At 74, Theresa Edwards rises before dawn, crisscrossing Los Angeles by bus to work as a caregiver. Her last patient of the day? Her husband of 55 years, recovering from a serious car accident. Every dollar counts in their household, where four grandchildren also reside. “Sometimes I wish I could stop working,” Edwards confides. “But the way life is going, I’m not sure I can.”

Edwards’ story is far from unique. It’s a stark illustration of America’s looming retirement crisis – a financial time bomb ticking away under the feet of millions. Consider this – a 2022 Federal Reserve study found that a staggering 43% of Americans aged 55 to 64 had no retirement savings at all. Zero. Nada.

The golden years? For many, they’re looking decidedly tarnished.

“America needs an organized, high-level effort to ensure that future generations can live out their final years with dignity,” warns Larry Fink, CEO of BlackRock, one of the world’s largest asset management firms. His concern is not misplaced. According to labor economist Teresa Ghilarducci, only 10% of Americans between 62 and 70 who are retired can be considered financially stable.

How did we get here? What does this mean for different generations of Americans? And most crucially, what can be done?

In this article, we will explore America’s retirement crisis, examining its causes, consequences, and potential AI-assisted solutions.

The Looming Retirement Crisis: An Overview

The American dream of a comfortable retirement is fast becoming a myth for millions. The landscape of retirement planning has shifted dramatically over the past few decades, leaving many unprepared for their golden years.

At the heart of this crisis lies a seismic shift in how Americans save for retirement. Gone are the days when workers could rely on company pensions to support them through their twilight years. In the mid-1980s, about half of private sector workers were covered by these defined-benefit plans. Fast forward to 2022, and that number had plummeted to a mere 15%.

In their place, 401(k)s and other defined contribution plans have become the norm. But this transition hasn’t been smooth. As Fink points out, “The ‘you’re on your own’ approach has shifted Americans from financial certainty to financial uncertainty.” This shift has left many workers ill-equipped to manage their retirement funds effectively.

The numbers paint a grim picture. According to the federal Survey of Consumer Finances, only about half of American households have retirement accounts at all. Even more alarming, a 2022 Federal Reserve study found that 43% of Americans aged 55 to 64 had no retirement savings whatsoever.

For those who do manage to save, the outlook isn’t much brighter. Teresa Ghilarducci’s research shows that just 10% of Americans between the ages of 62 and 70 who are retired can be considered financially stable. “One in 2 people reaching retirement won’t have enough, and 1 in 4 seniors are in poverty measured by international standards,” Ghilarducci warns.

