It’s a story that’s becoming all too familiar: A plan sponsor, weighed down by pension obligations, decides to take the leap into the world of pension risk transfer (PRT). And why not? PRT offers a tantalizing promise – the chance to secure participants’ benefits while saying goodbye to the risks and uncertainties of managing a pension plan.

In today’s volatile economic landscape, where low-interest rates and market fluctuations can wreak havoc on pension funding, PRT has emerged as an increasingly popular strategy for sponsors looking to de-risk their liabilities and focus on their core business objectives. But before you sign on the dotted line, it is crucial to understand exactly what you are getting into.

PRT is not a one-size-fits-all solution. From buy-ins to buyouts, various options are available, each with unique benefits and considerations. While PRT can be a powerful tool for managing risk and protecting participants, navigating the complex legal, financial, and logistical issues can be daunting.

Whether you are a sponsor just starting to explore the world of PRT or you’re already knee-deep in the process, this guide will provide you with the knowledge and tools you need to make informed decisions and achieve your derisking goals. So let’s navigate the ins and outs of pension risk transfer together.

Understanding Pension Risk Transfer

When it comes to PRT, you have three main options on the menu:

- Buy-in: Think of a buy-in as dipping your toes in the PRT pool. With this type of transaction, the plan sponsor purchases a group annuity contract from an insurer to cover a portion of the plan’s liabilities but still retains responsibility for administering the plan and making benefit payments.

- Buyout: Conversely, a buyout is a full deep dive. The plan sponsor transfers all of the plan’s liabilities to the insurer, who takes over benefit payments and administration. The insurer takes over from here, and you can focus on other core things crucial to your business.

- Lump sum settlement: Instead of transferring pension obligations to an insurer, you’re cutting a check directly to the participants. With a lump sum settlement, the plan sponsor offers eligible participants a one-time payment in exchange for releasing the plan from any future obligations. Participants get a chunk of change upfront, and the sponsor can wash their hands of future liabilities.

The evolution of the PRT market and current trends

The PRT market has come a long way in recent years, showing no signs of slowing down. Here are a few key trends to keep an eye on:

- Insurance market capacity: As more and more sponsors look to derisk their plans, insurers have been stepping up to the plate, with new players entering the market and existing providers expanding their offerings.

- Transaction profiles: While small- to mid-sized transactions have been the bread and butter of the PRT market in the past, we are also seeing an uptick in larger deals, including jumbo transactions and full plan terminations.

- Evolution of investment portfolios: Insurers are getting creative with their investment strategies, moving beyond traditional fixed-income assets to include a wider range of options, such as alternative investments and private placements. A little variety can go a long way in managing risk and generating returns.

- Increased focus on data quality: As PRT transactions become more complex, the importance of accurate and complete participant data has never been greater. Plan sponsors are investing in data cleansing and validation processes to ensure a smooth transfer of liabilities.

- Rise of bespoke solutions: No two PRT transactions are alike, and insurers are increasingly offering customized solutions to meet the unique needs of each plan sponsor. It is all about finding the perfect fit, from tailored contract provisions to flexible payment options.

Benefits of PRT for Participants

When it comes to PRT, it’s not just about the plan sponsors – participants have a lot to gain, too. Here is a rundown of the key benefits for those on the receiving end of the pension promise:

- Enhanced security through insurer backing: By transferring pension obligations to an insurer, participants gain an extra layer of protection, thanks to the insurer’s financial strength and regulatory oversight.

- Regulatory requirements and fiduciary obligations to protect participants: PRT is not a free-for-all—strict rules and regulations protect participants’ interests. Plan sponsors have a fiduciary duty to act in participants’ best interests, and that includes carefully selecting an insurer that can deliver on the pension promise.

- Additional protections: In addition to the insurer’s financial strength, PRT transactions often come with extra safety nets. Separate accounts can segregate pension assets from the insurer’s general accounts, providing additional protection. And if the worst should happen and the insurer becomes insolvent, state guaranty associations step in to safeguard participant benefits (up to certain limits).

- Potential for improved communication and customer service: PRT transactions often involve a transition to a specialized insurer with dedicated resources for pension administration. This can improve communication, user-friendly interfaces, and enhanced participant customer service.

- Peace of mind and reduced uncertainty: For participants, the knowledge that their pension benefits are secured by a highly rated insurer can provide a great sense of peace of mind. No more worrying about the plan sponsor’s financial health or the possibility of plan termination—with PRT, participants can have confidence in the security of their retirement income.

