Every day, insurers in the employee benefits space walk a tightrope, balancing profitability against market demands, regulatory pressures, and evolving workforce dynamics. One misstep in risk assessment or management can trigger a domino effect, potentially wiping out years of hard-earned gains.

In this high-stakes environment, risk isn’t just an abstract concept—it’s a tangible force that shapes every decision, every product, and ultimately, your company’s future.

Since the advent of managed care in the 1980s, the Employee benefits landscape has transformed dramatically. Today’s insurers navigate a risk environment that demands sophisticated management across four critical areas: financial underwriting, compliance and regulatory, operational, and market and competitive risks.

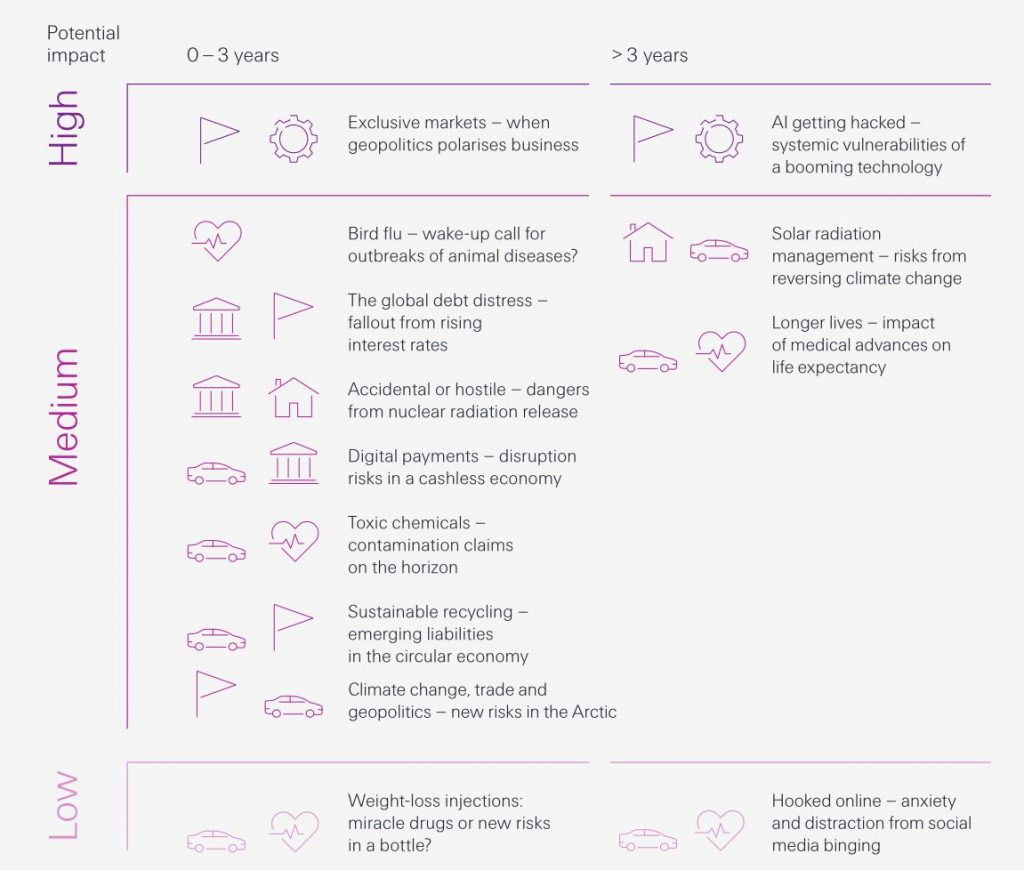

Source: Emerging Insurance Risk Themes from Swiss Re SONAR 2023 Report

Financial underwriting risk forms the foundation of an insurer’s risk landscape. It’s a delicate balance—aggressive pricing may boost market share but lead to losses, while conservative pricing can erode competitiveness. Economic factors significantly influence claim trends.

Compliance and regulatory risks pose significant challenges. Non-compliance costs are steep, sometimes in the millions of dollars per incident. Insurers must navigate over 50 different state regulatory environments.

