Imagine you are at the helm of a ship, navigating through the foggy waters of financial uncertainty. Much like ancient vessels, pension schemes carry the weight of future promises – a secure retirement for those who spent lifetimes in service. Enter Pension Risk Transfer (PRT), your beacon in the mist, a strategy as crucial as the lighthouse guiding ships to safe harbor.

But here’s where the plot thickens. The sea of PRT is stirred by swirling risks, from the longevity whirlpools that can pull schemes into the deep, to the squalls of market volatility threatening to capsize your financial stability. This journey is not for the faint-hearted. It demands a captain who is not only aware of the lurking risks but also equipped with the right strategies to steer clear of them.

Through this article, we will unfold a narrative that is less about abstract financial concepts and more about the real-world saga of navigating PRT’s challenging waters. It is a tale of foresight, preparation, and the art of turning potential threats into navigable pathways, ensuring that the pension promises of today stand resilient against the uncertainties of tomorrow.

Understanding Pension Risk Transfer

PRT is all about security and foresight. At its core, PRT’s mission is to safeguard the future: ensuring that pensions promised today remain promises kept tomorrow. It’s a strategic move where pension schemes pass on certain risks to insurers, effectively offloading the burden that comes with ensuring long-term financial stability for retirees.

But how does PRT work? Think of it as a financial toolkit, each tool tailored for a specific need. The tools? Annuity buy-ins, buy-outs, and longevity swaps. Annuity buy-ins allow pension schemes to keep the pensions on their books while insurers cover the payouts. Buy-outs transfer the responsibility entirely, as the insurer takes over the pension promises. Longevity swaps are a bit different – they are insurance against retirees living longer than expected, safeguarding the scheme against unexpected costs.

Within PRT, these mechanisms are not just strategies but lifelines, ensuring that when the financial seas get rough, pension promises remain steadfast and secure.

