In the late 17th century, Edmond Halley sat by candlelight.

He pored over numbers. Charts. Life tables. Halley, an astronomer by trade, ventured into uncharted waters. He sought to understand mortality, to predict life spans.

His work laid the foundation for modern actuarial science. It was a time of discovery, of manual calculations, and limited data. Yet, it was groundbreaking.

Fast forward to today. The essence of actuarial science remains unchanged. Its core mission is to predict. To assess risk. However, the tools and data at our disposal have transformed – Generative AI (GenAI) and Machine Learning (ML).

Where Halley had paper and pen, actuaries now have algorithms. Data sets not confined to a ledger or book but sprawling across digital landscapes.

GenAI and ML models do not merely calculate. They learn. They adapt. They predict with an accuracy Halley could only dream of.

They identify risk factors unseen to the human eye. Where once actuaries relied on historical data and static models, GenAI and ML offer dynamic, predictive insights.

Actuarial science, rooted in the meticulous study of mortality and risk, now stands at the forefront of technological innovation.

This is our era’s exploration. As Halley charted the stars and composed life tables, we now navigate data’s vastness with sophisticated algorithms.

GenAI and ML in Risk Assessment

In the world of actuarial science, the advent of GenAI and ML represents a paradigm shift. These technologies harness vast datasets—spanning historical claims, demographic information, and behavioral patterns to sculpt detailed, personalized risk profiles.

Where traditional actuarial methods may have relied on broad categorizations and historical averages, GenAI and ML dive into the granular, uncovering the minutiae of risk in a manner unprecedented in both scale and precision.

Unveiling Hidden Patterns

At the heart of this revolution is the ability of GenAI and ML to discern patterns and correlations invisible to traditional analyses.

For instance, ML algorithms can sift through decades of claims data, correlating seemingly disparate factors—such as weather patterns and healthcare outcomes to predict risks with startling accuracy.

This data-driven approach not only refines existing risk models but also unveils new risk factors, reshaping our understanding of what influences outcomes.