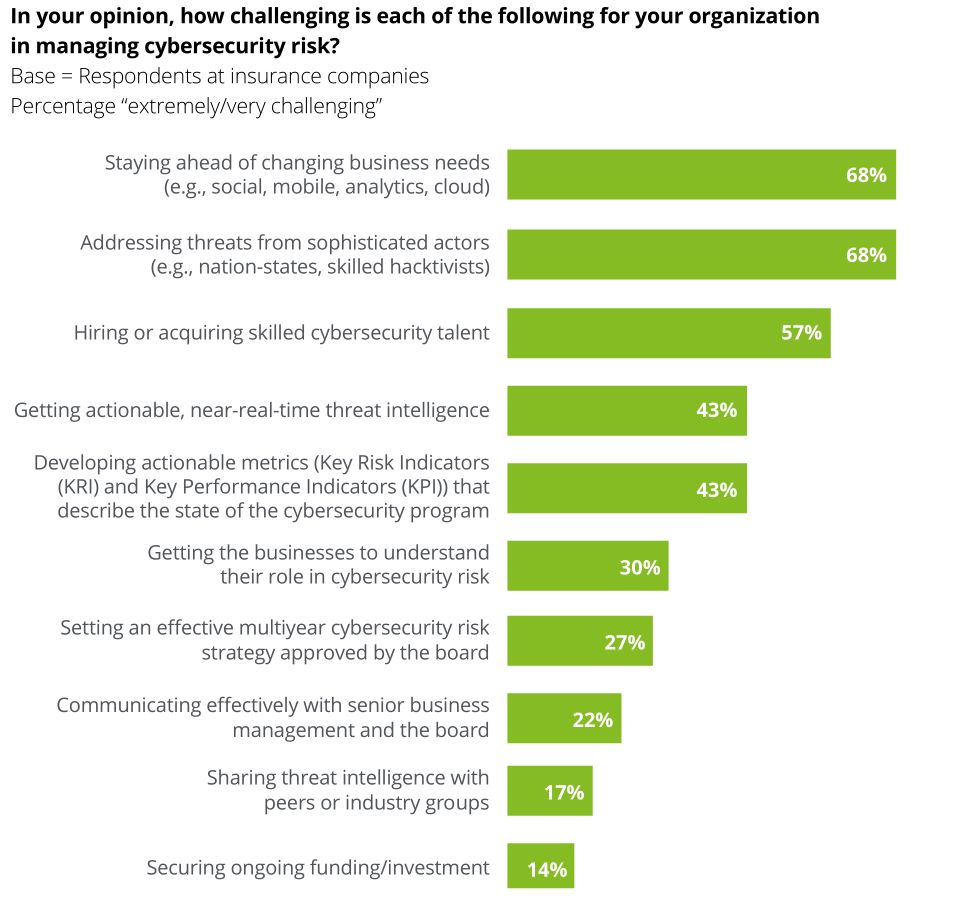

Operational risks, often underestimated, can have far-reaching impacts. Processing errors can cause customer dissatisfaction and regulatory scrutiny. Cybersecurity threats are particularly concerning, with data breaches costing companies around $4.45 million per incident.

Market and competitive risks complete the risk landscape. The Employee benefits space is volatile, with top insurers’ market share fluctuating by 5-10% annually. InsurTech firms are disrupting traditional models, forcing established insurers to innovate continuously.

The gig economy and remote work trends present new challenges in assessing and pricing risks for non-traditional employment arrangements. Insurers must adapt their risk management approaches to these rapidly evolving workforce dynamics.

The insurers who thrive will be those who not only manage risks effectively but also leverage their understanding to drive strategic decisions and product innovation. Are you one of the chosen few?

Risk Assessment and Analysis for Employee Benefits Insurers

Employee benefits risk assessment blends actuarial expertise with cutting-edge data analytics. The stakes are high for both insurers and their clients.