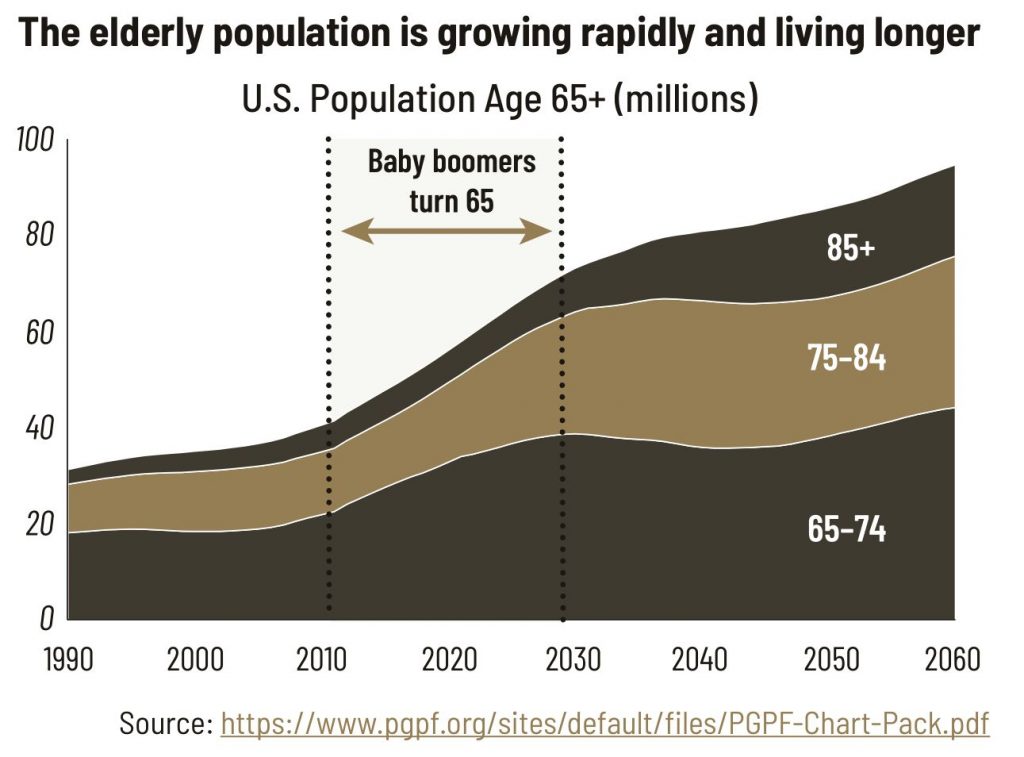

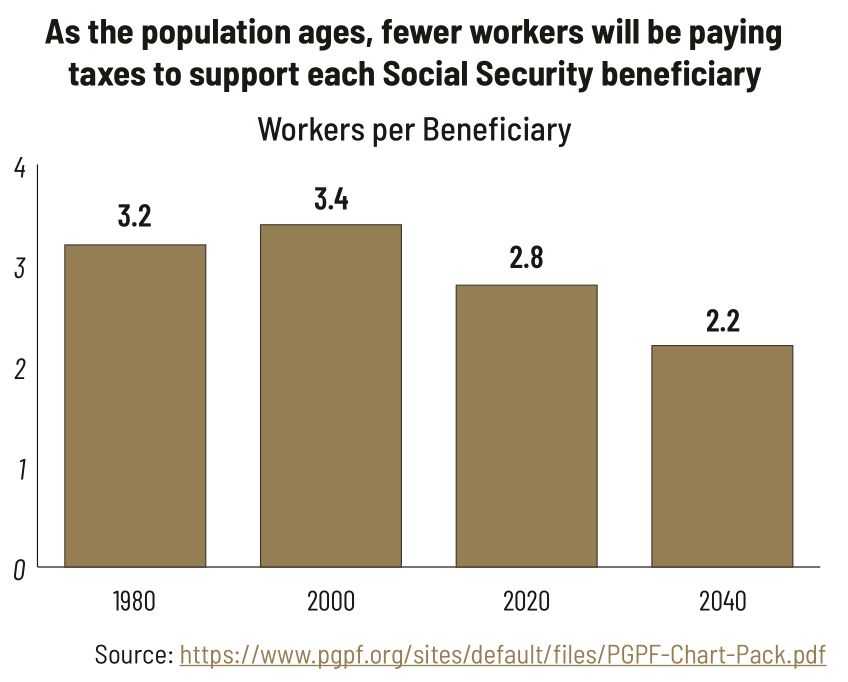

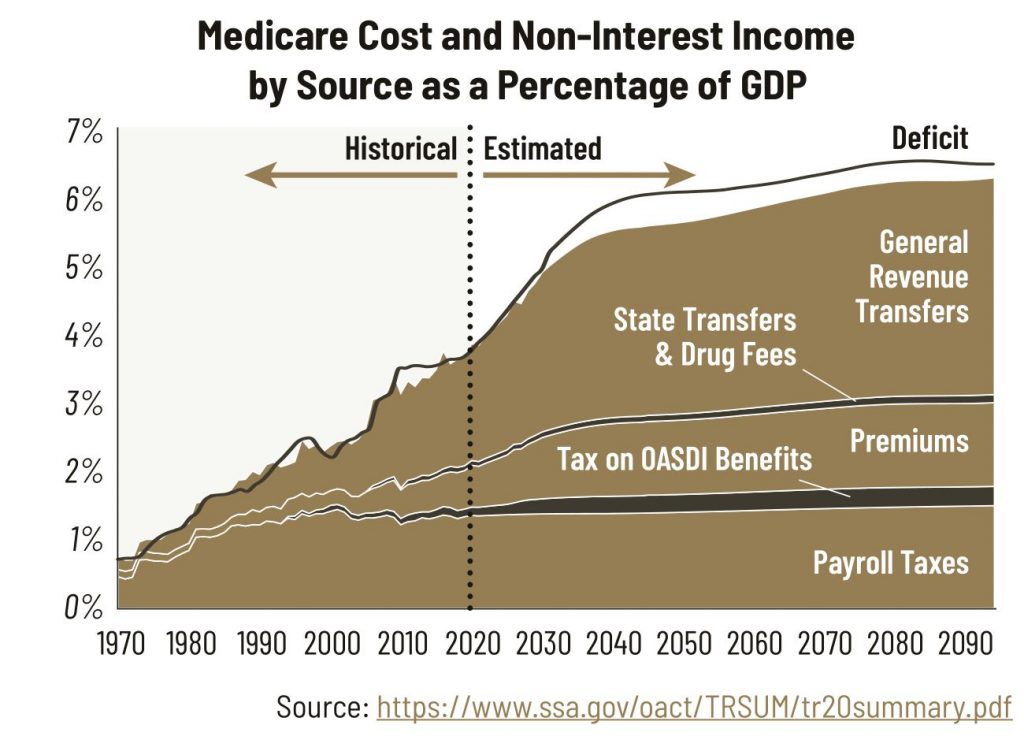

Adding to these concerns is the precarious state of Social Security, long considered a crucial safety net for retirees. While Social Security payments still provide about 90% of income for more than a quarter of older adults, the system faces significant challenges. Without intervention, the Social Security trust fund is projected to be depleted by the mid-2030s, potentially reducing benefits for future retirees.

Another important aspect of the retirement crisis is a hidden threat that experts call the “retirement savings time bomb.” But what exactly is this bomb, and why should retirees be concerned?

Imagine you’ve been diligently saving in a traditional IRA or 401(k) for years. These accounts allowed you to save money without paying taxes on it – a great deal, right? Well, there’s a catch. Ed Slott, a certified public accountant and IRA expert, explains: “These funds have not yet been taxed, so you need a plan to minimize these taxes so you can keep more of your hard-earned retirement money.”

Here’s how the “bomb” works – When you retire and start withdrawing money from these accounts, you’ll have to pay taxes on it as if it were regular income. But it gets trickier. Once you reach age 73, you’re required by law to withdraw a certain amount each year, called Required Minimum Distributions (RMDs). These forced withdrawals can push you into a higher tax bracket, potentially leading to a shockingly large tax bill.

Let’s say you’ve saved a hefty sum in your 401(k). You might think, “Great! I’m set for retirement.” But you could be in for a rude awakening if you haven’t planned for the taxes. A significant chunk of that money might go to the IRS instead of funding your retirement dreams.

This is why Slott emphasizes, “It’s what you keep that counts.”

Impact Across Generations and Demographics

Baby Boomers, particularly those born between 1959 and 1964 (often referred to as “peak boomers”), find themselves at the epicenter of the retirement crisis. A study from the Retirement Income Institute paints a sobering picture: two-thirds of these peak boomers will be financially challenged in retirement.