Types of Risk and Mitigation Strategies in PRT

1. Longevity Risk

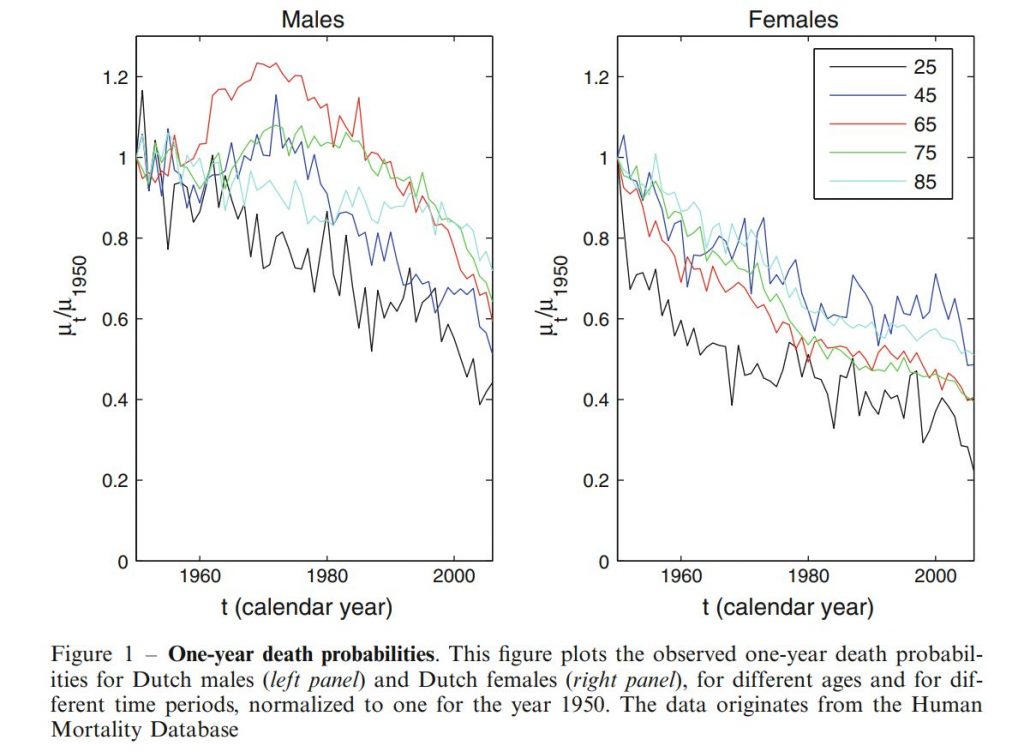

Longevity risk is a fundamental concern in pension schemes, emanating from the uncertainty surrounding the life expectancy of retirees. This risk is pivotal because actuaries must make assumptions about how long pensioners will live to ensure the fund has enough assets to cover future liabilities. If people live longer than expected, the scheme could face significant financial strain, as it will need to make payments for an extended period, thereby increasing the fund’s liabilities. This scenario can lead to a pension fund deficit, where the liabilities exceed the assets available to meet them.

In the context of PRT, longevity risk is especially critical because it directly impacts the cost and pricing of the transactions involved. Insurers taking on this risk need to accurately assess the probability of pensioners living longer than anticipated and the potential financial impact on the pension fund.

Mitigation Strategies:

- Annuity Buy-ins: This strategy involves the pension scheme purchasing a group annuity contract from an insurance company. The insurer then assumes the responsibility for paying the pensions of scheme members, although the scheme retains the liability on its balance sheet. The primary benefit is that the scheme can hedge against the longevity risk without transferring the total plan liabilities off its balance sheet.

- Annuity Buy-outs: In this case, the pension scheme transfers the entire liability to an insurer through the purchase of a bulk annuity policy. The insurer takes over the responsibility of paying all future pension payments, effectively removing the longevity risk from the pension scheme entirely. This transaction is usually irreversible and signifies the complete offloading of pension obligations by the employer.

- Longevity Swaps: These are sophisticated financial instruments that allow pension schemes to manage longevity risk by swapping fixed pre-agreed cash flows for cash flows that are dependent on the actual longevity experienced. Essentially, the scheme pays a fixed amount to a counterparty (usually an insurer or a bank) and receives payments that vary based on the realized longevity of the covered population. This strategy enables pension schemes to hedge against the risk of their pensioners living longer than expected without needing to transfer the pension liabilities.

In all these strategies, the goal is to align the pension scheme’s liabilities with secure income streams, ensuring that the fund remains solvent and can meet its obligations to retirees, regardless of how long they live.

