Underwriting is the ground zero of group benefits. The place where cost, risk, and regulation collide to shape coverage for millions of employees.

Done right, it keeps plans both affordable and solvent. Done wrong, it amplifies the system’s worst pressures.

In the U.S. alone, more than 155 million people rely on employer-sponsored health insurance. The average plan cost per employee now tops $16,000 per year. Meanwhile, healthcare inflation is edging above 10% globally, leaving little room for error. This trend is particularly pronounced in regions like Asia Pacific, where costs are expected to increase by 12.3%. When global catastrophes like a pandemic spike group life death claims by nearly 30%, underwriters must recast assumptions almost overnight.

But this is not just about profitability. For millions of families, group benefits are a literal, vital safety net. Therein lies the immense weight of group benefits underwriting decisions – real lives are on the line.

In this article, we will explore the unprecedented challenges that the industry is dealing with. We will discuss how insurers can navigate these tricky times to remain resilient, accessible and ready for whatever comes next.

Risk #1: Fraud and Abuse

Understanding the Risk

One in thirty. That’s how many insurance claims contain fraudulent elements. Industry estimates put it at 3–4% of all claims, a fraction that might sound small until you realize the sheer scale of group benefits. In the United States, insurance fraud siphons off $308.6 billion every year!

Global figures echo the same alarm. The National Health Care Anti-Fraud Association (NHCAA) estimates that US health insurers lose about $68 billion to fraud each year. Meanwhile, a 2024 survey by RGA found that 74% of life and health insurers see fraud as steady or rising, with 35% reporting an ongoing increase. Bad actors range from individual claimants padding medical bills to collusive rings involving providers and agents. For group benefits underwriters, the challenge lies in the high volume of claims and the limited scrutiny placed on each enrollment.

Guaranteed issue and minimal evidence-of-insurability can be major selling points for group coverage. They speed up enrollment and improve access, but they can also ease the path for fraudulent activities. Digital claims submissions add another layer. While they streamline processes, they can open new vulnerabilities if not paired with robust identity checks. Underwriters who underestimate this risk may see inflated loss ratios and volatile renewal pricing.

Mitigation Strategies

To counter fraud, most carriers now lean heavily on data analytics. They use predictive models to detect outlier patterns (such as a provider billing the exact same codes for every patient) or sudden spikes in claim frequency from specific groups. When red flags appear, underwriters and claims teams can intervene before payouts escalate.

Dedicated antifraud teams are also on the rise. According to RGA’s research, 78% of insurers globally have in-house investigation units, and 82% provide specialized training to staff. That training teaches employees how to spot inconsistencies, whether it’s an unlikely pattern in supplemental life elections or duplicated diagnostic codes on health claims.

Data sharing is another emerging best practice. Carriers, reinsurers, and external databases can pool information on known fraud patterns and repeat offenders. This collaborative approach helps preempt fraud schemes that might otherwise hop from one insurer to another. Some insurers even coordinate with law enforcement, ensuring that major fraud operations face real legal consequences.

Risk #2: Adverse Selection Risk

Understanding the Risk

Adverse selection occurs when higher-risk individuals enroll in coverage (or choose richer benefits) more often than healthier peers. Group benefit plans, which often feature minimal evidence-of-insurability and broad eligibility rules, can see this phenomenon play out in subtle yet costly ways. A 2022 study on employer-sponsored life insurance found that employees with higher health risks were more likely to elect supplemental coverage than those in better health. Even a small shift in enrollment by high-cost members can send claim expenses soaring.

Community-rated or guaranteed-issue coverage amplifies this issue. When insurers price based on the group’s overall characteristics (rather than individual underwriting) higher-risk members may gain more benefits without facing higher premiums. Over time, this dynamic can lead to a “death spiral,” where rising claims push premiums up, prompting healthier members to opt out. That exodus makes the group’s overall risk profile even worse, driving premiums higher still.

In health insurance, a small fraction of claimants often account for a disproportionately large share of total costs. If those higher-cost individuals cluster in one plan or coverage tier, the group’s loss ratio can quickly erode. Underwriters who fail to anticipate this risk might set premiums too low, leaving them vulnerable to sudden claim spikes.

Mitigation Strategies

Participation Requirements: Many carriers require that a certain percentage of eligible employees enroll, diluting the effect of a few high-cost members. This ensures risk is spread across a broader population. Some also restrict the ability to waive coverage, steering lower-risk employees into the plan and balancing the pool.

Evidence of Insurability (EOI): Even in group settings, underwriters can (and often do) require EOI for late entrants or those seeking coverage above a certain limit. A small but critical step like a health questionnaire or basic screening can keep extremely high-risk members from securing large amounts of coverage without higher premiums.