Advantages of PRT for Plan Sponsors

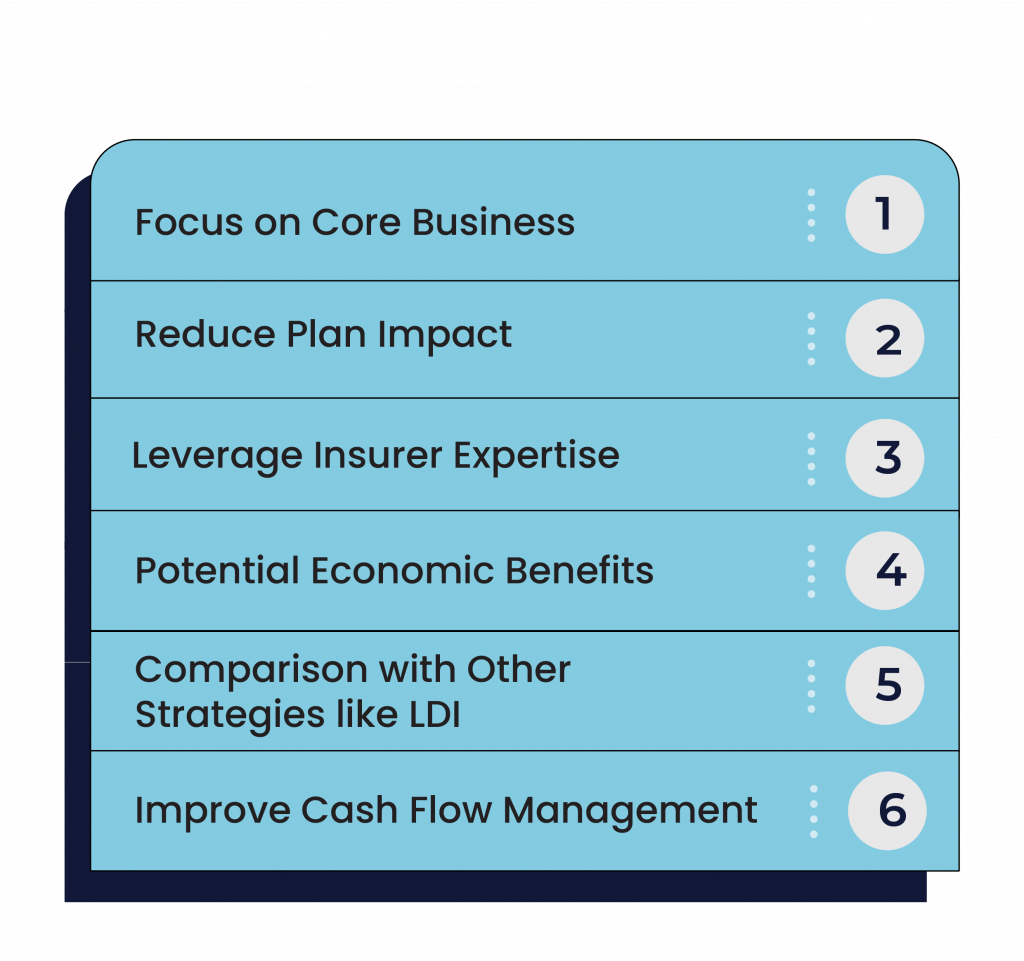

Now that we have covered the benefits for participants let’s talk about what’s in it for you, the plan sponsor. Here are some of the key advantages of PRT for your organization:

- Focusing on core business by transferring pension obligations: Managing a pension plan can significantly drain your company’s resources, diverting attention from your core business objectives. Transferring pension obligations to an insurer through a PRT transaction can alleviate the administrative, financial, and regulatory burdens associated with maintaining a pension plan.

- Reducing plan size and balance sheet impact: PRT can be an effective tool for reducing the size and impact of your pension plan on your company’s balance sheet. Transferring liabilities to an insurer can mitigate your exposure to various risks, including market volatility, interest rate fluctuations, and longevity risk. This can lead to a more stable balance sheet, improved financial metrics, and higher credit ratings.

