The storm rolling over the insurance industry has been long in the making.

Underwriting margins once cushioned by predictable payrolls now face a choppy sea of unpredictable market shifts. Brokers, desperate for swift answers, wrestle with outdated tech that chugs along like an old locomotive on a modern bullet-train line.

Employers, anxious to secure the best coverage for their teams, cast wary eyes on rising premiums and shifting regulations. Through it all, one question thunders across boardrooms and breakrooms alike – How can group benefit insurers remain profitable and relevant in a world that changes by the hour?

In this piece, we navigate the fault lines from underwriting to claims and beyond, before mapping out how new technologies and smarter processes might steer carriers toward a safer, more prosperous horizon. Because in this moment of sweeping disruption, no insurer can afford to drift.

Is Underwriting in Group Benefits Broken?

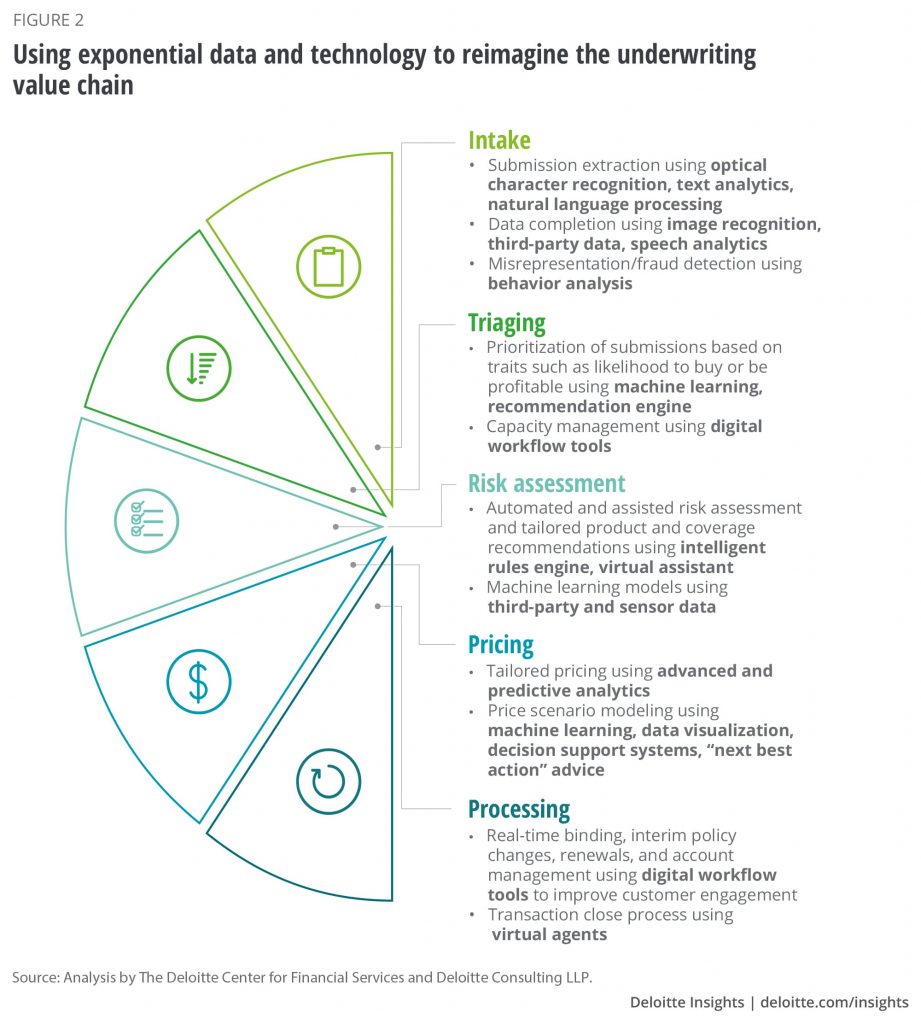

Underwriting remains the cornerstone of group benefits. Yet its traditional methods struggle to keep pace with today’s dynamic risk landscape and tightening regulations. Outdated systems, manual data management, and simplistic risk models cause delays, inflate costs, and erode profitability. Recent macroeconomic pressures, including high inflation and new business line volatility, only compound the urgency.

