Pension funds are like a vast web, woven over decades, where each thread represents a worker’s career—their wages, years of service, and life events. When this complex web worth billions of dollars changes hands, a single loose thread can unravel the entire fabric.

Remember that adage, “You can’t manage what you can’t measure”? Well, in PRTs, you can’t transfer what you can’t quantify.

The integrity of these massive deals hinges on one critical factor: data quality.

Consider the implications…

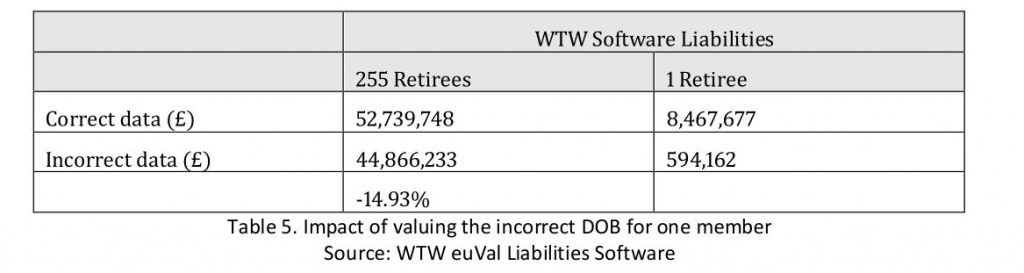

- A mistyped birth date could extend a pension’s liability by years.

- An overlooked salary increase might undervalue a plan by millions.

- A misclassified employee could skew an entire risk profile.

Despite this, many insurers cite data quality as a “significant concern” in PRT transactions. It is a startling statistic in an industry built on precision.

For insurers and plan sponsors, this challenge presents a paradox. The same data complexities that create risk also offer opportunity. Those who can master the intricacies of pension data—spotting loose threads before they unravel—stand to gain a significant edge in this high-stakes market.

This article delves into the critical role of data quality in PRTs. We will explore how leading firms are turning data from a liability into an asset, examine the impact of emerging technologies like AI-driven data assistants, and consider the evolving regulatory landscape that is raising the bar for data integrity.

The High Stakes of Data Quality in PRTs

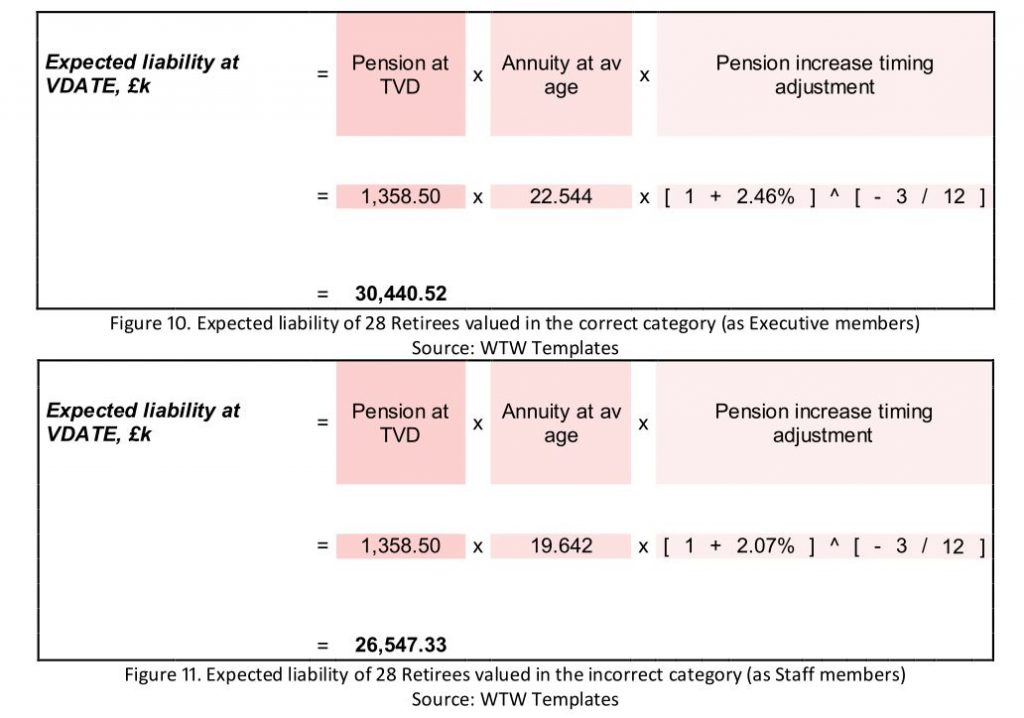

Consider the valuation process, the bedrock of any PRT transaction. A miscategorized executive pension plan can misrepresent liabilities. It can lead to an overvaluation of pension obligations, distorting the entire risk profile of the transfer.