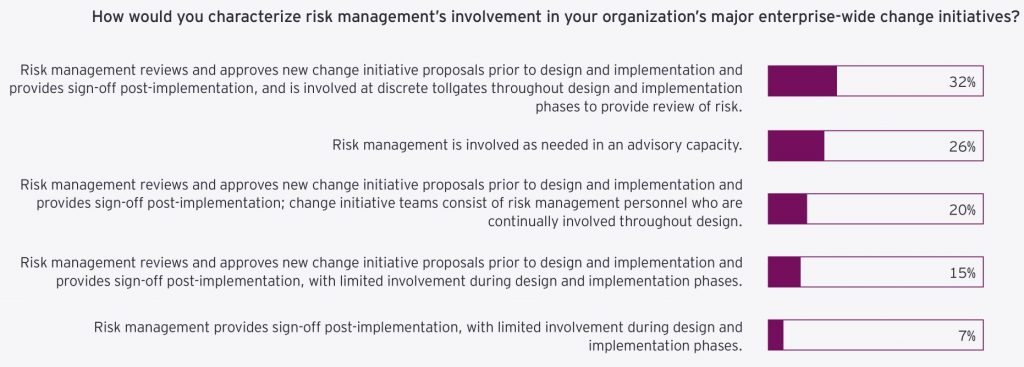

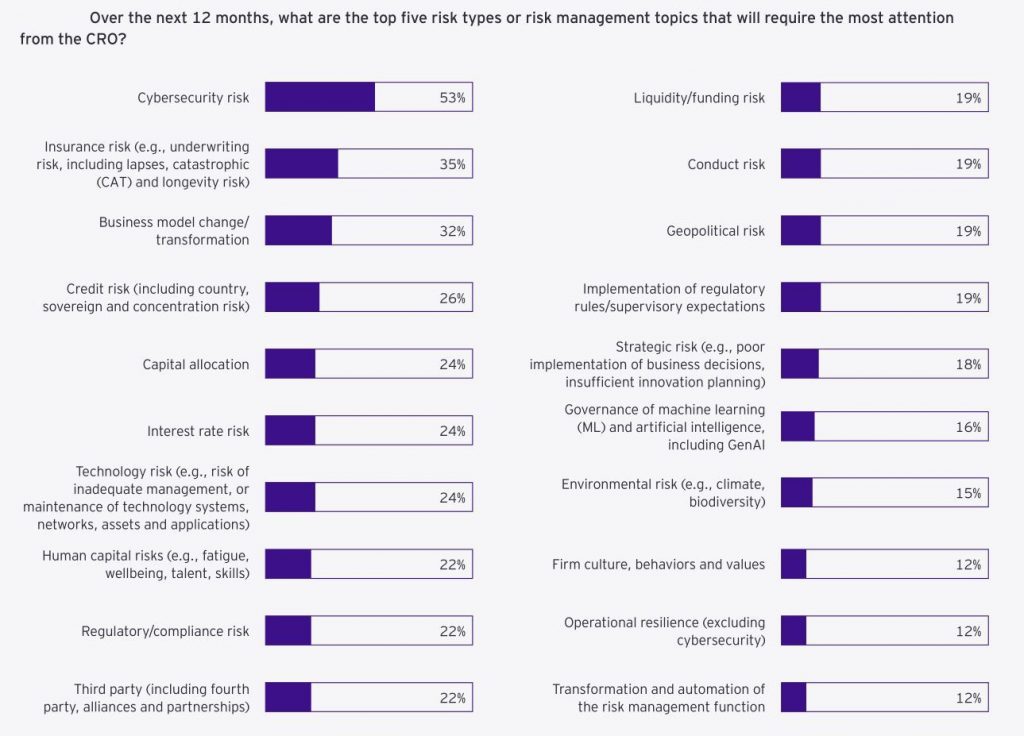

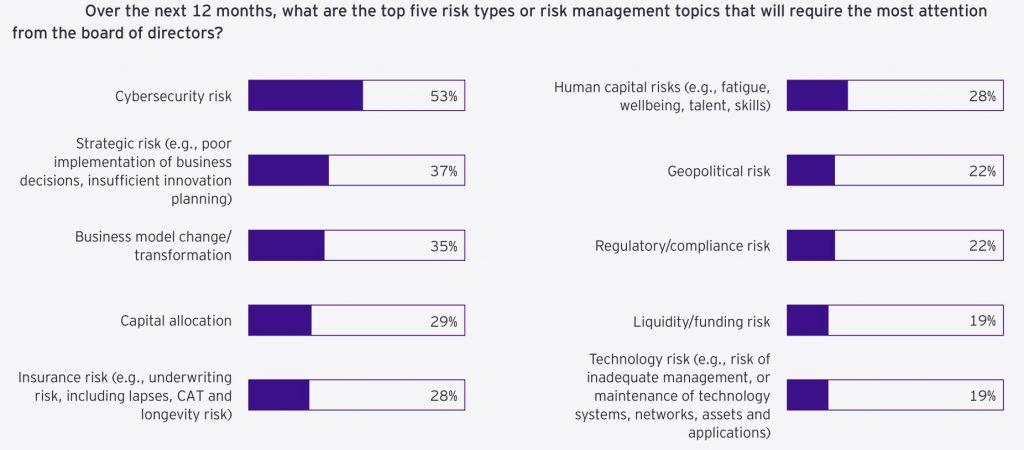

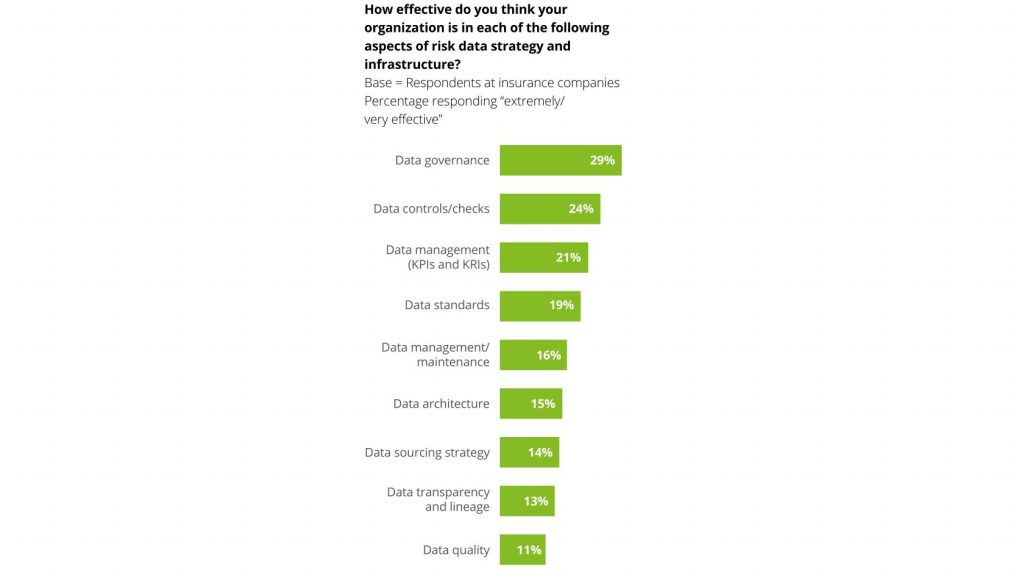

Source: EY/IIF Global Risk Insurance Management Survey

At the foundation lies experience rating, a method as old as the industry itself. For large groups with substantial claim history, actuaries analyze years of data, looking for patterns and anomalies that might indicate future trends such as

- Total Claim Amounts: This involves aggregating the total cost of claims over a specific period. Large aggregate claims can indicate higher risk and influence the premium rates.