2. Investment Risk

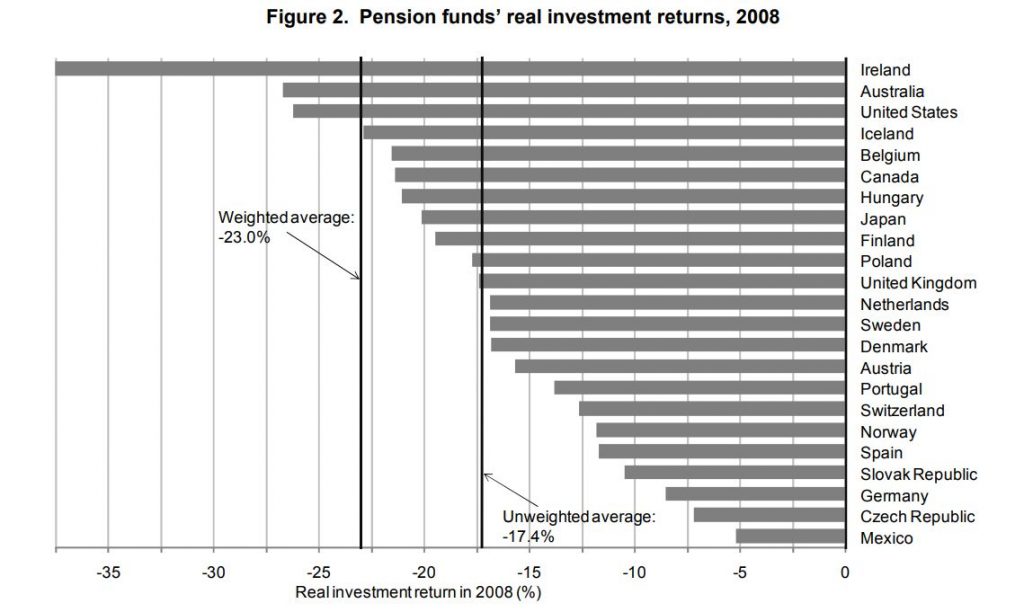

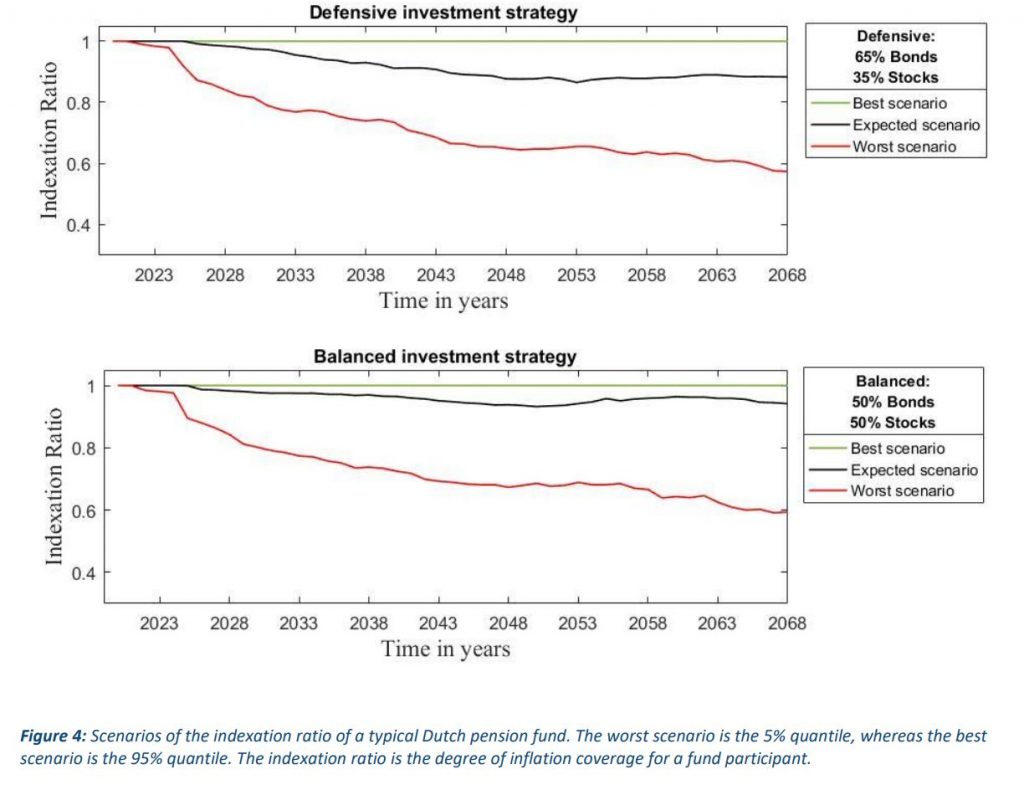

Investment risk refers to the uncertainty regarding the returns on the assets that back pension liabilities. Pensions are long-term commitments, and their funding assets are subject to the volatility of financial markets. If the actual returns on these investments are lower than expected, the pension fund might not have sufficient assets to meet its future obligations to retirees. This discrepancy can result from various factors, including market downturns, interest rate changes, or poor investment strategies, leading to a potential mismatch between the scheme’s assets and liabilities.