The costs associated with poor data quality extend beyond direct financial implications. Administrative burdens multiply as teams reconcile inconsistent records, often leading to protracted deal timelines.

Timing, a critical factor in PRT transactions, can be severely impacted by data quality issues. Market opportunities are fleeting, and the ability to act swiftly often hinges on having clean, readily available data. Insurers with robust data management practices can respond more quickly to market conditions, potentially securing more favorable terms or capturing time-sensitive opportunities.

Beyond financial repercussions, data quality issues in PRTs can have severe reputational and regulatory consequences. In an era of increased scrutiny, insurers and pension funds alike face potential backlash from stakeholders and regulatory bodies when data discrepancies come to light. The reputational damage from a publicly disclosed data error can far outweigh the immediate financial impact, potentially affecting future business opportunities and stakeholder trust.

As the PRT market evolves, the importance of data quality intensifies. The introduction of more complex pension structures, the growing emphasis on real-time valuations, and the increasing sophistication of regulatory requirements all underscore the need for impeccable data management.

Scribble Data’s Plan Data Cleaner AI assistant, for instance, offers a systematic approach to structuring, cleansing, and validating plan data.

The Four Pillars of Pension Data Excellence

- Accuracy: Accuracy in pension data transcends mere correctness. It embodies fiduciary responsibility. In PRT contexts, even minor inaccuracies can lead to significant valuation discrepancies. Sophisticated data validation techniques, including cross-referencing multiple data sources and employing advanced statistical anomaly detection, have become essential tools in ensuring accuracy.

- Completeness: Data gaps in pension records can severely undermine the integrity of PRT valuations. The challenge lies not just in identifying missing information, but in understanding the implications of these gaps on overall liability assessments. Advanced predictive modeling techniques now allow actuaries to estimate missing data points with increasing precision, though the goal remains to minimize such instances through comprehensive data collection and maintenance strategies.

- Consistency: Maintaining data consistency across various platforms and time periods poses a significant challenge, especially in an era of mergers, acquisitions, and legacy systems. Inconsistencies between HR records, payroll systems, and pension administration databases can lead to material discrepancies in liability calculations. Implementing robust data governance frameworks and utilizing sophisticated data reconciliation tools is crucial for ensuring consistency across all data points.

- Timeliness: The volatility of financial markets and evolving regulatory landscapes demand real-time or near-real-time data updates. Timely data not only ensures accurate valuations but also enables swift responses to market opportunities. The integration of automated data pipelines and real-time reporting systems has become a critical factor in maintaining the relevance and reliability of pension data.

Common PRT Data Pitfalls and Their Impacts

The landscape of pension data is fraught with potential pitfalls, each carrying significant implications for PRT transactions.

- Personal Information Discrepancies: Issues such as incorrect birth dates or misclassified beneficiary relationships can dramatically alter liability projections. A single year’s discrepancy in a participant’s age can shift liability calculations by 5-10%, depending on the specific plan structure.

- Benefit Calculation Errors: The complexity of pension benefit formulas, especially in plans with multiple tiers or special provisions, creates ample room for calculation errors. These can range from misapplied cost-of-living adjustments to incorrect service credit allocations, each potentially skewing liability assessments.

- Historical Record Inconsistencies: Mergers, plan amendments, and system migrations often result in fragmented or inconsistent historical records. Reconciling these discrepancies requires both technical acumen and a deep understanding of historical plan provisions and corporate structures.

Leveraging Data as a Competitive Advantage

Forward-thinking insurers increasingly view data quality not as a compliance burden, but as a strategic asset in PRT operations.

- Precision Pricing: High-quality data enables more granular risk assessments, allowing insurers to price PRT deals more competitively while maintaining appropriate risk margins.

- Operational Efficiency: Clean, well-structured data streamlines due diligence processes, reducing transaction timelines and associated costs.

- Enhanced Risk Management: Comprehensive, accurate data facilitates more sophisticated Asset-Liability Management (ALM) strategies and improved long-term risk forecasting.

The RFP Pricing Assistant by Scribble Data exemplifies the innovative tools now available to insurers. By extracting and analyzing complex parameters from RFPs, it enables more accurate and efficient analysis.

