Is it still possible to stay afloat when every new email threatens to submerge you in data?

For underwriters at group benefits insurance companies, that question hangs in the air each time a fresh Request for Proposal (RFP) makes its way to their inbox.

Modern RFPs rarely arrive in tidy packages. They are a mishmash of multiple Excel files, hefty PDFs, and endless back-and-forth email chains – every one of them harboring key details. A typical group benefits RFP might list an array of items – census data for thousands of employees, years of claims history, current policy documents, and requests for custom plan designs or pricing structures.

And therein lies the great irony. In the age of big data, the sheer volume and fragmentation of information can drown the very people who rely on it most.

In this article, we will explore the high cost of this information overload. We will also look at some potential solutions that could reshape these manual processes for the benefit of all parties in the benefits ecosystem. Could AI be the key to unlocking the potential hidden within these complex RFPs?

The Unseen Toll of Manual RFP Processing

A typical day for a group benefits insurer involves juggling multiple software platforms, countless spreadsheets, and a ticking clock.

To make sense of it all, they toggle between a proprietary underwriting system (like Guidewire PolicyCenter or Duck Creek Policy) + and statistical tools such as SAS or R. At the same time, they rely on Excel-based pricing models rigged with complex macros to calculate premiums. The job demands a meticulous eye – each data point must land exactly where it belongs, or else future policy decisions might crumble under the weight of errors.

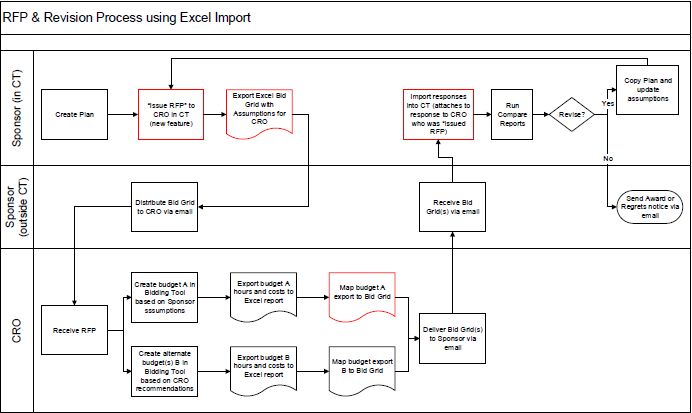

Sample RFP process using Excel

Even routine tasks can multiply when handled by tools such as the Gratex Underwriting Tool, which typically involves a series of steps.

- Creating a new client card with basic information

- Verifying the client in the underwriting system

- Generating a business file unique to each sales opportunity

- Compiling a proposal that includes quotes, policy terms, and conditions

- Updating the core system with policy details upon inception

If underwriters already face mounting pressure from the sheer volume and complexity of RFPs, the challenge only intensifies when multiple disconnected tools come into play.

Imagine a mid-sized insurer (let’s call them Real Good Insurance) receiving an RFP for a tech firm with 5,000 employees located in various states. The RFP arrives bearing a formidable 75-page PDF, three Excel workbooks packed with census data and claims history, and an ongoing email thread containing crucial clarifications.

One of the documents that the bunch might contain is a questionnaire that a broker has answered on behalf of their tech company client. It may include answers to questions such as

- Firm History: Provide the history of your firm, with a focus on your employee benefits division.

- Employee Count: How many employees does your company have? Generally, what are their job categories (e.g., management, sales, technical, customer service, etc.)?

- Client Contact Team: Who would be working directly with our company on administrative issues, questions, or problem solving? Please list each person’s role and qualifications.

The RFP handling process would typically go like this.

- Extracting Data from the PDF: Underwriters start by combing through the lengthy PDF, manually transferring details – such as age distributions and coverage requirements – into the company’s proprietary underwriting system. Although seemingly straightforward, each piece of data must be painstakingly double-checked.

- Cleaning Spreadsheets for SAS: Next, the three Excel files are prepared for statistical analysis in SAS. Because the files often arrive in a format incompatible with SAS, underwriters spend additional time reformatting cells, merging columns, and double-verifying figures.

- Switching Between Models: Once the data is scrubbed, underwriters feed the results into Real Good’s Excel-based pricing model. Despite its powerful macros and formulas, the model lives in isolation, forcing underwriters to manually transpose data from other systems – an error-prone process under tight deadlines.

- Referring Back to Emails: Throughout, underwriters frequently consult the original email thread for clarifications on coverage requirements or updated employee counts. Even a single overlooked message can derail the entire quote, underscoring the vulnerability of juggling multiple platforms.