This younger cohort of boomers faces unique hurdles. Unlike their slightly older siblings, many entered the workforce just as traditional pension plans were disappearing. The study reveals that only about a quarter of peak boomers have defined benefit plans, mostly those who had union jobs or worked for state and local governments.

Instead, the most common retirement plans among peak boomers are defined contribution plans like 401(k)s. However, the savings in these accounts are often inadequate. The study found that 48% of peak boomer men have defined contribution plans with median holdings of just under $100,000, while 41% of peak boomer women have these plans with median holdings of just under $60,000.

Education levels play a significant role in retirement preparedness among this group. The study notes that 55% of peak boomer college graduates have defined contribution accounts with assets worth $117,000, compared to 40% of high school graduates having accounts with assets of only $31,000. The situation is even more dire for those without high school diplomas – only 13% have defined contribution accounts, with a median balance of around $10,000.

Millennials and Gen Z

Younger generations are entering their prime earning years facing unprecedented challenges. At 23, Angel Herion was eager to start saving for retirement when she landed a job as an assistant manager at Macy’s, her first position offering a 401(k). However, a debilitating autoimmune disorder diagnosis derailed her plans, forcing her to live on public assistance and defer retirement savings indefinitely.

Herion’s situation reflects a broader trend among younger workers, many of whom are grappling with unstable employment, unsteady incomes, and significant student loan debt. These factors make it difficult for many to even begin thinking about retirement savings.

Economic and Societal Implications

From the job market to consumer spending, the ripple effects of inadequate retirement savings are being felt across the American economy.

Delayed Retirements

For many Americans, the traditional retirement age of 65 is becoming a thing of the past. The reality of insufficient savings is forcing a growing number of older Americans to work well into their golden years.