The Data Fragmentation Problem

Modern group benefits underwriting demands the seamless integration of diverse data sources—from historical claims and census records to real‐time feeds from wearables and IoT devices. Yet many legacy systems remain isolated and outdated. These systems rely on batch processing and old relational databases. The result is fragmented data that produces incomplete risk profiles and forces manual reconciliation. Such inefficiencies lead to processing delays and compromise data integrity.

Additionally, traditional underwriting models tend to oversimplify risk. They are built on generalized linear models or basic Bayesian frameworks that lack the finesse needed to capture individual-level risk factors. This often results in mispricing. Insurers either overestimate risk, thus eroding their competitive edge, or expose themselves to adverse selection.

As healthier employees leave for better-priced alternatives, the remaining pool becomes increasingly high-risk—a phenomenon known as the “death spiral.” Without a continuously calibrated risk engine, premiums escalate, and the cycle perpetuates itself.

How would the adverse selection happen? Let’s see.

- During open enrollment periods, individuals can freely enroll in or switch health plans. Those with known health issues may strategically select plans with richer benefits or lower out-of-pocket costs.

- Individuals who initially decline coverage but later enroll (late entrants) may do so because of a change in their health status.

- In self-insured plans, the employer bears the financial risk of providing healthcare to its employees. If a self-insured employer attracts a disproportionate number of high-risk employees, it could face significant financial challenges.

How AI/ML and Automation Can Transform Underwriting

Industry leaders are piloting AI-driven “intelligent underwriting” platforms that blend rule-based engines with adaptive machine learning. These systems can process applications up to 80% faster than traditional methods. They enrich risk assessments by incorporating real-time data to refine pricing and loss predictions. Early adopters report loss ratio reductions of up to 40%. More than just automating routine tasks, these solutions empower underwriters to concentrate on high-value, complex risk analysis.

A Swiss Re study found that 1.8% of AUW policies should have been declined or postponed due to missed conditions. While this is from individual life, imagine the impact if nearly 2 out of every 100 employees in a group plan have significantly underassessed health risks!

AI/ML solutions can address this by analyzing data sources beyond traditional health questionnaires, such as pharmacy benefit manager (PBM) data (to detect undisclosed tobacco or substance use), wearable device data (to track activity levels and potential build issues), and natural language processing (NLP) of doctor’s notes to identify mental health concerns.

Regulators now insist on clear and auditable underwriting decisions. Yet, many current models function as opaque black boxes. To address this, emerging explainable AI frameworks strive to make even the most complex models transparent.

How The Group Benefits Sales and Customer Experience Can Improve

Group benefits insurers face two major challenges on the sales front. Legacy sales processes and disjointed customer service workflows are slowing the quote-to-bind cycle, while a lack of personalization leaves clients craving tailored solutions.

The journey typically begins with lead generation through employers or brokers, often using legacy CRM systems that lack modern integration. Initial data capture is fragmented. Employers provide detailed demographic, financial, and risk information that must be manually compiled from disparate sources, such as HR records, historical claims, and external data feeds.

Once this data is gathered, underwriters laboriously input and validate information across multiple systems. Traditional risk models based on generalized linear models or basic Bayesian frameworks require extensive manual review. This leads to prolonged quote generation and extended underwriting assessments that can take weeks or even months. This slow pace frequently forces insurers into iterative rounds of negotiation and re-underwriting (particularly during renewal cycles) where updated risk profiles are manually reconciled against new market conditions.

The result is a sales process that is not only time-consuming but also prone to errors and missed opportunities. Prospective clients and brokers grow frustrated with delays, increasing the risk of losing business to competitors who offer more agile, data-driven services.