- Frequency of Different Claim Types: Actuaries analyze how often specific types of claims occur. For instance, frequent claims for certain illnesses or injuries might signal underlying issues that need addressing, such as workplace safety or employee wellness programs.

- Severity of Claims: This factor examines the cost per claim. Severe claims, which are high-cost individual claims, can significantly impact the overall risk assessment and necessitate higher premiums or targeted interventions.

For example, a spike in musculoskeletal disorders might prompt a deeper investigation into workplace ergonomics, while an uptick in stress-related mental health claims could signal underlying issues with company culture, necessitating mental health initiatives and stress management programs.

Experience rating isn’t without challenges. A single catastrophic claim can skew the data, potentially leading to overpricing and loss of business. To mitigate this, most insurers implement large claim thresholds, typically capping individual claims at $100,000 to $250,000 for rating purposes.

For smaller groups or new businesses, where credible claims data is scarce, manual rating takes center stage. This method relies on actuarial tables refined over decades of industry-wide data collection. Skilled underwriters adjust these base rates using a multitude of factors, including:

- Age and Gender Distributions: Younger populations might have lower healthcare costs compared to older groups, while gender-specific health issues can also influence costs.

- Geographic Location: Regional variations in healthcare costs and access to services can significantly impact the risk profile.

- Industry Classification: Certain industries inherently carry more risk due to the nature of work. For instance, construction workers might have higher risks of physical injury compared to office workers.

The real magic often happens in the middle ground, where experience and manual rating meet. For mid-sized groups, typically those with 100 to 500 employees, a blended approach offers the best of both worlds. Actuaries use credibility theory to determine how much weight to give to a group’s own experience versus industry averages.

Trend analysis, once a straightforward extrapolation of past claims, now considers a myriad of factors to provide a more nuanced risk forecast

- Seasonal Patterns in Claims: Certain health issues may peak in specific seasons, such as flu in winter, impacting overall claims patterns.

- Impact of New Medical Technologies and Drugs: Innovations in medical treatments and drugs can alter the cost and frequency of claims. For example, a new, more effective medication might reduce hospital stays but increase prescription costs.

- Shifts in Provider Reimbursement Models: Changes from fee-for-service to value-based care can affect how and when services are utilized, impacting claim frequencies and severities.

The advent of value-based care has introduced new wrinkles into trend analysis. As providers take on more financial risk, utilization patterns are shifting in ways that challenge traditional actuarial models. Providers are now incentivized to keep patients healthier, which can lead to lower overall claims but may require more upfront investment in preventative care.

Demographic modeling has also undergone a revolution. Today’s models incorporate a wealth of additional data points beyond age and gender. Family composition, income levels, and education can be powerful predictors of healthcare utilization. A workforce dominated by young singles will have very different health needs than one with a high proportion of employees with young children.

Industry-specific adjustments have become increasingly granular. A technology firm might have a younger population overall, but also higher rates of mental health utilization and repetitive stress injuries due to the nature of desk jobs. A manufacturing company, by contrast, might see more acute injuries but lower prescription drug costs.

As we push into the frontiers of risk assessment, multi-source data integration is opening up new vistas of understanding. Insurers are now incorporating,

- Social Determinants of Health (SDOH): Factors such as housing, education, and socioeconomic status can significantly impact health outcomes and healthcare utilization.

- Wellness Program Data: Participation in wellness programs and their effectiveness can provide insights into potential reductions in healthcare costs and improvements in employee health.

- Prescription Drug Information: Detailed data on medication usage helps in understanding trends in drug costs and their impact on overall healthcare expenses.

- Environmental Factors: Local environmental conditions, such as pollution levels or climate, can affect the health risks of a population.