Best Practices for Ensuring Data Quality in PRTs

PRTs demand a level of data precision that challenges even the most sophisticated data management systems. Leading insurers are adopting advanced strategies and emerging technologies to meet this challenge head-on.

Robust Data Governance

Effective data governance is the foundation of these efforts. Progressive insurers are fostering a culture of data stewardship throughout their organizations. This cultural shift is evident in multi-tiered governance structures that clearly define data ownership, establish rigorous quality standards, and enforce accountability at all levels.

Data Quality Councils

Data Quality Councils, comprising cross-functional teams, play a pivotal role in aligning data quality initiatives with strategic objectives. These councils typically include representatives from actuarial, IT, legal, and operations departments, ensuring a holistic approach to data management. They set and regularly review data quality metrics, oversee the implementation of data quality tools, and drive continuous improvement initiatives.

Data Lineage Tracking

A critical aspect of governance is data lineage tracking. Insurers now leverage advanced systems to monitor data provenance throughout its lifecycle, from initial collection to final use in PRT calculations. This capability proves invaluable when discrepancies arise, enabling quick identification and resolution of issues.

Modern Data Auditing

Modern data auditing has evolved significantly, incorporating predictive analytics and machine learning to identify subtle inconsistencies and potential future issues. Scribble Data’s Onboarding Assistant exemplifies this advanced approach, offering AI-powered tools for structuring, sanitizing, and validating onboarding data from diverse sources.

Artificial Intelligence and Machine Learning

Advanced algorithms can now identify subtle data patterns and flag deviations that might indicate errors, often catching issues that would elude human auditors. NLP has opened new frontiers in data extraction, allowing insurers to glean relevant information from unstructured sources like plan documents and participant communications.

NLP’s impact is particularly significant in dealing with legacy pension plans, where critical information often resides in decades-old paper documents. The Market Intelligence Assistant by Scribble Data showcases the power of AI in PRT data management, efficiently extracting and enriching data from complex sources like Form 5500 and 10-K filings.

Organizational Culture and Data Literacy

However, technology alone cannot ensure data excellence. True data quality stems from an organizational culture that values and prioritizes it at every level. Leading insurers are implementing comprehensive data literacy programs, elevating data understanding across all departments. These programs go beyond basic data management practices, delving into the specific data challenges of PRTs and their implications for the business.

Cross-functional data quality teams are becoming increasingly common, bringing together actuaries, IT specialists, and business analysts to address data challenges holistically. These teams work on projects like developing custom data quality scorecards for PRT deals, creating automated data quality dashboards, and designing data quality KPIs that are meaningful across different business units.

Balanced, Risk-Based Approach

While striving for perfect data is admirable, successful insurers recognize the need for a balanced, risk-based approach. They adopt strategies such as:

- Establishing clear materiality thresholds for data discrepancies.

- Implementing tiered data quality protocols based on data criticality.

- Using scenario analysis to understand the potential impact of data uncertainties.

Materiality thresholds help focus resources where they matter most. For instance, an insurer might set a threshold where any data discrepancy that could impact the total liability calculation by more than 0.5% triggers an in-depth review. This approach ensures that minor issues don’t consume disproportionate resources while significant risks are not overlooked.

Tiered data quality protocols recognize that not all data elements are equally critical. For example, an error in a participant’s date of birth might be treated with higher urgency than a discrepancy in their mailing address. This tiered approach allows for more efficient allocation of data quality resources.

Scenario analysis has become an essential tool in understanding the potential impact of data uncertainties. The Bid/No-Bid Assistant from Scribble Data embodies this balanced approach, offering intelligent deal assessment based on various data quality factors and their potential impact on transaction viability.

Navigating the Regulatory Landscape of PRT Data

The regulatory framework governing PRTs has grown increasingly complex, with data quality at its core. The Governmental Accounting Standards Board (GASB) Statements 67 and 68 have set new benchmarks for pension plan financial reporting. These standards require detailed reporting on pension liabilities, including sensitivity analyses that depend heavily on high-quality, granular data.

Simultaneously, the Actuarial Standards Board (ASB) has raised the bar for risk assessment and disclosure through Actuarial Standard of Practice (ASOP) No. 51. This standard mandates a more rigorous evaluation of risk factors in pension valuations, necessitating sophisticated data analysis capabilities.