The challenge is amplified in a PRT context because the transferred pension liabilities are particularly sensitive to investment performance. Inaccurate predictions or unforeseen market shifts can significantly affect the pension scheme’s financial health and its capacity to uphold the commitments made to pensioners.

Mitigation Strategies:

- Diversification: Spreading investments across a wide range of asset classes can reduce the scheme’s exposure to the risk of any single investment underperforming. By investing in a mix of equities, bonds, real estate, and other assets, pension schemes can mitigate the impact of market volatility and enhance the likelihood of stable returns.

- Liability-Driven Investing (LDI): This strategy involves aligning the investment strategy closely with the pension scheme’s liabilities. The main goal is to ensure that the growth of the assets is in sync with the valuation of the liabilities, primarily through investments in long-dated bonds and other fixed-income securities that match the duration and cash flow characteristics of the pension obligations.

- Hedging Strategies: Utilizing financial instruments like derivatives (e.g., swaps, options, futures) can provide a cushion against market volatility. For example, interest rate swaps can be used to manage the scheme’s exposure to fluctuating interest rates, which is a critical aspect since pension liabilities are often valued in relation to bond yields.

Implementing these strategies involves a careful balance between seeking returns to fund pension promises and managing the risks that could undermine the scheme’s financial stability.

3. Counterparty Risk

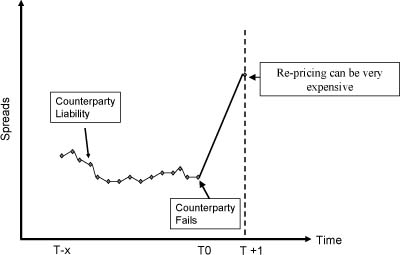

Illustrative Repricing of Derivatives When a Large Financial Institution Fails

Counterparty risk arises when the other party involved in a financial transaction, typically an insurer or a financial institution, fails to fulfill their obligations. This risk is significant in PRT transactions like longevity swaps, buy-ins, and buy-outs, where pension schemes rely heavily on the financial stability and reliability of the counterparty to manage their pension liabilities. If the counterparty were to default or become insolvent, the pension scheme might be exposed to substantial financial loss, potentially jeopardizing the security of the pensioners’ benefits.

This risk is particularly poignant in the wake of financial crises or market turmoil, where the solvency of financial institutions can be threatened.

Mitigation Strategies:

- Due Diligence and Selection: Conducting thorough due diligence before entering into a transaction is crucial. This involves assessing the financial health, credit rating, and reputation of potential counterparties. Choosing a counterparty with a strong credit profile and a solid track record can significantly reduce the risk.

- Collateral Arrangements: Establishing collateral arrangements can provide a safety net in the event of counterparty default. This might involve the counterparty posting collateral that the pension scheme can claim if the counterparty fails to meet its obligations. Such arrangements are common in derivatives markets and can be structured into PRT transactions to mitigate risk.

- Regular Monitoring and Reassessment: Continuous monitoring of the counterparty’s creditworthiness is essential, as financial conditions can change rapidly. Regular reassessments allow the pension scheme to take proactive measures if the counterparty’s stability is in question, potentially renegotiating the terms or exiting the arrangement if necessary.

- Diversification of Counterparties: Just as diversification is prudent in investment strategy, it can also be wise in the selection of counterparties. Engaging multiple counterparties can spread the risk, ensuring that the failure of a single institution doesn’t disproportionately impact the pension scheme.

- Insurance or Guarantees: In some cases, pension schemes can opt for insurance products or seek third-party guarantees to protect against the risk of counterparty default. These financial safeguards can provide an additional layer of security, albeit at a cost, which must be weighed against the potential risk.

Incorporating these strategies into the PRT process helps ensure that the pension scheme remains resilient against the financial instability of any single counterparty, safeguarding the retirement benefits of the scheme members.