- Leveraging insurer expertise in managing annuity obligations: Insurers specializing in PRT have extensive experience and expertise in managing annuity obligations. They have dedicated teams, robust infrastructure, and advanced risk management capabilities to ensure the effective administration of pension benefits. By partnering with an insurer for PRT, you can benefit from their specialized knowledge and resources, ensuring a seamless transition and ongoing management of your pension obligations.

- Potential economic benefits from market competitiveness and investment enhancements: The growth and maturation of the PRT market have led to increased competition among insurers, resulting in more favorable pricing and terms for PRT transactions. Additionally, insurers have expanded their investment capabilities to include a broader range of assets, such as alternative investments and private placements. This diversification can potentially enhance returns and lead to more efficient risk management, benefiting plan sponsors in pricing and risk transfer.

- Comparison with other risk management strategies like liability-driven investing (LDI): While strategies like LDI can help mitigate certain risks associated with pension plans, they have limitations. LDI primarily addresses interest rate risk by aligning the duration of assets with liabilities, but it does not fully eliminate other risks such as longevity risk or the operational complexities of managing a pension plan. PRT, in contrast, provides a more comprehensive solution by fully transferring the risks and responsibilities to an insurer.

- Improved cash flow management and predictability: PRT can significantly enhance a plan sponsor’s cash flow and predictability. By transferring pension obligations to an insurer, sponsors no longer face the uncertainty of future benefit payments, as the insurer assumes the responsibility for making these payments. This predictability allows for better budgeting, forecasting, and allocation of financial resources, enabling sponsors to make more informed decisions about their overall financial management.

Related: Pension Risk Transfer: The Role of Insurers in the Ecosystem

Selecting the Right Insurance Partner

Choosing the right insurance partner is like picking a teammate for a crucial project – you want someone reliable, experienced, and committed to success. Here’s what you need to know:

- Importance of rigorous due diligence and the role of qualified advisors: Conducting thorough due diligence on potential insurance partners is essential. Qualified advisors, such as consultants and legal experts specializing in PRT, can provide invaluable guidance in navigating the complex landscape of insurer evaluation. They bring the expertise and tools needed to assess an insurer’s financial strength, track record, and ability to meet your specific needs.

- Department of Labor Interpretive Bulletin 95-1 and safest available annuity standard: The Department of Labor’s Interpretive Bulletin 95-1 provides critical guidance for fiduciaries when selecting an annuity provider for a PRT transaction. It outlines the factors to consider, such as the insurer’s financial strength, investment portfolio, and experience. Most importantly, it emphasizes the “safest available annuity” standard, requiring fiduciaries to select the insurer that offers the most secure option for participants.

- Fiduciary and advisory support in the evaluation process: Engaging an independent fiduciary or advisor can provide extra protection and expertise in the insurer evaluation process. These professionals have the knowledge and tools to conduct comprehensive assessments of insurers, considering various factors beyond financial metrics. They can help ensure the selection process is thorough, objective, and aligned with your fiduciary responsibilities.

- Key factors to consider when assessing an insurer:

- Financial strength and capital adequacy: An insurer’s financial strength and capital adequacy are critical indicators of its ability to meet its long-term obligations to participants. Look for insurers with strong financial ratings from independent agencies like A.M. Best, Moody’s, and Standard & Poor’s. Evaluate their risk-based capital ratios, surplus, and overall financial stability to ensure they have the resources to weather market fluctuations and honor their commitments.

- Investment portfolio quality and diversification: The quality and diversification of an insurer’s investment portfolio are essential for generating the returns needed to support annuity obligations. Assess their portfolio composition, looking for a mix of high-quality, fixed-income assets and appropriate diversification across sectors, geographies, and asset classes. Consider their investment performance track record and ability to manage risk in different market conditions.

- Experience and scale in the PRT market: Insurers with extensive experience and scale in the PRT market are better positioned to handle the complexities of these transactions. Look for providers with a proven track record of successful PRT deals, strong relationships with plan sponsors and advisors, and the operational capabilities to handle large and complex transactions. Consider their ability to provide customized solutions and adapt to your specific needs.

- Commitment to participant security and service excellence: The success of a PRT transaction hinges on the insurer’s commitment to participant security and service excellence. Evaluate their processes to ensure accurate benefit calculations, timely payments, and responsive customer service. Look for providers with a strong culture of putting participants first and a history of high customer satisfaction. Assess their ability to communicate clearly and proactively to participants throughout the transition and beyond.