Case Studies in Revolutionizing Risk Assessment

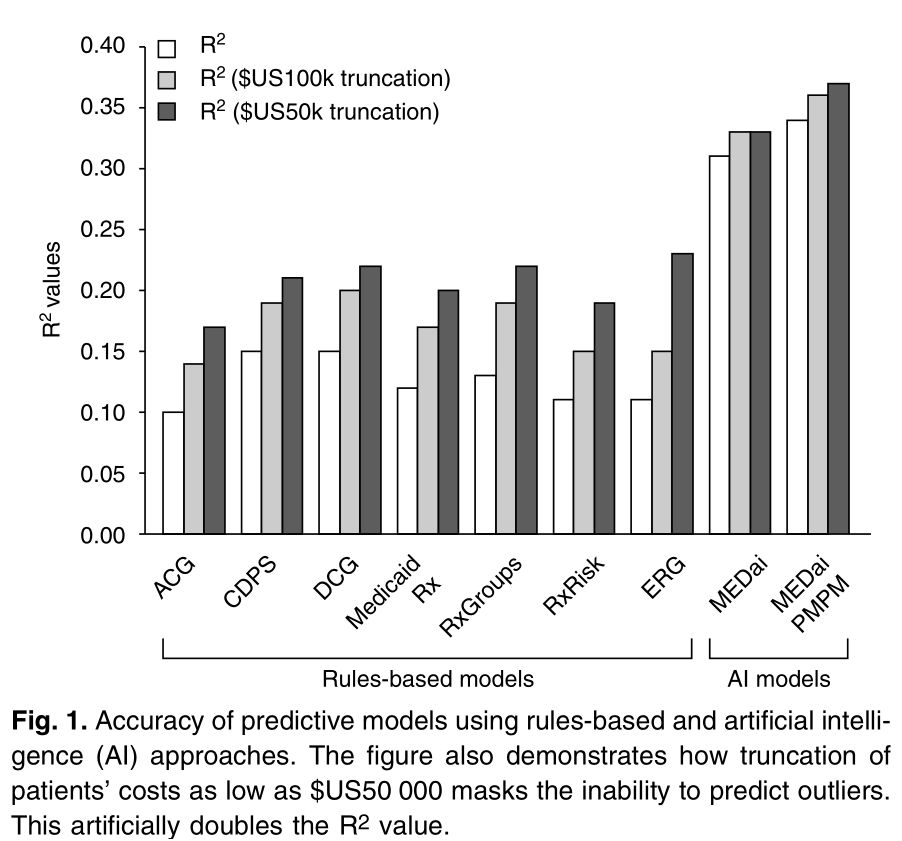

One illustrative example comes from the healthcare sector, where ML algorithms have been deployed to predict large insurance claims with remarkable accuracy. By analyzing patient histories, lifestyle factors, and even genetic information, these algorithms can forecast individuals’ future healthcare needs, allowing insurers to craft more accurate and equitable policies.

Another groundbreaking application is found in property insurance. Here, GenAI plays a crucial role in dynamic risk modeling, taking into account real-time environmental changes. For example, models that integrate data from satellite imagery and climate sensors can now predict the impact of climate change on property risks, enabling insurers to adjust policies in anticipation of increasing weather volatility.

Technological Foundations of Modern Risk Assessment

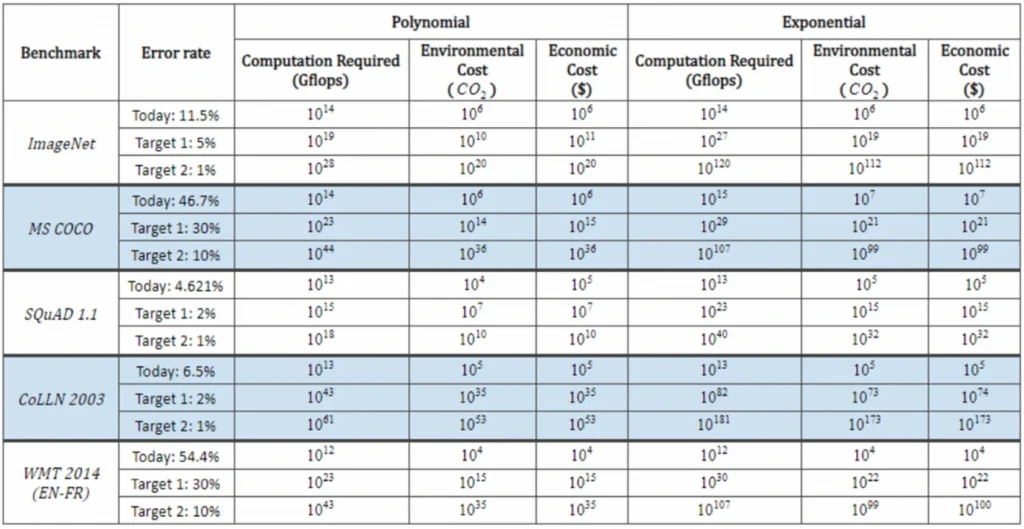

The efficacy of GenAI and ML in transforming risk assessment is anchored in the exponential growth of computational capabilities and data storage solutions.

Source: Implications of achieving performance benchmarks on the computation, carbon emissions (lbs.), and economic costs from deep learning based on projections from polynomial and exponential models (figure from Thompson et al. 2020)

- Computational Power: Today’s processors can perform trillions of calculations per second, enabling the real-time analysis of complex datasets. This computational might is crucial for running sophisticated ML algorithms and GenAI models, which require significant processing power to analyze patterns and predict outcomes.

- Data Storage Evolution: The advent of cloud storage and advancements in database technology have revolutionized data accessibility and analysis. Actuaries now can instantly access and analyze petabytes of data, a scale of information that provides an unprecedented depth of insight into risk factors.