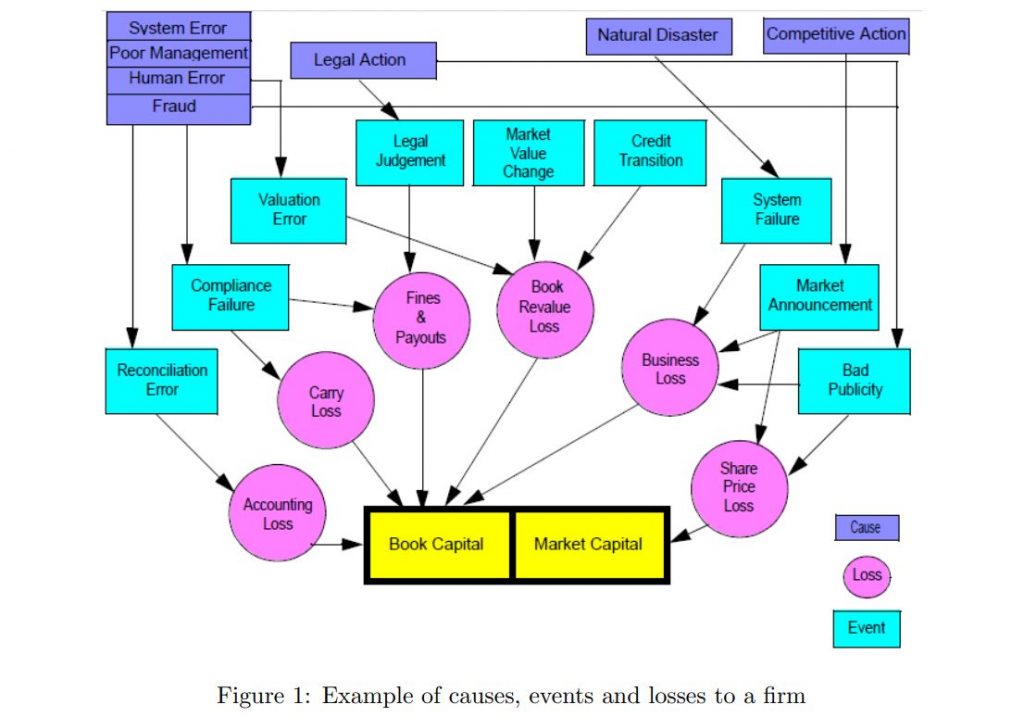

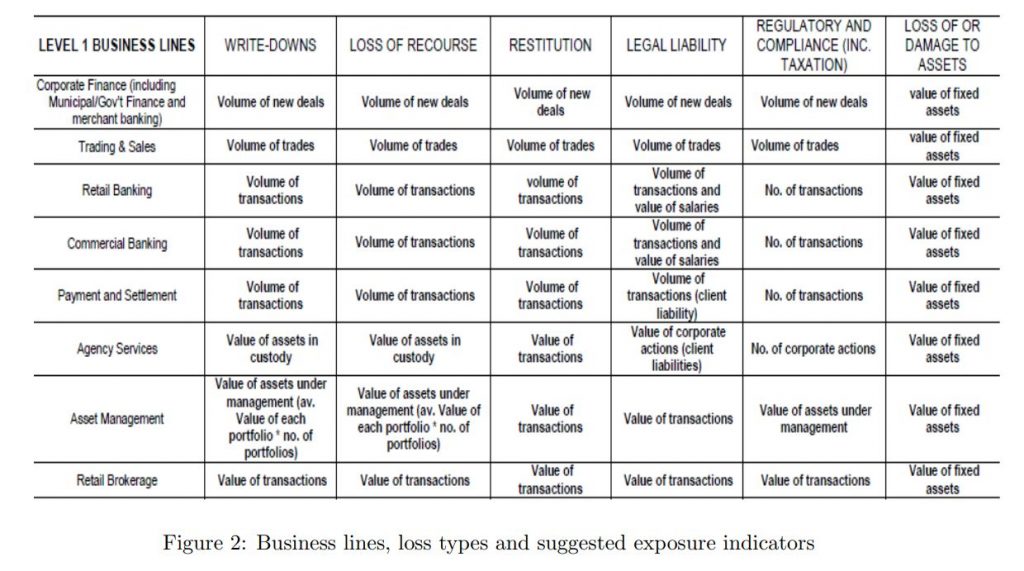

4. Operational Risk

Operational risk encompasses the potential for loss resulting from inadequate or failed internal processes, people, systems, or external events. This includes everything from data breaches and cybersecurity threats to human errors, processing failures, or the impact of natural disasters. These risks are particularly concerning because they can affect the administration of pension benefits, the accuracy of liability valuations, and the overall execution of the PRT strategy.

Operational failures can lead to financial losses, reputational damage, and regulatory penalties, all of which can undermine the trust in the pension scheme and its ability to fulfill its obligations.

Mitigation Strategies:

- Robust Internal Controls: Establishing and maintaining strong internal controls is vital. This includes clear procedures, regular reviews, and checks to ensure that operations are conducted correctly, efficiently, and comply with regulatory standards. Effective controls help prevent errors and ensure that any discrepancies are identified and rectified promptly.

- Comprehensive Risk Management Framework: Developing a comprehensive risk management framework that includes policies, procedures, and tools for identifying, assessing, monitoring, and mitigating operational risks is crucial. This framework should be integrated into the overall risk management strategy of the pension scheme.

- Regular Audits and Assessments: Conducting regular internal and external audits can provide an independent evaluation of the effectiveness of the operational risk management strategies. These assessments help in identifying potential vulnerabilities and implementing corrective actions.

- Disaster Recovery and Business Continuity Planning: Having a well-structured disaster recovery and business continuity plan ensures that the pension scheme can maintain or quickly resume mission-critical functions following a disruption. This is crucial for minimizing the impact on the scheme’s operations and its beneficiaries.

- Training and Awareness: Regular training programs for employees can enhance their understanding of operational risks and the importance of adhering to established controls and procedures. Fostering a culture of risk awareness and encouraging employees to report potential risks or incidents can also strengthen the scheme’s risk management.

