Octogenarians are becoming the norm. Centenarians are no longer a rarity.

As the world’s population ages, the financial burden on pension plans and insurers grows. Traditional risk models are crumbling under the weight of this demographic shift.

The solution? A groundbreaking financial instrument called the longevity swap.

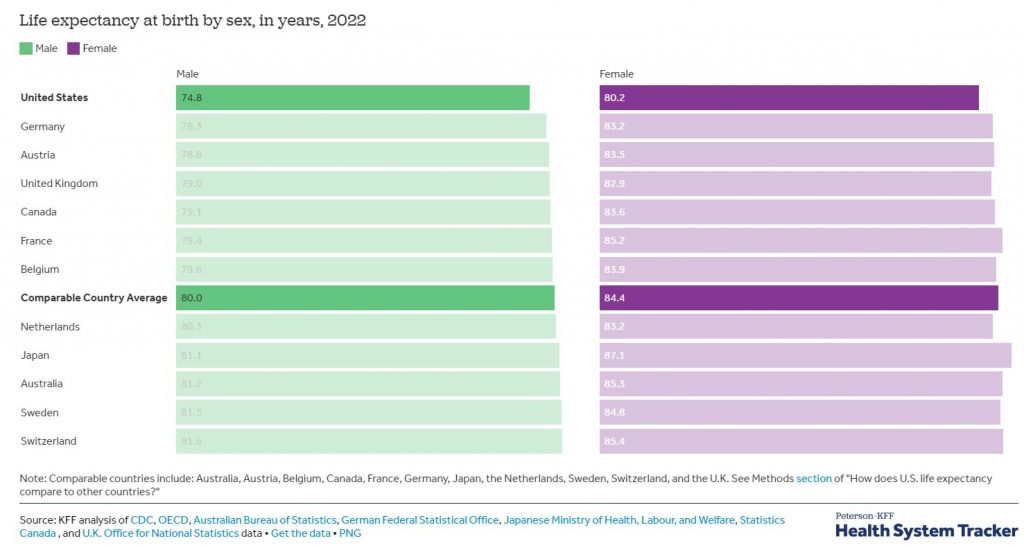

Longevity risk, the risk that people live longer than expected, has been a growing concern for the insurance industry in recent years. Increased life expectancy has put a strain on the balance sheets of insurers and pension providers. As more people reach advanced ages, these institutions must pay out benefits for longer periods, often exceeding their initial projections.

To address this challenge, the longevity market emerged in the early 2000s. This market brought together insurers, pension plans, reinsurers, and investors seeking to manage and transfer longevity risk. Central to this market are longevity swaps – innovative financial contracts that allow pension plans and insurers to hedge against the financial risk of increasing life expectancy.