Open Enrollment and Waiting Periods: By limiting the timeframe in which employees can enroll or change coverage, insurers reduce the likelihood that someone will wait until they need expensive treatment before signing up. Once that window closes, coverage changes typically require a qualifying life event or EOI.

Risk-Based Pricing and Plan Design: Some group plans use tiered rates or charge additional premiums for certain coverage enhancements (optional life, dental, or critical illness riders). This creates a more accurate alignment of cost with risk. Employers can also adopt plan designs that promote preventive care, aiming to reduce costly late-stage treatments and level out claim volatility.

Communication and Education: Finally, insurers often work with employers to educate employees about the value of continuous coverage and preventive health measures. When employees understand the plan’s benefits and costs, they are less likely to game the system.

Risk #3: Claims Volatility and Catastrophic Events

Understanding the Risk

Claims volatility arises when losses deviate significantly from expected patterns due to external shocks or concentrated high-cost events. For group benefits, this can take many forms. A pandemic, a sudden surge in mental health claims, or an economic downturn that drives more people to use their coverage.

During COVID-19, group life death claims spiked by nearly 29%, marking the largest single-year jump in death benefits since the 1918 influenza pandemic. Underwriters who had priced coverage based on “normal” mortality levels found themselves facing unprecedented payouts. Medical cost inflation adds another layer of complexity. Volatility can also emerge when a handful of employees require high-cost treatments or specialty drugs, disproportionately affecting the plan’s loss ratio.

Catastrophic events magnify these challenges. Although group benefits usually don’t face the same property losses seen in natural disasters, mass-casualty incidents such as severe weather events can result in multiple life or disability claims at once. Localized incidents like workplace accidents can trigger concentrated payouts that knock actuarial assumptions off course.

Mitigation Strategies

Reinsurance and Stop-Loss Coverage: Many insurers purchase specific stop-loss or aggregate reinsurance to protect against extreme claim spikes. Reinsurance steps in when a single claim (or an overall block of claims) exceeds a pre-defined threshold, shielding the carrier from devastating financial hits.

Pricing Margins and Trend Assumptions: Underwriters often build a cushion into their pricing to account for potential deviations in utilization or cost trends. This might mean using slightly higher-than-expected medical inflation factors or adding a risk charge for pandemics or catastrophic scenarios.

Diversification of Risk: Insurers diversify their portfolios across various industries, geographical regions, and plan sizes. By spreading the exposure, no single catastrophic event can cripple the entire block of business. Employer concentration (too many members come from a single company or location) heightens the risk of large-scale claims if a disaster strikes.

Proactive Claims Management: Case management and early intervention can temper the impact of sudden claim surges. For example, when mental health disability claims began climbing, some insurers introduced rapid-response resources that connected employees with counseling and treatment to reduce claim durations.

Scenario Planning and Stress Testing: Beyond day-to-day underwriting, carriers now regularly run “what-if” scenarios. These exercises help reveal vulnerabilities, such as a pandemic hitting when interest rates are low or a catastrophic event.

Risk #4: Regulatory and Compliance Risk

Understanding the Risk

Solvency II Framework Guidelines

Insurance is among the most regulated sectors in finance, and group benefits underwriters face a shifting legal landscape that affects everything from capital reserves to data privacy. Regulations like Solvency II in the European Union impose strict capital requirements and compel insurers to prove they can withstand catastrophic events. Meanwhile, IFRS 17 overhauled how insurers account for liabilities, forcing them to break down contracts and recognize profits in new ways.

Local mandates add layers of complexity. In the United States, large-group health plans must adhere to medical loss ratio (MLR) rules that require at least 85% of premium dollars to go toward claims or healthcare quality improvement. State-by-state regulations can also dictate what coverage employers must offer, such as mental health parity laws or network adequacy standards. A 2024 survey revealed that 61% of insurance executives identify evolving regulations as their top operational challenge.

Compliance can reshape product design and pricing. In some regions, insurers can no longer rate policies based on gender or genetic information, while data privacy rules like GDPR severely restrict how insurers collect and store personal health information. Multinational employers complicate matters further by spanning multiple jurisdictions, each with its own rules for how coverage must be offered, funded, and disclosed.

Mitigation Strategies

Active Monitoring and Engagement: Insurers that succeed in a complex regulatory environment do more than wait for new rules to drop. They engage with policymakers, participate in industry associations, and track emerging legislation.