- Technology and Cybersecurity Measures: Implementing advanced technology solutions and robust cybersecurity measures can safeguard against data breaches, cyber-attacks, and technology failures. Regular updates, security patches, and monitoring are essential components of an effective cybersecurity strategy.

By proactively managing operational risk, pension schemes can enhance their resilience against internal and external shocks, ensuring that their PRT strategies are executed smoothly and securely.

5. Regulatory/Legislative Risk

Regulatory or legislative risk refers to the potential challenges and financial implications that changes in laws, regulations, or governmental policies can impose on pension schemes and their PRT strategies. This risk is significant because pensions are heavily regulated, and any shift in the legislative landscape can have profound impacts, potentially altering the feasibility, cost, or intended outcomes of a PRT transaction.

Such changes might include modifications in pension funding requirements, alterations in tax laws, shifts in accounting standards, or new compliance obligations. For pension schemes, staying ahead of these changes is crucial to avoid unintended consequences, such as increased costs, additional funding requirements, or the need for strategic realignment.

Mitigation Strategies:

- Staying Informed: Pension scheme managers and their advisors must stay abreast of current and upcoming legislative and regulatory changes. This might involve subscribing to updates from regulatory bodies, engaging with industry associations, or consulting with legal and financial experts specializing in pension and retirement law.

- Flexibility in Plan Design: Designing pension plans with a degree of flexibility can allow schemes to adapt more readily to regulatory changes. This might involve incorporating adjustable benefit structures, funding arrangements, or investment strategies that can be modified in response to new laws or regulations.

- Engaging with Policymakers: Proactively engaging with regulators, policymakers, and industry bodies can provide early insights into potential legislative changes and offer opportunities to influence the development of regulations that impact pension schemes.