Source: Deloitte Global Risk Management Survey

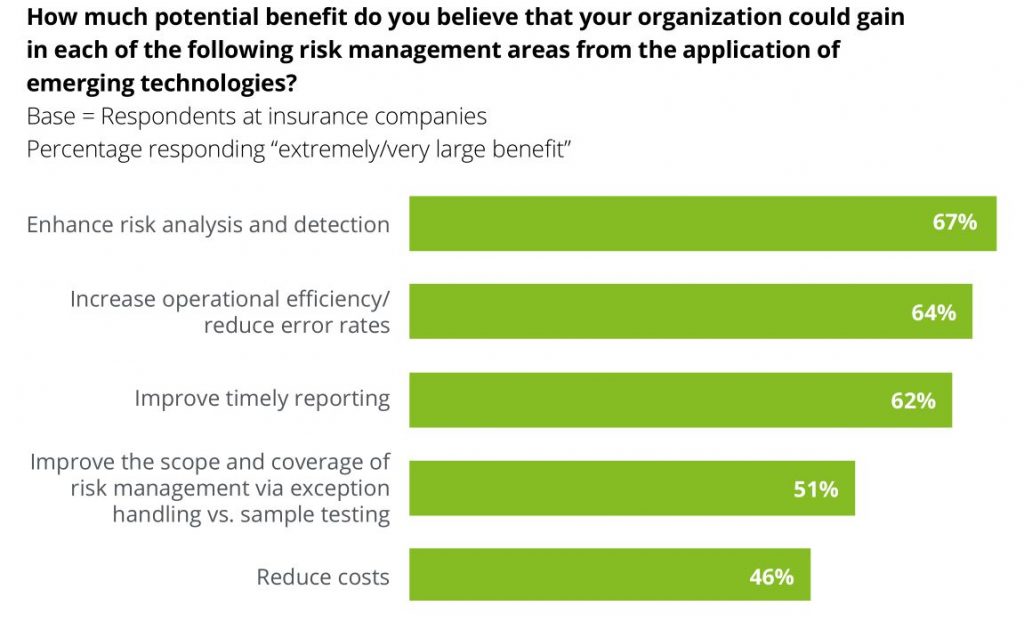

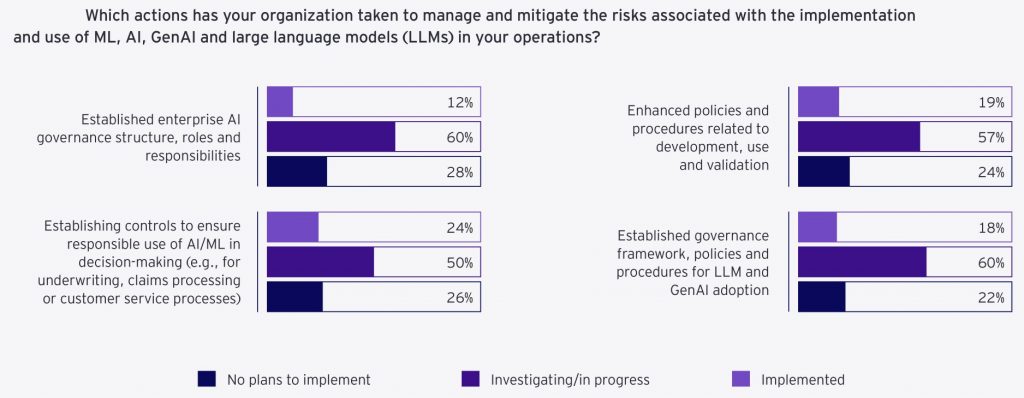

The rise of machine learning and artificial intelligence has supercharged these analytical capabilities. Natural Language Processing (NLP) algorithms are being applied to unstructured data in claims notes, extracting valuable insights that structured data alone might miss. Deep learning models are identifying subtle patterns in large datasets, uncovering risk factors that even experienced actuaries might overlook.

Source: Deloitte Global Risk Management Survey

Regulatory compliance has taken on new dimensions in the age of big data and AI. Insurers must navigate a complex landscape of state and federal regulations, ensuring their models don’t inadvertently discriminate based on protected characteristics.

Blockchain technology is emerging as a game-changer in benefits administration. By creating an immutable, transparent record of benefit eligibility and usage, insurers can reduce disputes over benefit eligibility.

Cybersecurity and data protection are paramount in an industry that handles sensitive personal and medical information. Real-time threat detection systems have become indispensable. Using machine learning algorithms, these systems can identify and neutralize 99.9% of cyber threats before they impact operations.

Risk Mitigation Strategies for Employee Benefits Insurers

Source: EY/IIF Global Risk Insurance Management Survey

What if you could design an employee benefits product that not only mitigates your risk but also gives you a significant edge over competitors? For insurers in this space, innovative risk mitigation isn’t just about protection—it’s about market leadership.

Precision Underwriting

Precision underwriting serves as the compass that guides insurers through the complex terrain of group risk. Dynamic underwriting models, powered by artificial intelligence and machine learning, are revolutionizing the way insurers assess and price risk.

- Real-Time Rate Adjustments: AI-driven models can adjust rates in real-time based on continuous data feeds. For example, an AI system might detect a sudden increase in stress-related claims within a particular industry and automatically adjust risk assessments for similar groups.

- Industry-Specific Guidelines: High-risk sectors like healthcare require tailored approaches. Specialized underwriting criteria for healthcare workers, considering factors such as exposure to infectious diseases and workplace violence risks can reduce loss ratios.

- Challenges: The wealth of data available can lead to analysis paralysis if not managed properly. Additionally, there’s a fine line between precise risk assessment and perceived discrimination.

Source: EY/IIF Global Risk Insurance Management Survey

Product Design and Diversification

The days of rigid, pre-packaged benefit plans are fading. Today’s market demands flexibility, and insurers are responding with modular product structures that allow for unprecedented customization.