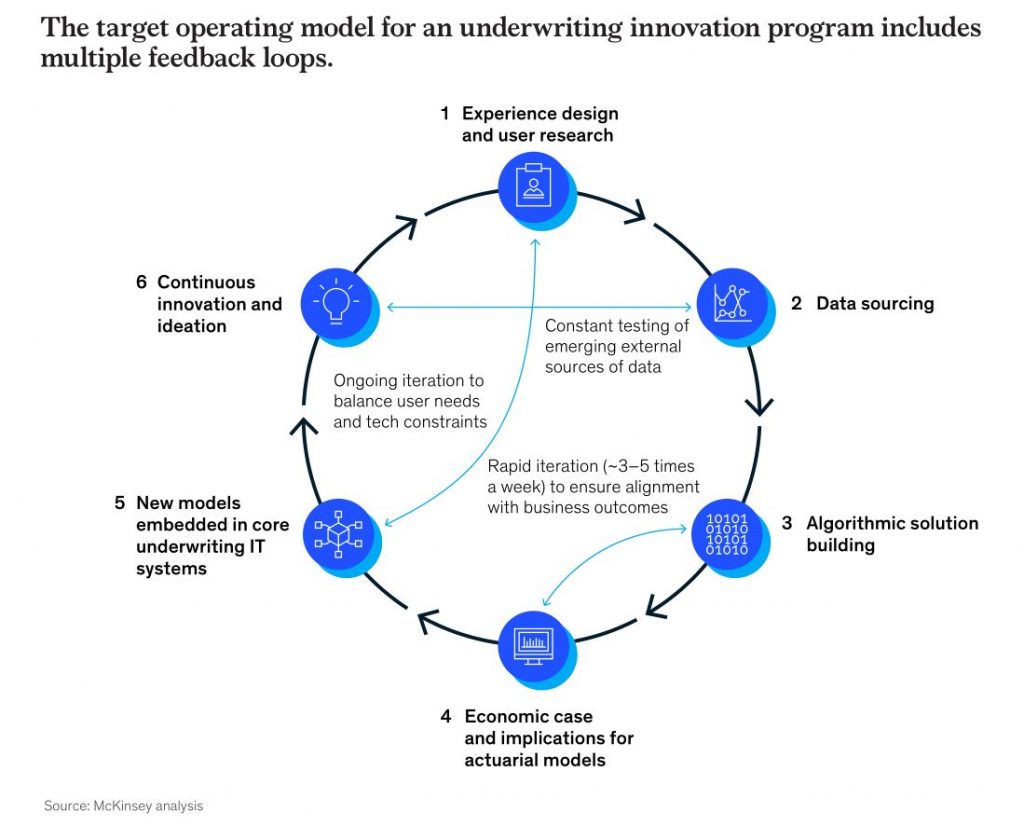

GenAI and ML for Underwriting

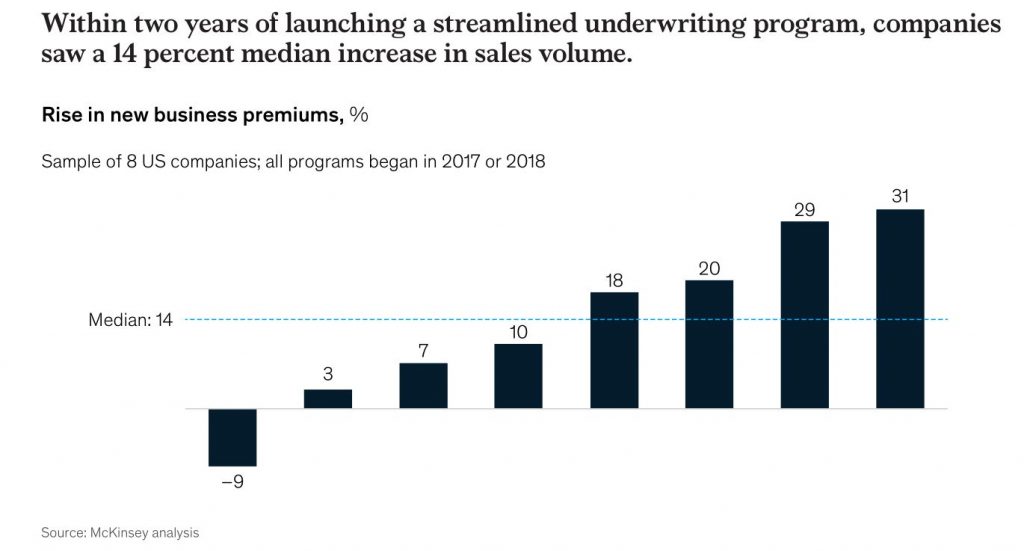

Underwriting, once a labor-intensive process, finds new efficiency with GenAI and ML. These technologies dissect mountains of data—medical records, lifestyle habits, financial histories—with an efficiency that human hands can’t match.

- Automated Analysis: Algorithms work tirelessly, parsing data with a precision that unveils the granular details of risk. This isn’t just automation, it’s augmentation. Underwriters, equipped with these insights, make decisions faster and with greater confidence.

- Real-Time Adaptation: ML models excel in learning. They ingest new information, adapting and refining risk assessments on the fly. This dynamic approach keeps risk models evergreen, aligning with the latest data, trends, and patterns.

Precision at the Core

The heart of GenAI and ML’s transformation in underwriting beats with precision. Risk models, once broad and generalized, now become laser-focused. Pricing strategies, tailored to the individual, emerge from the data.

- Tailored Risk Assessment: By delving into personal data points, algorithms craft risk profiles that mirror the individual, not the crowd. This precision ensures that premiums are fair, and grounded in data rather than assumption.

- Adaptive Pricing Models: ML models don’t just assess, they predict. It anticipates future risk based on ongoing data analysis, allowing insurers to adjust premiums proactively. This isn’t static pricing – it’s dynamic, responsive to the evolving nature of risk.

Real-World Transformations

- Life Insurance Personalization: Life insurance companies can ML to personalize policies. By analyzing a wide array of factors, from health metrics to lifestyle choices, insurers can develop premiums that accurately reflect individual risk, increasing customer satisfaction and market competitiveness.

- Commercial Risk Differentiation: In commercial insurance, firms can use GenAI to differentiate risks more finely among businesses. These models can help analyze industry-specific trends, company financials, and even social media sentiment. This results in risk profiles that allow for more nuanced underwriting and pricing strategies.

This shift is not merely operational but strategic, positioning insurers to embrace the complexities of the modern risk landscape with tools designed for precision, adaptation, and insight.

