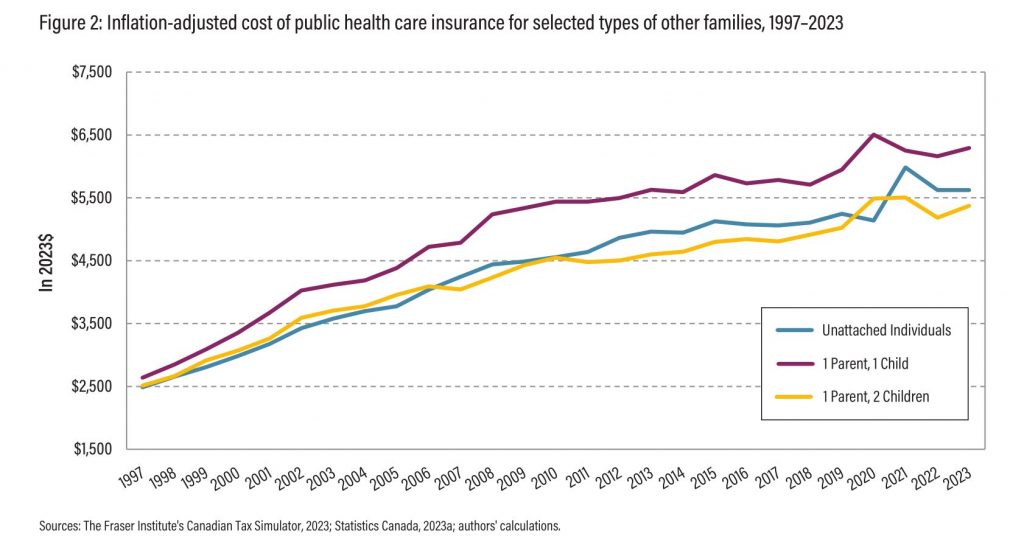

Recent data sheds light on this hidden cost:

- In 2023, preliminary estimates suggest that the average payment for public health care insurance ranges from $5,373 to $17,039 for six common Canadian family types, depending on the family structure.

- The cost increase of public healthcare is outpacing other essential expenses. Between 1997 and 2023, the cost of public health care insurance for the average Canadian family increased 4.2 times as fast as the cost of clothing, 2.1 times as the cost of food, 1.8 times as fast as the cost of shelter, and 1.7 times as fast as the average income.

- There’s a significant disparity in contributions across income levels. In 2023, the 10 percent of Canadian families with the lowest incomes will pay an average of about $644 for public health care insurance. Meanwhile, families earning an average income of $80,946 will pay around $7,715, and those in the top 10 percent of income earners will contribute an average of $44,314.

These figures illustrate that the rising cost of healthcare is not just an issue for employer-provided benefits, but a systemic challenge affecting all Canadians. Employers grapple with balancing comprehensive coverage and fiscal responsibility, while employees face the prospect of higher premiums or reduced benefits in their workplace plans. Simultaneously, all Canadians are contributing more to the public system, often without realizing the extent of their contribution.

Canada’s population is projected to age substantially in the coming years. While individuals aged 65 and older accounted for 16.2% of the total population in 2018, they are expected to represent 23.4% of the population by 2040.

The financial implications of this demographic shift are staggering. Assuming no change in the prices of inputs to the provision of health care services, the growth in the number of Canadians aged 65 and older will increase health care expenditures by approximately 88% from 2019 to 2040.

Innovations Reshaping the Canadian Benefits Landscape

The Canadian employee benefits sector is evolving rapidly, driven by technological advancements and changing workforce needs. Here are the key innovations transforming this space:

Personalization: Benefits packages are becoming increasingly tailored to individual needs. Flexible benefits programs like Deloitte Canada’s allow employees to customize their benefits, while Health Spending Accounts (HSAs) and wellness accounts give employees more control over their benefits allocation. As this trend continues, we may see hyper-personalized packages where each employee has a unique benefits profile based on their specific needs and preferences.

Artificial Intelligence (AI): AI is revolutionizing benefits administration through predictive analytics, personalized recommendations, fraud detection, and improved customer service. AI-driven systems analyze data to predict health needs, suggest benefit options, identify fraudulent claims, and provide 24/7 support through chatbots.

Blockchain: This technology is enhancing the security and efficiency of claims processing by creating an immutable ledger system, reducing fraud, and speeding up reimbursements. As blockchain technology matures, it could expand beyond claims processing to revolutionize overall benefit delivery, potentially enabling real-time benefit transactions and seamless coordination between different benefit providers.

Virtual Healthcare: Many Canadian employers, such as Shopify and Sun Life Financial, are now offering virtual care services like Maple and Dialogue as part of their benefits packages. Employers like Bell Canada and Manulife are offering virtual mental health services through platforms like Inkblot Therapy and MindBeacon, providing employees with on-demand access to therapists and counselors.

The Canadian government has invested over $200 billion in initiatives like the “Working Together to Improve Health Care for Canadians Plan”. The growth of virtual health options may lead to a reimagining of traditional healthcare benefits, with virtual care becoming a primary mode of healthcare delivery for many employees.

Work-Life Balance Initiatives: Scotiabank, one of Canada’s largest banks, offers enhanced parental leave benefits – new mothers receive 100% of their salary for 16 weeks. Deloitte Canada offers several weeks of paid sabbaticals, allowing employees to recharge and spend time with loved ones.

Conclusion

From the foundational pillars of the Canada Pension Plan and provincial healthcare to the innovative flexible benefits and AI-driven personalization, we’ve seen how Canadian benefits have evolved to meet the changing needs of a diverse workforce.

In an era of global competition for talent, robust and innovative benefits packages serve as a powerful tool for attraction and retention. Moreover, as the nature of work continues to evolve, with remote work and the gig economy gaining prominence, benefits play a crucial role in providing stability and security.

In closing, let us consider this: the true value of Canadian benefits lies not just in the financial security they provide, but in the societal statement they make. They are a declaration that in Canada, a worker’s value extends beyond their productive output – that every individual deserves dignity, security, and the opportunity to thrive.

Do check out Carver Agents’ RegWatch – our new AI solution for real-time contextual regulatory risk intelligence, built for risk and strategy executives. Think of it as agentized mid-market LexisNexis. Visit https://carveragents.ai/.