- Customizable Benefit Modules: Leading insurers now offer several customizable benefit modules, allowing employers to tailor plans to their unique workforce needs. For instance, a tech startup might opt for mental health support and fitness perks, while a manufacturing firm might prioritize accident and disability coverage.

- Value-Added Services: Integration of services such as telehealth has reduced claims frequency for routine health issues. These services encourage preventive care and enhance the perceived value of the insurance product.

- Wellness Programs: Data-driven wellness initiatives targeting specific health risks can lead to measurable reductions in claims.

Reinsurance and Risk Transfer Mechanisms

Catastrophic reinsurance protecting against large claims over $1 million has long been a staple. However, approaches to reinsurance are becoming more nuanced and strategic.

- Layered Reinsurance Structures: Different levels of excess risk are ceded to multiple reinsurers, allowing for more precise risk management and often resulting in more favorable terms. For example, an insurer might retain the first $500,000 of risk, cede the next $500,000 to one reinsurer, and work with a different reinsurer for claims exceeding $1 million.

- Parametric Insurance: For pandemic risk, policies that pay out based on predefined triggers, such as the official declaration of a pandemic, are gaining traction. This provides certainty in payouts and reduces administrative costs.

- Captive Insurance Arrangements: Large employers are increasingly using captives to share risks and potentially achieve cost savings. Insurers are partnering with employers to create captive structures tailored to their unique needs.

Source: EY/IIF Global Risk Insurance Management Survey

Insurers who can turn risk management into a competitive advantage will be well-positioned to lead in this dynamic environment.

Compliance and Legal Risk Management for Employee benefits Insurers

The regulatory environment for Employee benefits insurers has grown exponentially complex since the passage of ERISA (Employee Retirement Income Security Act) in 1974. Today’s compliance landscape is a labyrinth of federal, state, and local regulations that demands constant vigilance and expertise.

Source: Deloitte Global Risk Management Survey

Effective compliance and legal risk management for Employee benefits insurers revolves around three core strategies

- Proactive regulatory monitoring

- Robust multi-state compliance frameworks

- Strategic management of emerging legal risks

Proactive Regulatory Monitoring

Proactive regulatory monitoring is the first line of defense. Many insurers are now implementing AI-driven regulatory tracking systems. For example, an AI system might flag a proposed change to state-level mental health parity laws, allowing the insurer to begin impact assessments and product adjustments well in advance of implementation.

Active participation in industry associations provides invaluable insights into pending legislation and regulatory trends. This involvement can give insurers several months of lead time in product adjustments which is invaluable in a competitive market.

Multi-State Compliance Frameworks

Multi-state compliance frameworks are essential for insurers operating across state lines.

- State Insurance Laws: Each state has its own set of insurance regulations governing employee benefits, including requirements for coverage types, minimum benefits, and premium rates.

- Mental Health Parity and Addiction Equity Act (MHPAEA): Ensures that mental health benefits are not more restrictive than medical/surgical benefits.

- Affordable Care Act (ACA): Imposes requirements such as essential health benefits, coverage for pre-existing conditions, and preventive services without cost-sharing.

- HIPAA (Health Insurance Portability and Accountability Act): Protects patient health information, requiring stringent data privacy and security measures.

Leading insurers are looking at developing dynamic compliance matrices that track over 500 regulatory requirements across 50 states, updated in real-time. These matrices serve as a centralized repository of compliance knowledge, ensuring consistency across operations.

Automated compliance checking in product development significantly reduces time-to-market.

Managing Emerging Legal Risks

Managing emerging legal risks is perhaps the most challenging aspect of compliance in the Employee benefits space. The legal landscape is constantly evolving, often in unpredictable ways. Developing contingency plans for potential changes to major legislation like the Affordable Care Act is crucial. These plans might include scenario modeling for different legislative outcomes, allowing insurers to minimize market disruption regardless of political shifts.

Source: EY/IIF Global Risk Insurance Management Survey

Legal risk scoring in underwriting is an emerging trend. This might involve analyzing factors such as the employer’s history of employment-related lawsuits or the litigiousness of the industry sector.

Data Privacy and Security

Source: EY/IIF Global Risk Insurance Management Survey

Data privacy and security regulations add another layer of complexity. With the increasing use of health data in underwriting and claims management, insurers must ensure compliance with regulations like HIPAA and state-level privacy laws.

Source: EY/IIF Global Risk Insurance Management Survey

The integration of AI and machine learning in compliance processes holds great promise. Predictive analytics can help identify potential compliance issues before they become problems. Natural language processing can assist in interpreting complex regulatory texts, ensuring more accurate and consistent compliance across the organization.