The Personalization Gap

Customers today expect insurance products that reflect their individual circumstances. However, many group benefits providers still use uniform risk segmentation techniques, which fail to capture the intricacies of member profiles. This “one-size-fits-all” strategy leads to generic offerings and static pricing.

In practice, a standard policy might assign identical premiums across a diverse workforce, even when subgroups demonstrate markedly different risk characteristics. Insurers miss opportunities to integrate alternative data sources like digital health records, data from wearable devices, and behavioral analytics that could provide a more detailed risk profile.

The consequence is twofold. First, customers receive impersonal, static pricing that fails to reward healthier or lower-risk individuals. Second, adverse selection intensifies as lower-risk members seek out competitors offering more personalized benefits, leaving behind a pool skewed toward higher risk and driving up overall costs.

Technical Enhancements for a Modern Sales Experience

By integrating digital platforms—whether through systems like FINEOS Underwrite or API-enabled cloud solutions from Scribble Data, insurers can automate lead management and data entry, drastically reducing the time needed to generate quotes. Advanced predictive models, including ensemble methods and even deep learning classifiers, can quickly analyze a multitude of data sources (from CRM records to real-time behavioral data) to dynamically adjust pricing and offer personalized policy recommendations.

Imagine an employee enrolling in benefits and the AI assistant recognizing a family history of diabetes. The assistant could then proactively suggest plans with robust diabetes management programs or connect the employee with resources for preventative care.

AI-powered chatbots and virtual assistants (leveraging NLP engines such as IBM Watson or custom-built solutions on platforms like Salesforce Einstein) can provide round-the-clock customer support. We are seeing the rise of embedded insurance models, where coverage is offered at the point of sale through partnerships in automotive, retail, and real estate. Group carriers could adopt similar strategies by collaborating with HR tech providers, bridging the gap between policyholder data and product offerings.

Streamlining Resolution and Accuracy in Benefits Claims Management

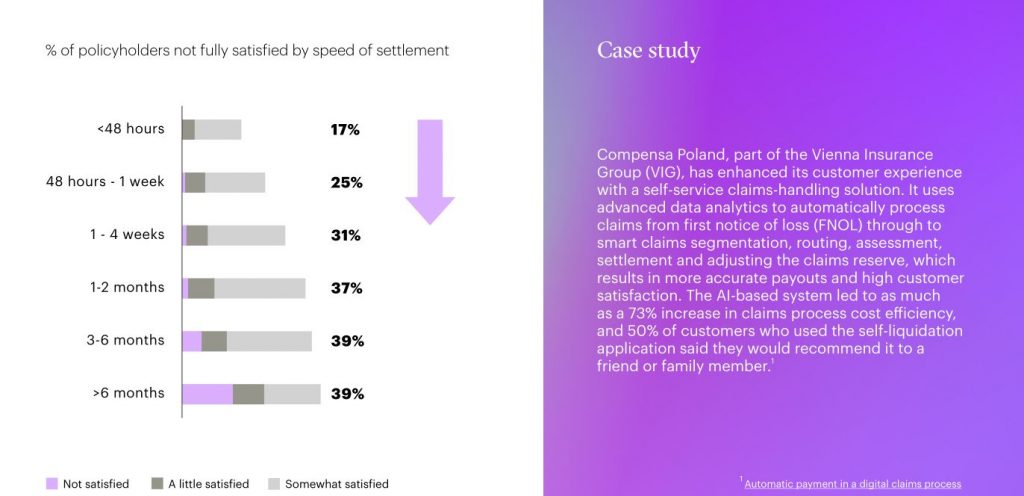

Traditional processing is slowed by manual reviews, paper submissions, and siloed systems. This is time-consuming, costly, and error-prone.