Understanding Longevity Risk

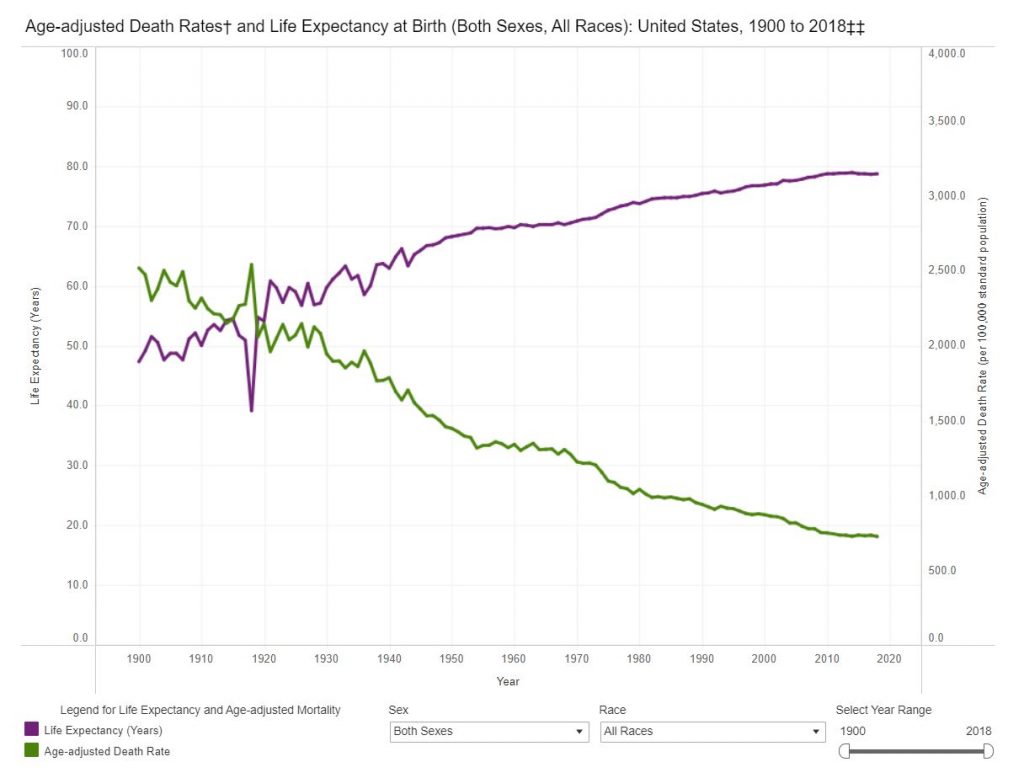

Longevity risk is not a new concept, but its significance has grown in recent years. To understand why, we must first examine the remarkable changes in human life expectancy over the past century. In the United States, life expectancy at birth increased from 47.3 years in 1900 to 78.7 years in 2018. Similar trends have been observed in developed countries worldwide.

Mortality Trends in the United States

Several factors have contributed to these longevity improvements:

- Advances in medical technology

- Better access to healthcare

- Increased awareness of healthy lifestyle choices

- Socioeconomic factors such as rising standards of living and education levels

As a result, people are not only living longer but also experiencing a higher quality of life in their later years.

While these trends are positive, they pose significant challenges for the institutions responsible for providing retirement income. Pension plans and insurers rely on accurate predictions of future mortality rates to ensure they have sufficient funds to meet their long-term obligations.

Longevity risk refers to the risk of unanticipated changes in mortality rates. It is the risk that people will live longer than predicted, leading to higher-than-expected pension liabilities. For pension plans, this can result in a funding gap, where the assets set aside to pay benefits fall short of the actual amount needed. For insurers, longevity risk can lead to higher-than-anticipated payouts on annuity contracts, eroding profitability.

The impact of longevity risk on pension liabilities cannot be overstated. It is commonly estimated that a one-year increase in life expectancy can increase the liabilities of a defined benefit pension scheme by approximately 3-5%. Using these figures, if a defined benefit pension scheme has liabilities of £1 billion, a one-year increase in life expectancy could potentially increase those liabilities by £30 million to £50 million.