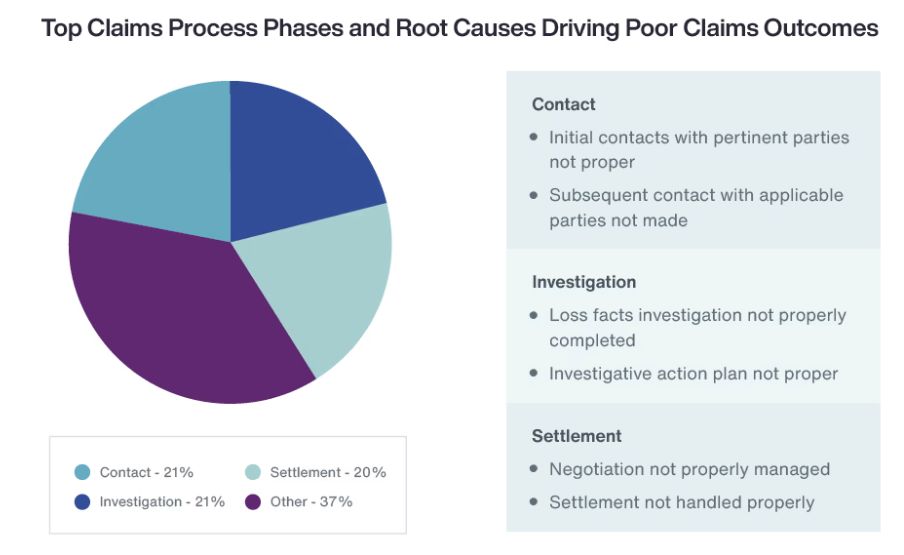

GenAI and ML in Claims Processing

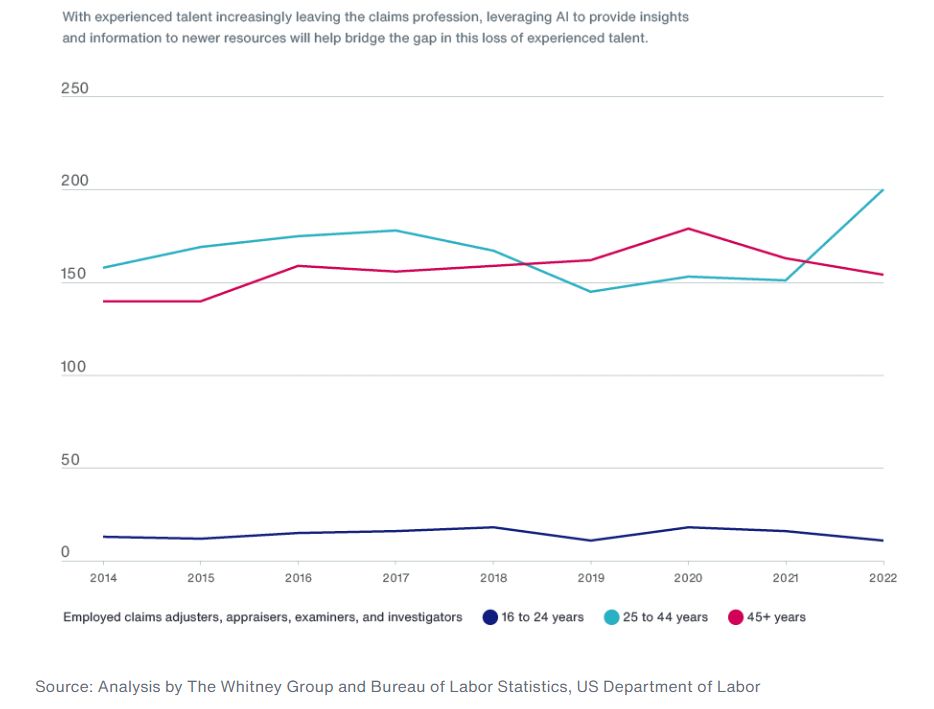

The integration of Generative AI (GenAI) and Machine Learning (ML) into claims processing is revolutionizing the insurance industry. These technologies automate tasks, cutting down on the time and labor traditionally required for claims handling.

GenAI tools, with their natural language processing capabilities, can parse through claim documentation, extracting key details such as policy information and incident descriptions. This leads to swifter claims resolutions, enhancing customer satisfaction.

Automation and Accuracy

GenAI models automate claims assessment, swiftly reducing the time-consuming and mundane checks that are prone to human error. For instance, a global provider of claims management solutions implemented a cloud-based LLM framework that automated the assessment process, leading to improved efficiency and customer satisfaction. This automation not only speeds up the process but also increases the accuracy of claims handling.

First Notice of Loss (FNOL)

The moment a claim arises, AI steps in. IoT and telematics bridge the gap between incident and insurer. Smartphones ping, home assistants notify, and smart cars alert insurers directly. This immediate communication streamlines the FNOL process.

- Automated Intake: Chatbots take the helm, guiding claimants through initial reporting. They gather essential information without human intervention, freeing resources for more complex tasks.