Source: EY/IIF Global Risk Insurance Management Survey

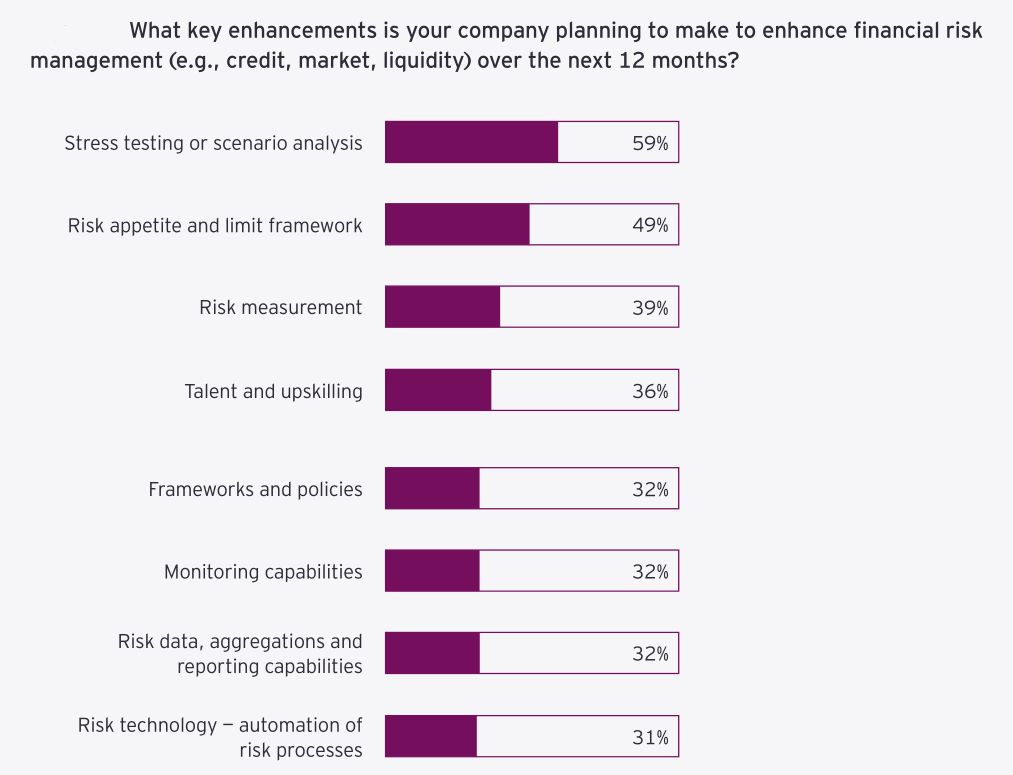

Financial Risk Management for Employee benefits Insurers

Source: EY/IIF Global Risk Insurance Management Survey

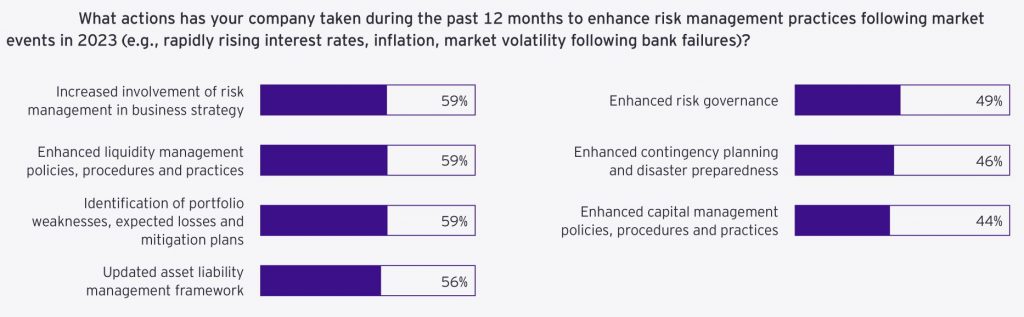

The approach to financial risk management in Employee benefits has evolved dramatically since the 2008 financial crisis. Insurers now employ sophisticated techniques that were unimaginable just a decade ago. These advancements rest on three pillars: dynamic pricing and reserving strategies, robust capital management, and liability-driven investment approaches.

Dynamic Pricing

Leading insurers are implementing real-time pricing models that adjust rates weekly based on emerging claim patterns.

Real-Time Data Integration: These systems integrate various data sources such as claims data, market trends, and demographic changes to adjust pricing dynamically.

- Predictive Analytics: Advanced predictive models forecast future claims based on historical data, allowing insurers to anticipate and adjust for potential spikes or drops in claim frequencies.

- Example: An insurer’s system detects a spike in prescription drug claims for a particular employer group. Within days, the pricing model recalibrates the risk assessment, adjusting premiums for similar groups at their next renewal. This rapid adaptation prevents the accumulation of underpriced risk.

Reserving Strategies

Reserving strategies have also become more sophisticated. Stochastic reserving methods now run over 10,000 scenarios to set reserves, reducing reserve volatility significantly. This approach allows insurers to hold more accurate reserves, balancing the need for financial security with the efficient use of capital.

- Stochastic Modeling: These models consider a wide range of variables, including claim frequency, severity, economic conditions, and regulatory changes, to simulate possible future outcomes.

- Tail Risk Management: Identifying and preparing for low-probability, high-impact events that could significantly affect reserves.

Robust Capital Management

Capital management and solvency considerations are paramount in this space. Insurers are implementing dynamic capital models that update required capital daily based on market conditions and portfolio changes. These models ensure that capital levels remain adequate without being excessive, optimizing financial efficiency.