Inefficient Claims Processing

Repeated data entry at multiple steps adds friction to each claim’s journey. Modern, cloud-based straight-through processing (STP) systems help fix these inefficiencies. By integrating data sources through APIs, claims staff can confirm details quickly and reduce manual effort. As climate-related losses grow and litigation becomes more complex, carriers without fast, accurate claims operations risk falling behind.

Advanced Fraud Detection

Traditional fraud detection uses static, rule-based methods. A common approach is to flag claims that exceed a fixed dollar threshold. However, this method can miss sophisticated fraud schemes. For instance, an insurer might not detect a series of smaller, split claims designed to avoid the threshold. Such gaps have led to a 25% higher rate of undetected fraud in some cases.

New AI tools combine anomaly detection, pattern recognition, and convolutional neural networks (CNNs) for image analysis. These systems cross-reference historical data and flag inconsistencies in real time. As losses from natural catastrophes climb worldwide – global insured losses topped US$100 billion in 2023 with no single event surpassing $10 billion, early fraud detection becomes even more crucial for insurers’ bottom lines.

The Impact of AI/ML for Claims Management

Ensemble methods or deep neural networks can automate routine claims decisions while routing complex, high-dollar cases to human adjusters. This “human + AI” model speeds resolutions, cuts overhead, and lets staff focus on nuanced claims. AI-powered virtual assistants also provide instant claim updates to policyholders, lowering call center volumes.

The conditions missed during underwriting (build, tobacco, mental health) have a direct impact on claims costs. AI/ML can analyze claims data to identify patterns related to these conditions, allowing insurers to proactively manage care and reduce costs. For example, AI can flag members with a history of depression and substance abuse who are not currently receiving treatment, enabling the insurer to offer targeted support.

Administrative Burdens and Compliance are Crippling Group Benefits

Group benefits insurers often grapple with complex administrative processes that drain resources and hinder agility. Managing enrollments, renewals, claims processing, and employee queries is a labor-intensive operation, especially for SMEs with limited IT capabilities.

Complex Administration and Legacy Constraints

Many insurers still operate on monolithic legacy systems. These systems rely on batch processing and outdated relational databases, resulting in data silos that hinder smooth operations. For example, enrollment data might reside on one platform while renewals are managed on another. Staff then must manually reconcile records from disparate sources such as HR systems, historical claims databases, and paper files. On top of that, new global minimum tax rules (Pillar Two) are rolling out in various jurisdictions, requiring carriers to invest in modern data-collection and reporting capabilities just to stay compliant.

Compliance Under Constant Change

The regulatory landscape for health insurance is in perpetual flux. Insurers must continuously adapt to evolving rules—from HIPAA and the Affordable Care Act in the U.S. to GDPR in Europe. Many national and local regulators are also demanding greater transparency around risk modeling, especially as coverage limitations and premium hikes test public goodwill. Legacy systems lacking integrated audit trails or real-time monitoring struggle under these pressures.

Leveraging Automation for Operational Excellence

A cloud-based data lake, robust API integrations, and robotic process automation (RPA) can unify scattered data sources, improve accuracy, and reduce redundant tasks. Accenture found that automating manual workflows can cut administrative time by 40% and operational costs by up to 20%. Surveys highlight additional gains when carriers partner with third-party vendors or insurtechs to fast-track modernization.

Consider the complexity of managing dependent eligibility in group plans. AI/ML can automate the process of verifying dependent eligibility by cross-referencing data from multiple sources (HR systems, payroll, birth certificates, etc.), reducing errors and fraud.