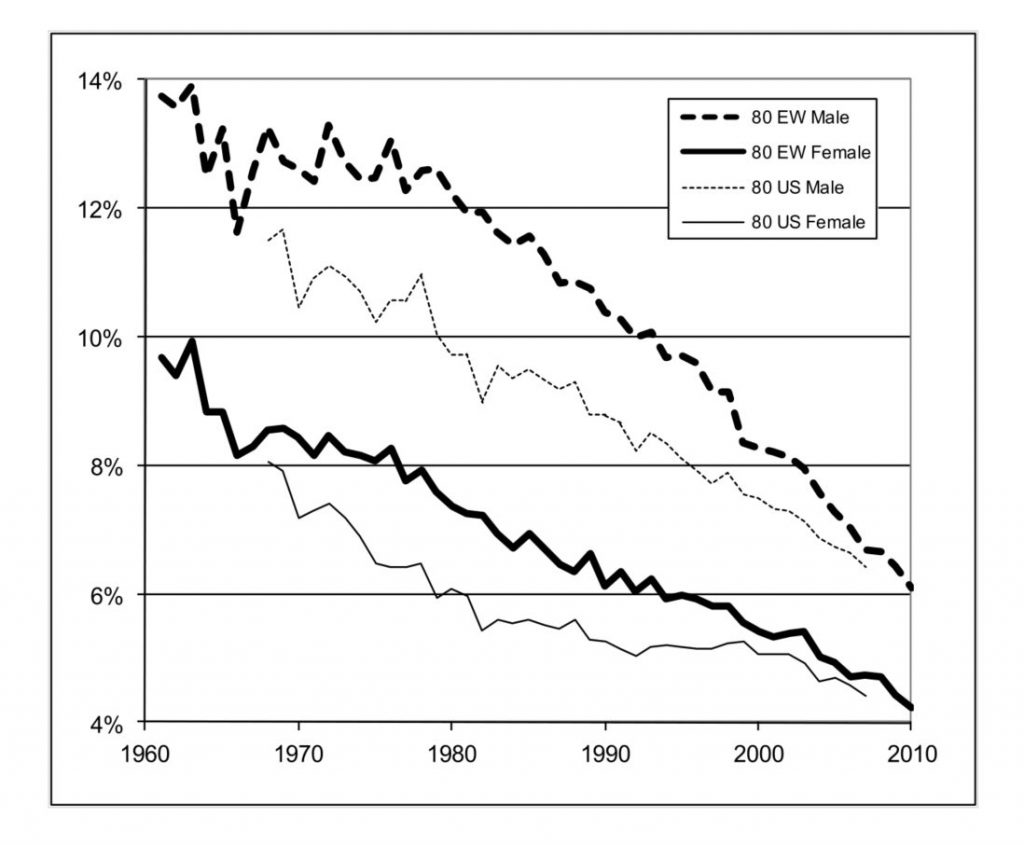

Mortality Rates for 80-year-olds in the US and England & Wales 1961-2010

To manage longevity risk effectively, accurate mortality assumptions and forecasting are essential. Pension plans and insurers use a variety of mortality tables and projection models to estimate future mortality rates. However, these assumptions are subject to uncertainty and can be influenced by a range of factors, from medical breakthroughs to changes in lifestyle habits. As a result, there is always the potential for actual mortality experience to deviate from expectations.

This is where the concept of Economic Capital (EC) comes into play. EC is a measure of the amount of capital that an institution needs to hold to absorb unexpected losses arising from various risks, including longevity risk. It is calculated based on a specified confidence level and time horizon, typically using stochastic models that simulate a range of possible future outcomes.

For example, a pension plan might calculate its EC for longevity risk by simulating thousands of potential future mortality scenarios. By analyzing the distribution of outcomes, the plan can determine the amount of capital needed to cover potential losses at a given confidence level, such as 99.5% over a one-year horizon.

While EC provides a way to quantify longevity risk, it does not directly address the question of how much an institution should charge to take on this risk. This is where the Market Value Margin (MVM) comes in. The MVM is essentially the price of longevity risk, representing the compensation that an institution would require to assume the risk of future adverse mortality developments.

The MVM is calculated by projecting the future EC requirements arising from longevity risk over the lifetime of the liabilities and then discounting these capital charges back to the present using a risk-adjusted discount rate. This rate reflects the cost of capital for the institution, which is typically higher than the risk-free rate due to the uncertainty associated with longevity risk.

Development of the Longevity Market

As the understanding of longevity risk grew, so did the need for solutions. Enter the longevity market, a new frontier in risk management that brought together insurers, pension plans, and capital market participants. The market’s birth can be traced back to the UK in the early 2000s, when a series of innovative transactions paved the way for a new era in longevity risk transfer.

The Birth of the Longevity Market in the UK

It all started with the establishment of Paternoster, a monoline insurer designed specifically to acquire UK defined benefit pension plans. Paternoster’s arrival marked a significant shift in the pension risk transfer landscape, which had previously been dominated by two insurers: Legal & General and Prudential Plc.

Soon after, new players entered the market, including Pension Insurance Corporation, Synesis, and Lucida. These firms, backed by investment banks and private equity investors, brought fresh capital and innovative solutions to the table. In 2007, Goldman Sachs threw its hat into the ring with the creation of Rothesay Life, further cementing the role of investment banks in the longevity market.

Key Market Participants

The longevity market brought together a diverse group of participants, each with their own objectives and expertise:

- Hedgers: Insurers and pension plans looking to mitigate their exposure to longevity risk. These institutions had a clear motivation to transfer risk off their balance sheets, either to free up capital or to reduce volatility in their funding levels.

- Investors: A mix of insurers, reinsurers, insurance-linked securities (ILS) funds, hedge funds, and endowments. For these players, longevity risk represented an attractive investment opportunity, offering returns that were largely uncorrelated with traditional asset classes.

- Intermediaries: Banks and other financial institutions played a crucial role in facilitating risk transfer between hedgers and investors. These firms brought expertise in structuring and pricing complex transactions, as well as deep pools of capital to support market growth.

Evolution of Longevity Risk Transfer Solutions

As the longevity market evolved, so did the range of risk transfer solutions available.

- Pension Buyout: One of the earliest and most straightforward solutions where a pension plan transfers all its assets and liabilities to an insurer in exchange for a premium. This removes the longevity risk from the plan sponsor’s balance sheet but comes at a significant upfront cost.

- Pension Buy-ins: A more flexible alternative, allowing pension plans to transfer a portion of their liabilities to an insurer while retaining the assets and responsibility for paying benefits. Buy-ins provided a way for plans to gradually de-risk over time without the need for a full buyout.

- Bulk Annuity Transfers: Involving the transfer of a group of annuity policies from one insurer to another, these transactions allowed insurers to manage their longevity risk exposure by diversifying their portfolios or exiting certain market segments.

While these insurance-based solutions were an important part of the longevity market’s development, they were not without limitations. Pension buyouts and buy-ins required significant upfront capital and were often expensive relative to the level of risk transferred. Moreover, these solutions were not always accessible to smaller pension plans or those with unique benefit structures.