- Enhanced Communication: The convenience of mobile apps and texting features transforms communication. It becomes direct, swift, ensuring claimants and insureds stay informed and engaged.

Investigation and Coverage Determination

AI accelerates the investigation phase. It brings precision and speed, cutting down cycle times dramatically.

- Document Interpretation: Optical character recognition scans and categorizes handwritten documents. Police and medical reports are digitized, streamlining the evaluation of damages and coverage.

- Advanced Investigations: Computer vision and intelligent drones assess images and videos, creating systematic damage estimates. This tech-driven approach optimizes the investigation, making it faster and more accurate.

- Fraud Detection: AI’s advanced analytics swiftly identify fraud. By correlating information and making predictions, it uncovers deceptive patterns, safeguarding against fraudulent claims.

Valuation and Payment

The valuation and payment of claims see a revolution with AI. Processes become automated, accurate, and aligned with policyholder preferences.

- Distributed Ledger AI: This technology records transactions in real-time. It predicts claim values, automates estimates, and streamlines payment processes based on specific triggers.

- Payment Solutions: Chatbots and texting services facilitate payment arrangements. They communicate preferences, ensuring a smooth transaction from valuation to payment.

- Policy and Payment Analytics: Advanced analytics play a crucial role in correlating policy checks with payment calculations. This ensures that payouts reflect the true value of claims, maintaining fairness and accuracy.

Advanced Fraud Detection

ML algorithms are particularly adept at identifying patterns indicative of fraudulent claims. They can analyze vast amounts of data to spot anomalies that may suggest fraudulent behavior.

For example, Wipro’s analysis of machine learning techniques for detecting insurance fraud shows that these models can significantly improve the accuracy of fraud detection in imbalanced samples, such as those found in insurance claims. This capability is crucial for insurers as it enables them to prevent losses due to fraudulent activities.