- Scenario Planning: Implementing scenario planning can help pension schemes anticipate the potential impact of regulatory changes and develop strategic responses. This involves assessing how different regulatory scenarios could affect the scheme’s PRT strategy and financial position and planning accordingly.

- Legal and Compliance Expertise: Maintaining access to legal and compliance expertise is essential for interpreting regulatory requirements and ensuring that the pension scheme’s PRT strategy remains compliant. This may involve in-house expertise or consulting with external legal advisors.

- Risk Management Framework: Incorporating regulatory and legislative risk into the scheme’s broader risk management framework allows for a more integrated approach to identifying, assessing, and mitigating risks. Regular reviews of the risk management framework can ensure that it remains aligned with the current regulatory environment.

By effectively managing regulatory and legislative risk, pension schemes can better position themselves to navigate the complexities of the regulatory environment.

6. Inflation Risk

Inflation risk pertains to the potential erosion of the real value of the pension liabilities due to rising prices, which can decrease the purchasing power of fixed-income payments over time. This is a critical concern for pension schemes, particularly those with defined benefits that are not explicitly linked to inflation. If the inflation rate surpasses the anticipated levels used in the actuarial assumptions, the actual value of the payouts could be less than what the retirees need to maintain their standard of living.

This risk is exacerbated in a PRT context because the liabilities are often fixed or have limited inflation adjustments. Therefore, if inflation unexpectedly accelerates, the pension fund or the insurer (post-transfer) might have to bear the higher costs, impacting the scheme’s financial stability or the effectiveness of the risk transfer.

Mitigation Strategies:

- Inflation-linked Bonds: Investing in inflation-linked bonds, such as Treasury Inflation-Protected Securities (TIPS) in the United States, can provide returns that are directly tied to the inflation rate, thereby offering a hedge against inflation risk. The principal of these bonds increases with inflation, providing a payout that adjusts for rising prices.

- Inflation Swaps: Entering into inflation swaps can allow pension schemes to manage inflation risk. In an inflation swap, fixed payments are exchanged for payments that are linked to an inflation index, such as the Consumer Price Index (CPI). This can help ensure that the scheme’s assets increase in line with inflation, protecting against the eroding impact of rising prices on the fund’s liabilities.

- Inflation Protection in PRT Agreements: When structuring PRT agreements, particularly buy-ins and buy-outs, it is possible to include terms that provide inflation protection. This might involve the insurer providing benefits that increase in line with a recognized inflation measure, thereby transferring the inflation risk from the pension scheme to the insurer.

- Asset-Liability Matching with Inflation Considerations: This strategy involves aligning the investment strategy with the pension liabilities, considering the impact of inflation. By matching the duration and cash flows of the pension liabilities with assets that are expected to perform well in inflationary environments, pension schemes can mitigate the risk of inflation eroding the real value of the assets.

- Diversifying into Real Assets: Investing in real assets like real estate or commodities can provide a natural hedge against inflation, as these assets tend to appreciate in value when inflation rises. Including such assets in the investment portfolio can help offset the impact of inflation on the pension scheme’s liabilities.

By incorporating these mitigation strategies, pension schemes can effectively manage the inflation risk associated with PRT, ensuring that the purchasing power of the pension benefits is preserved and that the scheme remains financially robust in the face of inflationary pressures.

Case Studies of Successful PRT Risk Mitigation

IBM’s Landmark Pension Risk Transfer

IBM undertook one of the most significant pension risk transfer deals in history, partnering with Prudential Financial Inc. and MetLife Inc. They transferred $16 billion in pension obligations, a move that showcased a proactive approach to managing pension-related financial risks.

Implementation:

- Engaged with Prudential and MetLife to issue nonparticipating single-premium group annuity contracts, sharing the obligations evenly.

- The strategic transaction was meticulously planned to ensure a smooth transition of pension responsibilities.