- Evaluating an insurer’s administrative capabilities: In addition to financial strength and investment expertise, assessing an insurer’s administrative capabilities is crucial. Look for providers with robust systems, processes, and teams to handle annuity benefits’ day-to-day administration. Evaluate their track record of timely and accurate benefit payments, responsive customer service, and effective communication with participants. Consider their ability to handle complex benefit structures and adapt to your needs.

As the PRT market evolves, it’s important to select an insurer that embraces innovation and values long-term partnerships.

Preparing for a Successful PRT Implementation

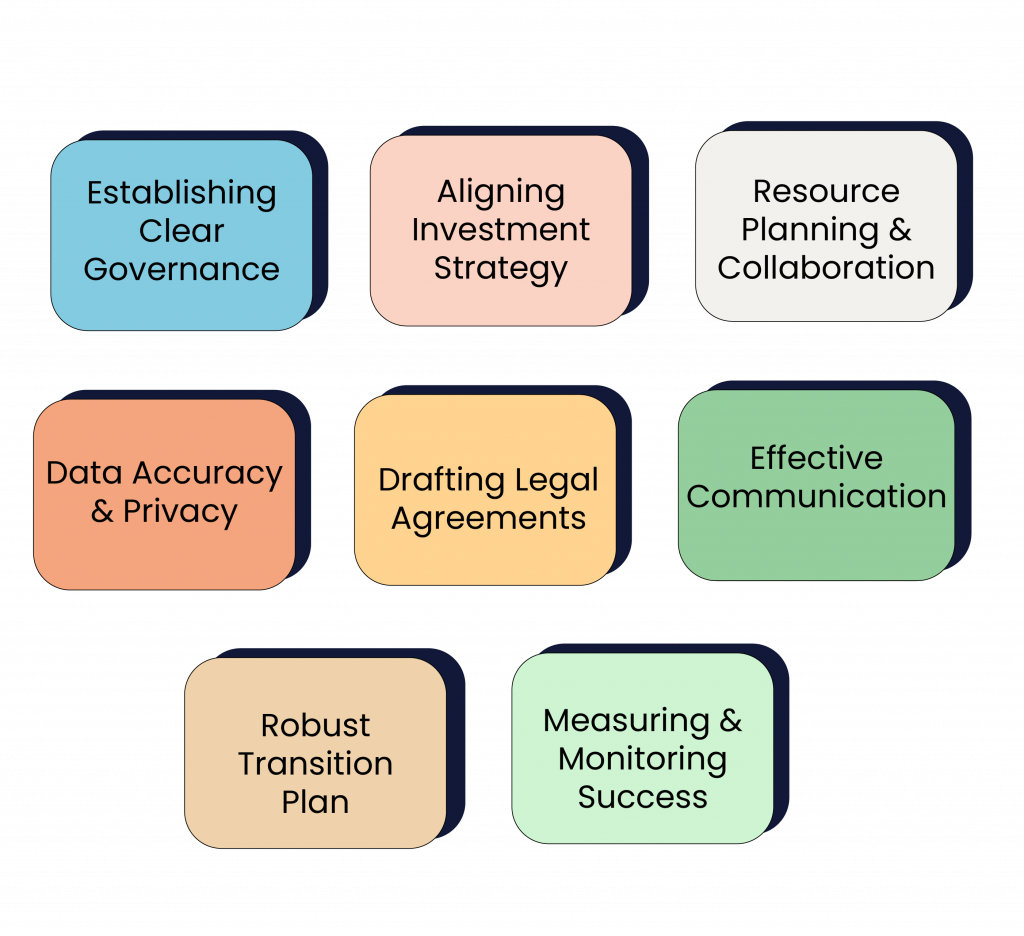

You’ve selected your insurance partner and are ready to embark on the PRT journey. But before you hit the ground running, there are a few critical steps to ensure a smooth and successful implementation. Here’s what you need to know:

- Establishing clear governance: Clear governance is the foundation of a successful PRT implementation. Establish a project steering committee with representatives from key stakeholders, including finance, HR, legal, and communications. Define decision-making protocols, escalation paths, and reporting lines to ensure accountability and effective oversight.

- Aligning investment strategy: If you conduct a partial PRT transaction, aligning your investment strategy for the remaining plan assets is crucial. Work with your investment advisors to reassess your asset allocation, risk tolerance, and return objectives in light of the reduced plan size and liability profile. Consider strategies like liability-driven investing (LDI) to better match assets with liabilities and mitigate interest rate risk.