Take Robin Delucia, for instance. At 70, she found herself unable to stay retired. “It’s the only way I can afford to keep living,” Delucia said. After a brief two-month retirement, she was back in the job market. “To live on Social Security alone nowadays is an absolute joke, especially in Florida,” she added.

The trend of delayed retirement is also creating challenges for employers. Companies are grappling with an aging workforce, which can have implications for productivity, healthcare costs, and succession planning.

Historically, we can see how pension obligations strained companies. By the late 1990s, General Motors had 180,000 employees and was paying pensions to 400,000 retirees. This imbalance contributed to the financial struggles of many large American manufacturers.

Today, while most companies have shifted away from traditional pension plans, they face different challenges with an older workforce. These include higher healthcare costs and the need to accommodate older workers’ needs and preferences.

Economic Effects

As retirees struggle financially, there could be a significant drag on consumer spending, which is a crucial driver of economic growth.

Moreover, as more retirees rely heavily on Social Security and other social services, there’s an increased strain on these systems. This could lead to broader fiscal challenges for the government and potentially impact tax rates and social program funding for future generations.

As retirees with inadequate savings look to downsize or tap into their home equity to fund their retirement, it could lead to shifts in housing demand and supply in certain markets. With many unable to afford quality care in their later years, there could be increased pressure on families and social services to provide for aging Americans.

Fink points out “4 in 10 Americans don’t have $400 in emergency savings to cover a car repair or a trip to the emergency room, let alone retirement savings.”

Strategies and Solutions to Navigate the Retirement Crisis

The far-reaching implications of the retirement crisis demand a multi-faceted approach, combining individual strategies, policy changes, and innovative technological solutions.

Individual Strategies

At the individual level, experts emphasize the importance of early and consistent saving. Ghilarducci advises “Put away 5% of your take-home pay in your 20s and 30s and 10% for the rest of your working life.” She adds, “The earlier you save, because of the power of compound interest, the better.”

For those nearing retirement, tax management becomes crucial. Ed Slott, a CPA and IRA expert, recommends considering Roth conversions to manage future tax liability. “Always pay taxes at the lowest rates,” Slott advises, highlighting the importance of strategic tax planning to avoid the “tax time bomb” in retirement.

Policy Proposals

On a broader scale, policy proposals aim to address systemic issues contributing to the retirement crisis. Some of the proposed solutions are.

- Expanding access to workplace retirement plans

- Strengthening Social Security

- Addressing rising healthcare costs

- Improving financial literacy education, with a focus on retirement planning and tax strategies

The Role of AI/ML

As we grapple with these challenges, the potential of AI and machine learning to revolutionize retirement planning and management is becoming increasingly apparent. While not a panacea, AI-driven solutions can play a significant role in addressing various aspects of the retirement crisis.

Personalized robo-advisors can provide tailored advice based on an individual’s unique financial situation, risk tolerance, and retirement goals. These tools could help bridge the gap in financial literacy, making sophisticated retirement planning more accessible to the average American.

Forward-thinking insurers have an opportunity to leverage AI and machine learning to better serve their clients facing retirement challenges. Some key focus areas that can be uniquely enabled with AI are as follows.

- Developing more accurate risk assessment models for long-term care insurance and other retirement-related products.

- Creating personalized retirement savings and drawdown strategies based on individual client data.

- Improving fraud detection to protect retirees’ assets.

- Enhancing customer service with AI-powered chatbots that can answer basic retirement planning questions.

- Using predictive analytics to identify clients who may be at risk of inadequate retirement savings and proactively offer guidance.

Several leading insurers like Prudential and BlackRock have already been actively exploring the use of AI assistants for retirement and pensions. However, it’s important to note that while AI can be a powerful tool, it’s not magic. The human element in financial planning remains crucial, especially when dealing with the complex emotional and personal factors involved in retirement decisions.

Kevin Prindiville, executive director of Justice in Aging, underscores the urgency of these measures: “If we don’t take action, future generations will face an even more challenging retirement landscape.”

The choice is ours. The clock is ticking, and the future of millions hangs in the balance. What we do now will echo through generations.

Do check out Carver Agents’ RegWatch – our new AI solution for real-time contextual regulatory risk intelligence, built for risk and strategy executives. Think of it as agentized mid-market LexisNexis. Visit https://carveragents.ai/.