How To Deal with Group Carrier Profitability Amid Back-Office Challenges

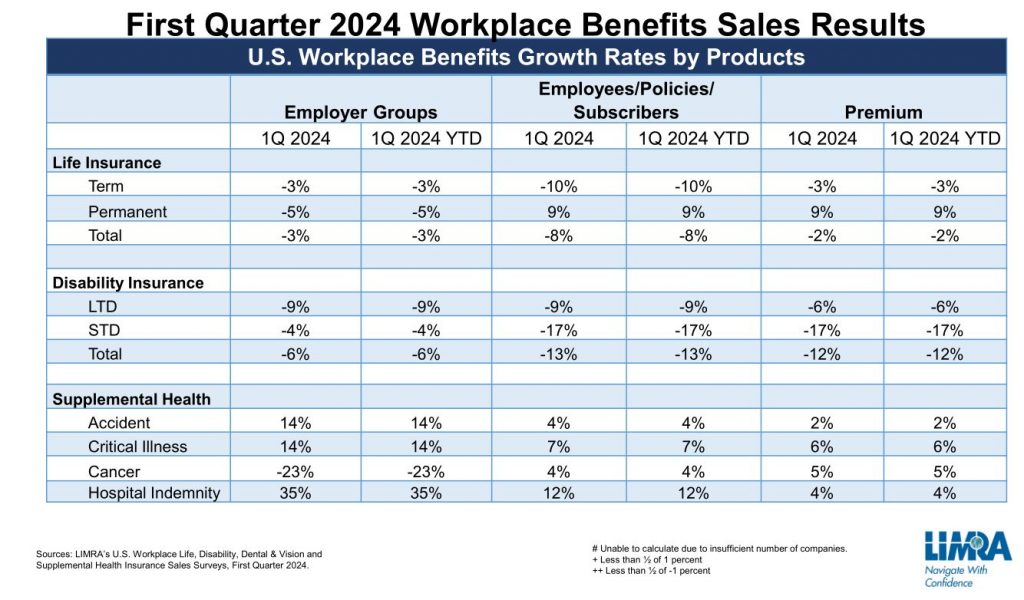

Life and annuity carriers have recently posted record sales, but profitability can erode quickly if legacy processes and policy churn aren’t addressed. Forecasts show that interest rate and inflation trends will remain fluid, requiring carriers to be nimble.

Fragmented enrollment, renewal, and service systems force manual cross-referencing. Beyond driving up costs, this bottleneck can alienate customers. Studies show that simpler policy management and robust digital experiences can help retain policyholders, even when rates rise.

Persistency Under Pressure

Policy persistency (the rate of renewals) directly affects margins. A 5% drop can reduce profits by 10% or more. Deloitte economists forecast US unemployment to top 4% by 2026, with the employment cost index dipping to 3.3% by 2025 (down from 4% in 2023). Slower employment growth undercuts renewal premiums, placing extra pressure on group carriers to find alternative avenues of growth.

This adverse selection cycle forces carriers into a costly cycle of aggressive marketing and underpricing, further eroding their competitive edge.

Digital Transformation as a Profit Lever

The path to enhanced profitability lies in digital transformation. Modern, cloud-based workflow systems and robotic process automation (RPA) can streamline back-office operations. For example, an AI system might identify a member with multiple chronic conditions who is not adhering to their medication regimen and proactively enroll them in a medication therapy management program.

In previous years, persistently low unemployment and fierce competition for talent contributed to wage growth that hovered around 4%. This trend helped bolster group premiums, since many group benefits products are tied to payroll amounts. Employers, grappling with talent shortages, leaned into richer compensation and benefits packages—effectively driving up persistency, as these benefits became a critical tool for recruitment and retention.

As Deloitte economists forecast unemployment to surpass 4% by 2026 and the employment cost index to dip to 3.3% by 2025, carriers can no longer assume payroll-based expansions will fuel continued growth. That shift may lead to more volatility in premium volumes and greater emphasis on delivering higher-value offerings to preserve renewals.

Conclusion

Market cycles rarely offer easy solutions. But this moment, as disruptive as it appears, holds the seeds of renewal for group benefit insurers willing to adapt. From underwriting desks that embrace AI-driven insights to claims departments running straight-through processing on cloud platforms, the path forward is ripe with opportunities to move faster and think bigger.

Those who cling to old processes might keep afloat for now, but they may soon find themselves at the mercy of rapid shifts in technology, regulations, and consumer expectations.