Outcome:

- Effectively mitigated investment, longevity, and associated risks by transferring them to the insurers.

- Strengthened IBM’s financial posture by offloading substantial pension liabilities, safeguarding the benefits of about 100,000 participants.

Key Takeaway:

This case underscores the significance of large-scale PRT transactions in securing retiree benefits and managing corporate financial risks effectively.

Rothesay’s Strategic Pension Risk Transfers

Overview:

Rothesay, a UK-based pension insurance specialist, has been instrumental in executing several large-scale pension de-risking transactions, including the largest full buy-out in the UK market and securing a multi-billion-pound pension scheme.

Implementation:

- Executed a series of high-profile buy-outs and buy-ins, including a landmark £4.7 billion full buy-out of the GEC 1972 Plan.

- The transactions involved detailed strategic planning and risk assessment to ensure the pension commitments were met.

Outcome:

- Provided comprehensive security for thousands of pension scheme members by taking over their pension liabilities.

- The series of transactions exemplified Rothesay’s capability to manage and execute large-scale pension de-risking solutions efficiently.

Key Takeaway:

Rothesay’s experience in executing substantial pension risk transfers demonstrates the effectiveness of well-structured buy-ins and buy-outs in managing pension liabilities and offering long-term security to members.

British Steel Pension Scheme’s Strategic Partnership with Legal & General

The British Steel Pension Scheme engaged in a significant pension risk transfer, forming a strategic partnership with Legal & General. This collaboration resulted in one of the UK’s largest full insurance deals, totaling £7.5 billion over several transactions.

Implementation:

- The scheme entered into multiple buy-in agreements with Legal & General, cumulatively amounting to a substantial £7.5 billion, marking a landmark in the UK pension sector.

- Lane Clark & Peacock (LCP) acted as the lead transaction adviser, guiding the scheme through the complex process and negotiations involved in such large-scale transactions.

Outcome:

- Successfully achieved full insurance for the scheme, representing a significant step in securing the retirement benefits of its members.

- Set a precedent in the market for large-scale pension de-risking transactions, illustrating the feasibility and benefits of securing comprehensive insurance cover for pension liabilities.

Key Takeaway:

This case study exemplifies the impact of strategic partnerships and the importance of expert advisory in executing large-scale pension de-risking transactions, particularly in securing the long-term stability of pension benefits.

RSA’s Record-Breaking £6.5 Billion Buy-In with PIC

RSA Insurance Group’s pension schemes undertook the largest-ever bulk annuity transaction in the UK, a £6.5 billion full buy-in with the Pension Insurance Corporation (PIC), covering 40,000 members.

Implementation:

- LCP acted as the lead transaction adviser, providing strategic advice and overseeing the transaction process, ensuring alignment with the schemes’ objectives and financial interests.

- The transaction was part of a broader strategy to secure the pension promises by transferring the liabilities to an insurer with strong financial standing.

Outcome:

- Marked a milestone in the UK pension risk transfer market by setting a new record for the largest bulk annuity transaction.

- Provided a robust solution to RSA’s pension schemes, effectively mitigating various risks associated with their pension liabilities and enhancing the security of member benefits.

Key Takeaway:

This transaction demonstrates the scalability of pension risk transfers in the market and highlights the importance of meticulous planning and expert advisory in executing transactions of such magnitude.

Conclusion

Embarking on a PRT journey is not just about shifting financial burdens—it’s about forging a pathway to certainty in an unpredictable financial landscape. We have discussed the intricacies of PRT, demystified its risks, and showcased its transformative power through tangible, real-world applications.

As we conclude, let us carry forward the insights from these impactful case studies. It is time to view PRT not just as a financial strategy but as a commitment to the enduring welfare of those who have invested a lifetime in their work. The roadmap is clear, the benefits are undeniable, and the potential to inspire confidence and stability in pensions is immense. Let’s embrace the promise of PRT, shaping a future where pension promises are not just made but are steadfastly kept.