- Dynamic Capital Models: These models continuously assess the capital requirements based on real-time data, ensuring optimal capital allocation.

- Economic Capital: Measuring the amount of capital required to remain solvent at a given confidence level, considering the insurer’s risk profile.

- Solvency II and Other Regulations: Compliance with international standards such as Solvency II, which requires insurers to maintain sufficient capital to cover their risk exposures.

- Stress Testing: Stress testing has become more rigorous. Insurers now model the impact of simultaneous economic downturns and pandemics, ensuring solvency in 99.5% of scenarios.

Liability-Driven Investment Approaches

Liability-driven investment (LDI) approaches are gaining traction, with insurers matching asset and liability durations to within 0.5 years to reduce interest rate risk.

- Matching Duration: Ensuring that the durations of assets and liabilities are closely aligned to mitigate the impact of interest rate fluctuations.

- Cash Flow Matching: Structuring investments to provide cash flows that match expected benefit payments, thereby reducing reinvestment risk.

- Risk Hedging: Using financial instruments such as interest rate swaps, futures, and options to hedge against market risks.

An insurer might use a combination of corporate bonds and interest rate swaps to create a cash flow profile that closely matches their projected benefit payments.

Are you leveraging the full power of data analytics in your pricing models? Have you stress-tested your capital position against extreme but plausible scenarios?

Vendor and Partner Management for Employee benefits Insurers

For insurers in this space, strategic vendor and partner management is about creating a powerful ecosystem that enhances your market position.

- Expertise: TPAs and vendors specialize in specific areas, like claims processing or wellness programs. Their expertise ensures tasks are done correctly and efficiently, reducing the chance of mistakes that could lead to financial loss.

- Advanced Technology: They often use advanced technology and processes that insurers might not have in-house, improving accuracy and speed.

- Cost Control: By outsourcing to experts, insurers can control costs better, avoiding the expenses of hiring and training in-house staff for specialized tasks.

Strategic Selection of Service Providers

Leading insurers are implementing AI-driven vendor selection processes that analyze over 50 criteria to identify optimal third-party administrators (TPAs).

Criteria to Identify TPAs

- Claims Processing Speed: How quickly the TPA processes claims, which impacts customer satisfaction and operational efficiency.

- Accuracy Rates: The accuracy of claims processing to minimize errors and rework.

- Customer Satisfaction Scores: Feedback from clients regarding their experience with the TPA.

- Technological Capabilities: The TPA’s ability to integrate with the insurer’s systems and use advanced technologies such as AI and machine learning.

- Regulatory Compliance: The TPA’s track record in adhering to regulatory requirements.

- Financial Stability: The financial health and stability of the TPA to ensure long-term partnership viability.

- Experience with Similar Client Demographics: The TPA’s experience in handling claims for similar employer groups.

- Innovation in Claims Management: The TPA’s history of implementing innovative solutions to improve claims processing.

- Cost Efficiency: The cost-effectiveness of the TPA’s services.

- Scalability: The TPA’s ability to scale operations as the insurer’s business grows.

- Data Security Measures: The TPA’s protocols for protecting sensitive customer data.

Leveraging Health and Wellness Partnerships

Partnerships with telehealth providers have become increasingly valuable, offering 24/7 virtual care access and decreasing unnecessary ER visits by 30%. These partnerships extend beyond simple video consultations. Some insurers are now offering integrated care pathways that combine telehealth, in-person care, and digital therapeutics for comprehensive disease management.

Vendor Risk Management and Performance Monitoring

Vendor risk management and performance monitoring have evolved significantly. Real-time vendor performance dashboards tracking over 20 KPIs across all critical vendors are now industry standard. These dashboards allow insurers to identify issues 50% faster than traditional quarterly reviews.

KPIs for Critical Vendors

- Claims Processing Accuracy: The rate of correctly processed claims without errors.

- Customer Satisfaction Scores: Regular feedback from clients on their satisfaction with the vendor’s services.

- Data Security Compliance: The vendor’s adherence to data protection regulations and protocols.

- Service Level Agreement (SLA) Adherence: The vendor’s performance against agreed-upon service levels.

- Turnaround Time for Claims: The average time taken to process and resolve claims.

- Cost Efficiency: The cost-effectiveness of the services provided.

- Client Retention Rates: The percentage of clients retained by the vendor over time.

- Quality of Reporting: The accuracy and comprehensiveness of reports provided by the vendor.

Conclusion

Risk management in Group Benefits insurance isn’t just about defense. Proactively addressing risks head on is how market leaders are made. Financial, operational, compliance, and vendor risks all present opportunities for innovation and growth.

To dominate this market,

- Innovate in risk assessment and mitigation

- Turn data into actionable insights

- Form partnerships that amplify your strengths

- Stay nimble amid regulatory and market shifts

By weaponizing risk management, insurers can boost profits, satisfy customers, and claim the industry’s top spots.

The future favors those who master risk, not just manage it. Are you ready to lead?