Case Studies

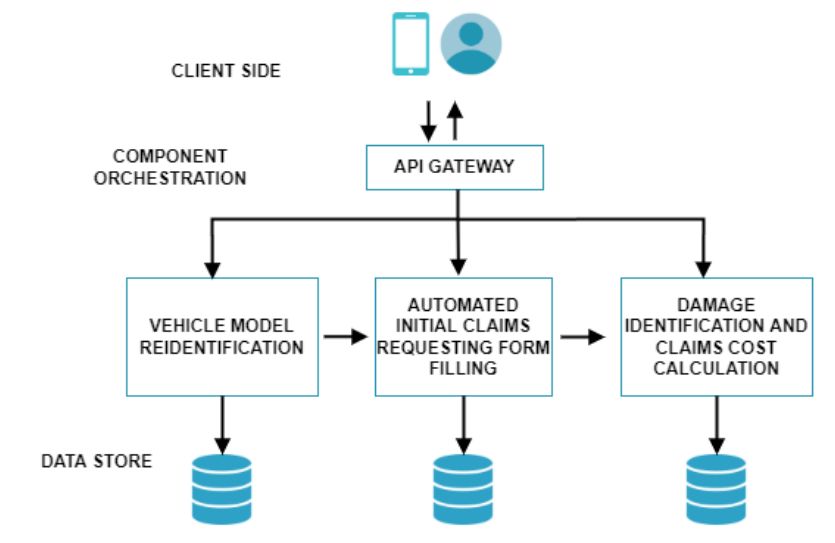

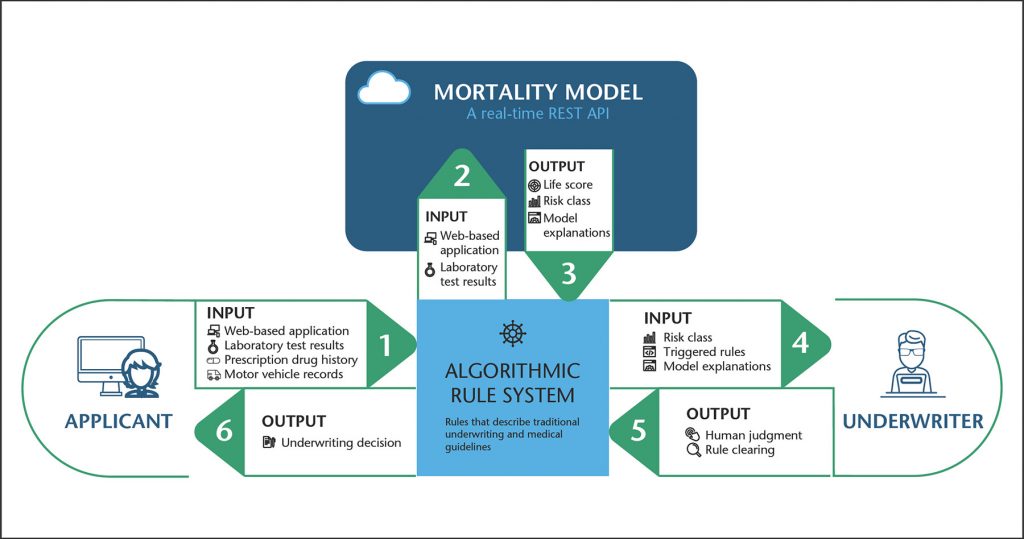

High-Level Schematic of the Algorithmic Underwriting System

Several case studies highlight the impact of GenAI and ML on claims processing. A leading independent provider of claims management solutions used GenAI to ensure compliance and consistency across numerous claims, particularly complex cases. The solution provided by Persistent, an AWS Partner Network member, delivered enhanced insights from a massive flow of documents, demonstrating the potential of GenAI in reducing time, effort, and cost in claims processing.

Another example is the use of AI-powered claims processing to create new efficiencies in insurance. AI can handle customer interactions through chatbots, analyze relevant documents, and detect patterns of potentially fraudulent behavior.

GenAI and ML in Product Development

In the theatre of product development, GenAI and ML command the spotlight. They transform the script, turning traditional insurance offerings into personalized narratives. Here, data is the muse, inspiring products that resonate on a personal level.

Crafting Customization

GenAI and ML weave through customer data, seeking patterns, preferences, and trends. This journey through data is not aimless. It aims to understand.

Data-Driven Insights: These technologies digest vast arrays of customer interactions, social media behavior, and transaction histories. They seek the unspoken, the patterns that indicate a preference, need, and future desire.

Personalized Products: From this wealth of data, customized insurance products emerge. No longer one-size-fits-all, these offerings reflect individual lifestyles, risks, and aspirations. It is precision in product form.

Impact on Market Responsiveness

The agility of GenAI and ML in product development is unmatched. They allow insurers to respond to market shifts with a nimbleness previously unseen.

Rapid Innovation: As customer behaviors evolve, so too can insurance products. GenAI and ML facilitate this evolution, turning new data into new products, seamlessly adapting to changing needs.

Targeted Offerings: These technologies identify niche markets and emerging trends, enabling insurers to develop targeted products. This isn’t just adaptation, it’s anticipation.

Real-World Innovations

Lemonade Inc.: This disruptor in the insurance industry leverages AI to offer home and renters’ insurance. Its AI-driven platform analyzes customer data to provide personalized quotes and coverage recommendations. Lemonade’s use of AI doesn’t stop at product development, it extends to claims processing, where AI evaluates claims for instant payouts, redefining customer experience.

John Hancock: In its life insurance policies, John Hancock integrates ML to encourage healthier lifestyles among policyholders. Through its Vitality program, wearable device data is analyzed to track fitness and health markers. Policyholders can earn rewards, such as premium reductions, based on their lifestyle choices. This is product development driven by ML, creating policies that are not just protective but proactive in promoting well-being.