- Resource planning and collaboration: Effective resource planning and stakeholder collaboration are essential for a smooth PRT implementation. Assess the internal and external resources needed for the project, including staff time, budget, and subject matter expertise. Engage key stakeholders early and often, including your insurer, legal counsel, actuaries, and benefits administrators.

- Ensuring data accuracy and privacy: Accurate and complete participant data is the lifeblood of a successful PRT transaction. Conduct a thorough data cleanse and validation process to identify and rectify discrepancies, gaps, or errors in your participant records. Implement strict data privacy and protection measures to safeguard participant information throughout the transfer process.

- Drafting and negotiating legal agreements: Careful drafting and negotiation of legal agreements are critical for protecting your interests and ensuring a smooth PRT implementation. Work closely with your legal counsel and insurer to develop and review key documents, including the purchase agreement, annuity certificates, and participant communications. Consider engaging an independent fiduciary to review and approve the agreements to ensure compliance with ERISA and other regulatory requirements.

- Communicating effectively with participants: Effective communication is the key to a successful PRT implementation. Develop a comprehensive communication plan that outlines key messages, timing, and channels for engaging participants before, during, and after the transaction. Use clear, concise language to explain the rationale for the PRT, the insurer’s selection, and the participants’ benefits.

- Establishing a robust transition plan: A well-defined transition plan is essential for ensuring a seamless handover of responsibilities from the plan sponsor to the insurer. Work closely with your insurer and benefits administrator to map out the transition’s key milestones, deliverables, and timelines. Conduct thorough testing and quality assurance to identify and resolve issues before going live.

- Monitoring and measuring success: Monitoring and measuring the success of your PRT implementation is crucial for ensuring a positive outcome. Define clear success metrics and key performance indicators (KPIs) for the project, such as participant satisfaction, data accuracy, and financial impact. Conduct regular status meetings with your insurer and project team to review progress, identify issues, and make course corrections as needed.

Preparing for a successful PRT implementation requires careful planning, collaboration, and execution. Related: Pension Risk Transfer Explained: Key Concepts and Trends

Case Studies and Success Stories

Pension Risk Transfer 2.0 – Part 2: Dynamics of the Insurance Market. (n.d.). https://www.nepc.com/pension-risk-transfer-2-0-part-2-dynamics-of-the-insurance-market/

You have heard the theory, now let’s dive into the real world. Here are some examples to inspire and inform your PRT journey.

In 2012, General Motors, one of the “Big Three” U.S. automakers, completed a massive PRT transaction, transferring $25 billion in pension obligations to Prudential Financial. The deal involved 118,000 retirees and was the largest PRT transaction at that time.

The transaction was completed successfully, with Prudential Financial assuming responsibility for benefit payments and administration. General Motors reduced its pension liabilities by 20% and improved its balance sheet.

Interserve, a company that has experienced repeated high-profile restructurings and financial crises, faced significant pension liabilities. The Trustee of the Interserve Pension Scheme was tasked with securing the benefits of its members while navigating the company’s challenging financial landscape.

The PRT transaction for Interserve involved a series of steps:

- Initial Buy-In: In 2014, the Trustee completed a £300 million pensioner-only buy-in, a significant step towards de-risking the pension scheme.

- Follow-Up Buy-In: The Trustee then executed a £400 million “PPF +” buy-in with Aviva in 2022, securing the benefits of more than 7,000 members. This transaction ensured that the pension liabilities of all Interserve section members were covered.

Conclusion

As seen throughout this article, PRT offers a compelling solution for plan sponsors looking to de-risk their pension plans and enhance participant security. By transferring pension obligations to an experienced insurer, plan sponsors can reduce their financial liabilities, improve balance sheet stability, and focus on their core business priorities. For participants, PRT provides greater peace of mind, with the insurer’s financial strength and expertise ensuring the security of their benefits.

However, achieving a successful PRT outcome requires careful planning, due diligence, and partnership. Plan sponsors must navigate a complex landscape of financial, legal, and operational considerations, from assessing their pension liabilities and selecting an insurance partner to managing the implementation process and communicating with participants.

To unlock the full benefits of PRT, plan sponsors should start early, engage experienced advisors, and prioritize transparency and collaboration throughout the journey.