Robust Compliance Frameworks: Building compliance into daily operations is essential. Many carriers maintain dedicated teams or committees to oversee capital adequacy, data governance, and distribution practices.

Flexible Product Designs: Underwriters can future-proof their portfolios by crafting plans that can be adapted quickly. This might mean offering coverage riders that can be added or removed if new mandates appear or building variable rate structures that accommodate shifts in premium taxes or coverage limits.

Technological Investments: Modern underwriting platforms help automate compliance checks. They can restrict certain rating factors (like gender) in regions that ban them or apply different premium taxes for each state or country. By centralizing data management, insurers reduce the risk of costly privacy breaches that could lead to fines or reputational damage.

Conservative Capital and Reserving: When facing uncertain regulatory changes, some insurers opt to hold additional capital or reserves to cushion potential impacts.

Risk #5: Demographic and Economic Factors

Understanding the Risk

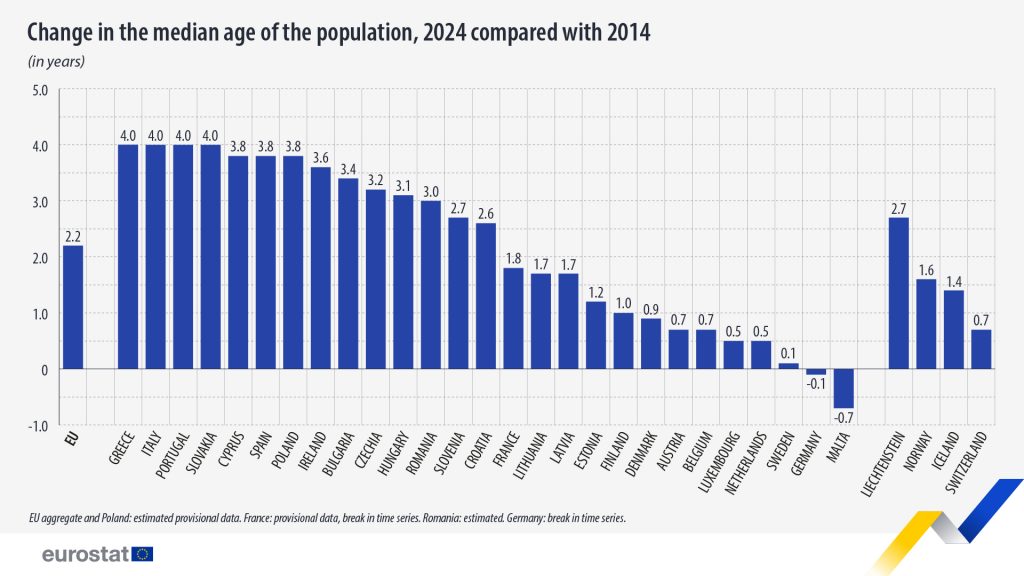

Demographic and economic shifts can reshape entire blocks of group benefits business. Populations are aging fast, especially in Europe, where the median age is about 42.5 and many countries count 20% or more of their residents over age 65. Longer life expectancies boost claim costs for retiree health plans and pensions.

In fact, according to data from the BIS and IMF, each additional year of life expectancy adds about 3–4% to the total liabilities of pension or annuity products. On a global scale, if longevity assumptions are off by just one year, the extra payouts could be in the billions of dollars.

Interest rates also play a pivotal role. After experiencing historically low yields, many markets saw a significant uptick in rates from 2022 to 2024, providing relief by reducing the present value of future liabilities but causing short-term balance sheet volatility. Recessions drive up unemployment, shrinking enrollment, while inflation affects wage-indexed products like disability or life insurance. Underwriters must remain agile.

Mitigation Strategies

Advanced Risk Modeling: Insurers use refined mortality tables and stress tests to capture longevity uncertainty, particularly in group annuities. If longevity improves faster than expected, it can have massive financial repercussions.

Asset-Liability Matching (ALM): Carriers often invest premiums in assets that match the duration and risk profile of their liabilities. This helps mitigate interest rate volatility, ensuring that sudden rate hikes or drops don’t leave reserves underfunded.

Reinsurance and Capital Market Solutions: Just as reinsurance is used for catastrophic claims, many insurers now hedge longevity risk. They may partner with reinsurers or use capital-market instruments such as longevity swaps, spreading exposure across a broader pool of investors.

Flexible Product Design: Group pension plans can incorporate features that adapt to economic changes, such as variable annuity payout rates or built-in cost-of-living adjustments.

Ongoing Monitoring and Adjustments: The rapid changes in global interest rates and inflation highlight the need for continuous review. Underwriters who track actual vs. expected mortality and cost trends can fine-tune premiums mid-cycle.