GenAI and ML in Customer Segmentation

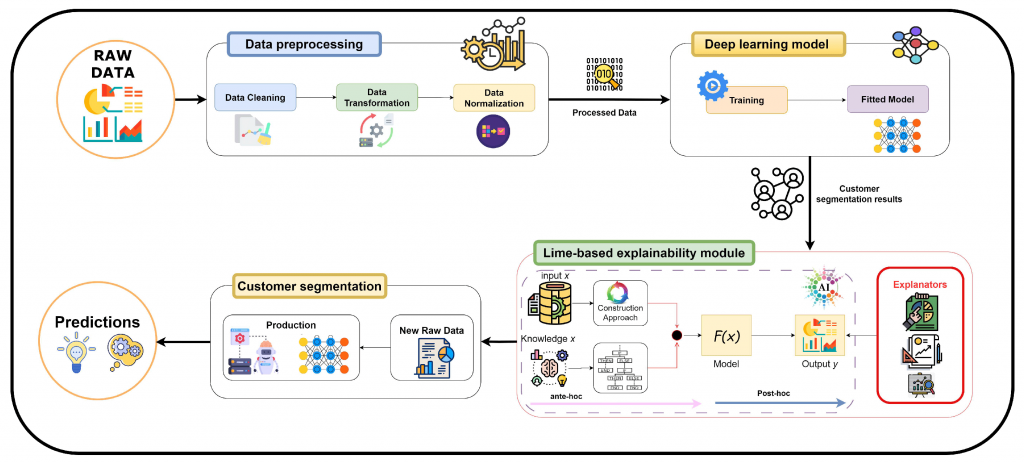

The use of GenAI and (ML) in customer segmentation is transforming the landscape of personalized marketing and customer interaction. These technologies enable businesses to analyze customer data with unprecedented depth and precision, uncovering insights that drive highly personalized experiences.

Granular Customer Segmentation

GenAI and ML dissect vast amounts of customer data to identify detailed segments based on behavior, preferences, and demographics. This analysis goes beyond traditional segmentation, offering a nuanced view of each customer.

For instance, Google Cloud’s application of GenAI in BigQuery DataFrames showcases how customer feedback can be segmented and summarized to extract actionable insights, demonstrating the power of GenAI in understanding customer nuances.

Unprecedented Customization

The detailed segmentation achieved through GenAI and ML allows for the customization of customer experiences and product offerings with a level of precision previously unattainable. This is not just about recommending products but tailoring every interaction to meet the unique needs and preferences of each customer segment.

Lexology highlights how combining machine learning with GenAI can significantly enhance business impact by enabling precise targeting and message crafting for micro-segments, leading to a 40% increase in revenue per targeted customer.

Case Studies of Success

- Retail Viewpoint: Demonstrates the synergy of ML and GenAI in marketing, where micro-segments derived from ML models are fed into GenAI algorithms to create and test personalized messaging, significantly boosting message effectiveness over time.

- Walmart: Uses GenAI to craft customized marketing content based on individual customer interests, enhancing retention and engagement. This approach underscores the potential of GenAI in creating deeply personalized customer experiences.

- Geospatial Data Analysis: Mosaic Data Science explores how combining geospatial data with ML can refine customer segmentation, leveraging location data to predict purchasing behaviors and optimize marketing strategies.

These examples illustrate the transformative impact of GenAI and ML on customer segmentation. It allows businesses to achieve a level of customer understanding and engagement that was previously impossible, leading to enhanced customer satisfaction and loyalty.

Conclusion

The GenAI and ML into actuarial science is expected to lead to deeper integration with the Internet of Things (IoT) and blockchain, enhancing data security and enabling real-time risk analysis.

These technologies will enable actuaries to process vast datasets with unprecedented speed and accuracy, leading to more informed decision-making and finely-tuned insurance products.

However, challenges persist, such as ensuring ethical use, managing privacy concerns, and maintaining regulatory compliance. The transformative impact of GenAI and ML on actuarial science is undeniable, offering a blend of opportunities and challenges that will shape the future of the insurance industry.