- Generating a Quote in PolicyCenter: Finally, all the vetted numbers and assumptions are re-entered into Guidewire PolicyCenter to produce a formal proposal. At this last juncture, even a minor slip – like inverting a group’s average age – can send the team back to square one, especially if underwriters only catch the error after running the final calculations.

According to the 1-10-100 rule, a principle well-known in data management circles, it costs $1 to verify data accuracy at the point of entry, $10 to correct it in batch form, and $100 or more per record if nothing is done.

There is also a significant security risk associated with so much fragmentation. Let’s say our fictitious Real Good Insurance receives multiple Excel files from a large tech client’s broker. Each file contains personal employee data. Because the files arrive at different times, the underwriter saves them to a shared internal folder for later consolidation, inadvertently granting broader access than intended.

A colleague who’s working on an unrelated project spots these spreadsheets and shares them, thinking they contain useful reference data. Before anyone realizes the mix-up, sensitive details are floating outside the original underwriting team, dangerously close to a full-on breach.

Without a centralized, secure system of record, it is easy to lose track of who has access to which documents. Multiply that by dozens of brokers each sending files in various formats and you have a recipe for confusion.

Exploring timelines for a typical Group Benefits RFP

The RFP response process typically spans 6 to 10 weeks, with complex cases taking even longer. Let us explore how a typical group benefits RFP would play out for an insurer if they receive it from a large tech company called “Orange Tech.”

Phase 1 – RFP Creation (1-3 Weeks)

Once the RFP lands in the inbox, underwriters devote multiple full days just to decoding every requirement. Even at this preliminary stage, questions arise – How comprehensive is the prospect’s international expansion? What about specialized coverage in regions with differing regulations?

The insurer’s team coordinates with the prospect’s sales team for further clarity, an iterative process that stretches into 2-3 additional days of back-and-forth. Each piece of newly revealed information has ripple effects for pricing models, coverage recommendations, and potential plan designs. And all of this must happen before our insurer can even begin the more intensive underwriting tasks.

Phase 2 – RFP Administration (3–6 Weeks)

Once the initial review wraps up, our insurer forms a project team to tackle Orangetech’s RFP head-on. The claims analyst digs into five years of historical data, employing specialized actuarial software to forecast future costs. Meanwhile, the product development team brainstorms a tailored wellness program – a task that demands creativity as much as calculation. Requests from Orangetech hint at onsite health screenings and mental well-being initiatives, so this new program can’t be just a “check the box” offering.

While these subteams handle their pieces, underwriters shoulder a mountain of data entry. Occasional gaps in Orangetech’s demographic data force them to pause mid-process and request clarifications. That missing workforce detail – perhaps an age breakdown or a cross-border employee count – can easily tack on an extra week.

- RFP Evaluation (1–4 Weeks)

After several intense weeks – five, if all goes smoothly – our insurer finalizes its proposal. But that milestone is only the beginning of a new phase. Orangetech’s broker responds with a deluge of questions about the proposed plan design, premium structure, and the “why” behind certain coverage limits.

The insurer’s team yet another week refining their bid, running fresh scenarios in pricing models, and preparing a robust presentation for Orangetech’s decision-makers.

The next step? A virtual meeting that challenges our insurers to defend the math behind each premium and to explain the rationale for coverage nuances. Even then, negotiations are not guaranteed to end. A last-minute request from Orangetech – maybe for expanded dental coverage or an added wellness perk – can send the insurer back to the drawing board to recalculate rates and reconfigure plan documents.

From an employer’s perspective, these bespoke features can be make-or-break factors in finalizing a policy. If competitors deliver more precisely targeted coverage or can illustrate how those benefits will actually address an employer’s unique demographics, insurers without agile, personalized options may quickly fall out of contention.

Broker and Consultant Dynamics

Brokers and consultants sit at the intersection between insurers and prospective clients. Yet, when manual processes bog underwriters down, brokers often bear the brunt of the frustration. They may have to re-send census details, clarify plan design requests multiple times, or wait on incomplete quotes as underwriters chase missing numbers. In turn, this can reflect poorly on the broker’s service and stall the client’s entire decision-making timeline.

The stakes are high. In a crowded market where numerous insurers vie for a single employer’s business, slow or inconsistent proposals can quickly prompt a broker to switch gears and lean on a competitor that promises a faster response.

Regulatory Compliance Remains an Ongoing Concern

Regulatory compliance is a make-or-break imperative for insurers. Each jurisdiction imposes distinct rules on everything from licensing to capital requirements, and a single oversight can trigger steep fines, damaged reputations, or worse.