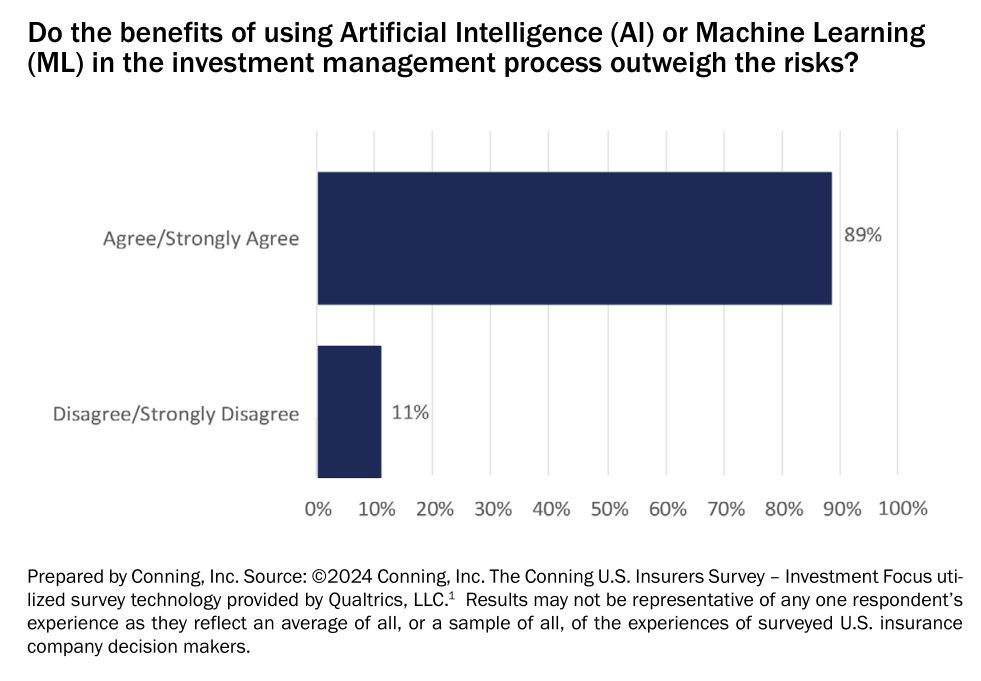

The March towards AI Underwriting

AI-driven underwriting in group benefits is picking up speed. In a 2024 survey, 89% of insurers were enthusiastic about the adoption of AI. Much of this momentum centers on underwriting, where 54% of insurers report using machine learning and predictive analytics in at least a partial capacity.

Early movers see major gains in efficiency. One life carrier slashed decision times from eight weeks to mere days, thanks to AI that automates data gathering and medical record analysis. Others note a 50% boost in underwriter productivity, as repetitive tasks move to algorithms. Carriers that adopt dynamic pricing and data-driven models can also capture new revenue by aligning premiums more precisely to risk.

Why it Matters for Group Benefits

Speed is critical in large-scale employee enrollments. Automated AI underwriting can handle thousands of applications at once, significantly improving the customer experience. At the same time, AI-driven risk scoring sifts through far more variables than a human could manage manually, spotting subtle red flags or unique risk factors that lead to more accurate pricing. Insurers also credit AI with reducing human error, producing consistent decisions, and lowering unexpected claim costs.

Challenges and Watchpoints

Yet AI underwriting isn’t a plug-and-play solution. Regulators are vigilant, wary of “black-box” models that could discriminate based on zip code, credit score, or other proxies for protected characteristics. Some regions require explainable AI, meaning underwriters need to show how an algorithm arrived at a decision.

Data privacy laws like GDPR add another layer, restricting how insurers handle sensitive health information. Even so, the North American market is pushing forward. About 67% of insurers are piloting large language models (LLMs) to expedite processes further. In Europe, the proposed AI Act classifies underwriting as “high-risk,” demanding transparency and fairness. Japan and Singapore have struck a middle ground, issuing clear guidelines and “AI handbooks” that promote innovation while keeping oversight intact.

Conclusion

Regulations tighten without warning, and medical costs can spike overnight. But the same forces that are ratcheting up risk in group benefits insurance are also spurring innovation. AI-driven underwriting, advanced analytics, global data-sharing, and creative product designs are giving insurers the means to tackle uncertainty head-on.

Wise carriers need to keep their ears to the ground. They must balance caution with readiness, and tradition with innovation. There is a strong reward for those who manage these changes well – deeper trust from employer groups, more stable premiums, and a stronger system that supports millions of employees.