The GDPR and similar data privacy laws have significant implications for PRT data management, particularly in cross-border transactions. These regulations necessitate stringent data protection measures, adding another layer of complexity to PRT operations.

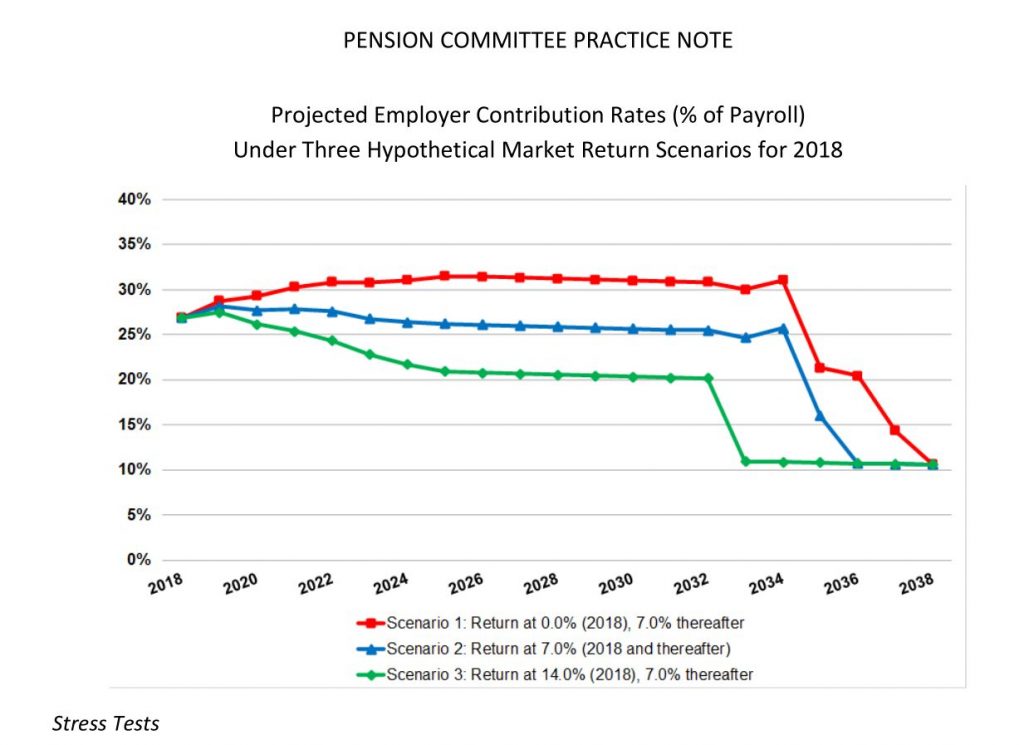

Stress testing has become a critical component of regulatory compliance in the PRT space. Regulators increasingly expect insurers to demonstrate their ability to withstand adverse scenarios, which requires sophisticated data modeling capabilities. The Pew Charitable Trusts’ proposed stress testing scenarios, for instance, demand the ability to rapidly analyze the impact of various economic and demographic shifts on pension liabilities.

Scribble Data’s Valuation Assistant exemplifies the type of tools insurers are leveraging to navigate this complex regulatory environment. By automating the compilation of financial extracts and performance metrics for deal-specific reporting, it not only enhances efficiency but also reduces the risk of reporting errors that could trigger regulatory scrutiny.

The regulatory focus on data quality has also spurred innovations in audit trail management. Insurers are implementing sophisticated data lineage tracking systems that can trace every data point used in PRT calculations back to its source.

Proactive engagement with regulators has become a key strategy for leading insurers. By participating in industry working groups and providing input on proposed regulations, these insurers are helping to shape the regulatory framework while also gaining early insights into upcoming changes.

Conclusion

The evolution of PRT has elevated data quality from a back-office concern to a strategic imperative. The multifaceted challenges of PRT data management—from ensuring accuracy and completeness to navigating regulatory complexities and embracing technological innovations—demand a holistic, forward-thinking approach.

Insurers who excel in PRT data management stand to gain significant competitive advantages. They can price risks more accurately, respond to market opportunities more swiftly, and build stronger trust relationships with plan sponsors and participants.

As we have seen, in the complex world of pension risk transfers, the devil isn’t just in the details—it is the details.

Do check out Carver Agents’ RegWatch – our new AI solution for real-time contextual regulatory risk intelligence, built for risk and strategy executives. Think of it as agentized mid-market LexisNexis. Visit https://carveragents.ai/.