ERISA List of compliance laws for health benefits administration

Yet, many insurers still rely on manual, disjointed workflows such as re-keying data, double-checking spreadsheets, and juggling multiple systems. In such a high-stakes environment, even the smallest error – like overlooking one country’s reporting mandate – can spark a cascade of penalties and lost trust.

Without streamlined processes to unify compliance efforts, insurers remain one clerical slip away from crisis.

- Data Entry Errors: With underwriters manually re-keying information from RFPs into various systems, even a small slip – like typing “50” instead of “500” – can trigger inaccuracies in risk calculations and premium rates, potentially resulting in regulatory breaches.

- Missed Deadlines: Labor-intensive tasks often extend turnaround times, making it all too easy to overshoot filing deadlines. Late submissions can incur punitive fees and increased oversight from regulators.

- Inconsistent Policy Application: Without built-in, automated checks, underwriting guidelines may be applied unevenly from one proposal to another – a discrepancy that regulators might view as discriminatory or noncompliant.

- Difficulty in Audit Trails: Manually managed processes typically lack robust, automated logs. This scarcity of clear documentation complicates the auditing process, forcing insurers to scramble when regulators request proof of compliance.

The Economic Impacts of Inefficient RFP Handling

Fragmented and manual RFP processes pose serious business challenges for insurers competing in the group benefits market. Inefficiencies erode profitability, weaken competitive positioning, and risk customer satisfaction.

- Lost Revenue Opportunities: Lengthy turnaround times can delay responses, causing insurers to miss out on high-value deals or lose business to faster competitors.

- Reduced Scalability: Manual processes limit an insurer’s ability to scale operations effectively, making it harder to manage multiple RFPs simultaneously without sacrificing accuracy or speed.

- Higher Operational Costs: Labor-intensive workflows inflate costs by requiring more human resources to process data, validate entries, and manage corrections.

- Weakened Client Relationships: Errors, delays, and unclear communications can frustrate brokers and clients, damaging trust and increasing churn risk.

- Innovation Barriers: Insurers bogged down by manual tasks have less time to focus on strategic initiatives, such as developing new products or leveraging analytics to create competitive pricing models.

To remain competitive, insurers must reimagine their approach to RFP processing, investing in technologies that streamline workflows, ensure data accuracy, and enable faster, more agile decision-making.

How AI Can Accelerate Group Benefits RFP Processing

For many insurers, the appeal of AI and ML lies in their capacity to tackle precisely those tasks that most bog down group benefits underwriters – extracting mountains of data, crafting custom proposals, calculating risk with precision, and staying aligned with ever-shifting regulations.

- Automated Data Extraction: Underwriters often spend entire days gathering details from scattered PDFs, Excel sheets, and email threads. AI-driven solutions equipped with OCR and NLP can lift much of that burden, parsing and classifying information at remarkable speed. This lowers the risk of errors and frees underwriters to focus on strategic decisions.

- Intelligent Proposal Generation: Group benefits rarely fit a one-size-fits-all mold. AI assistants can read an employer’s unique profile – like demographic data, regional factors, and budget constraints – and produce proposals that align precisely with their needs. This reduces manual drafting and boosts the chances of a successful pitch.

- Risk Assessment: Traditional methods can take weeks. In contrast, AI tools process large datasets in moments, enabling more frequent and detailed evaluations. This allows insurers to price more accurately and remain agile in a market that prizes precision and speed.

- Regulatory Compliance: The cost of non-compliance can be devastating. AI assistants can automatically verify that policies meet local and national guidelines. This helps insurers dodge penalties and stay on top of shifting regulations, preserving their trust and credibility.

Ultimately, implementing AI tools to improve the efficiency of group benefits RFP handling is not just about technology. It is about reshaping an insurer’s culture to embrace data-driven tools, continuous learning, and faster decision-making.

Underwriters and analysts, already pressed for time, need clear training on new tools. Managers worry about short-term impacts on productivity, and compliance teams demand airtight proof that AI-driven processes meet regulatory standards. If these concerns are not addressed early, even a well-built system can remain unused.

Gradual, well-managed rollouts can help build confidence. Some insurers start small—perhaps by using AI only for data extraction—then gradually expand its role to quoting and compliance checks. This incremental approach provides real-world feedback without overwhelming teams. Equally important is proactive stakeholder communication. showing how each new feature improves accuracy, slashes turnaround times, or strengthens compliance can turn skeptics into advocates.

Do check out Carver Agents’ RegWatch – our new AI solution for real-time contextual regulatory risk intelligence, built for risk and strategy executives. Think of it as agentized mid-market LexisNexis. Visit https://carveragents.ai/.