The Emergence of Capital Market Solutions

To address these limitations, the market began to explore capital market solutions, such as longevity bonds and swaps.

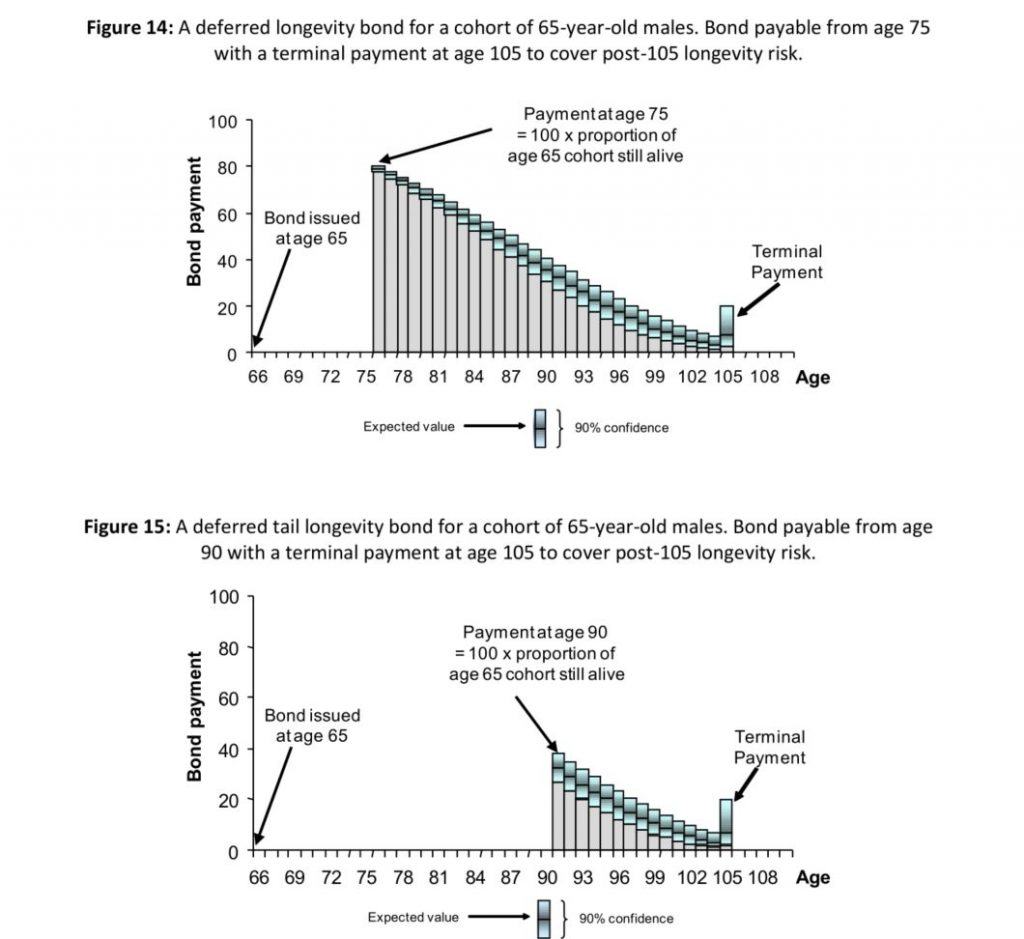

- Longevity Bonds: First proposed in the early 2000s, these were designed to pay higher coupons when mortality rates were lower than expected, thereby offsetting the increased costs faced by insurers and pension plans. The EIB/BNP Paribas longevity bond, announced in 2004, was the first attempt to bring such an instrument to market. Although it was ultimately withdrawn due to insufficient demand, it paved the way for further innovation.

- Longevity Swaps: Emerging in the late 2000s, these provided a more flexible and customizable solution. In a typical longevity swap, the hedger (an insurer or pension plan) agrees to pay a fixed set of cash flows to the investor (a reinsurer or investment bank) in exchange for variable payments linked to the actual mortality experience of a specific population. The first longevity swap in the UK took place in 2009 between Babcock International and Credit Suisse.

In the years that followed, longevity swaps became increasingly popular, with a range of structures and features designed to meet the needs of different market participants. Some swaps were based on standardized mortality indices, while others were customized to the specific demographics of a particular pension plan or annuity book.

Longevity Swaps: Mechanism and Pricing

Longevity swaps have emerged as one of the most innovative and flexible tools for managing longevity risk. At their core, these instruments involve the exchange of fixed payments for variable payments linked to the actual survival rates of a specific population. But beneath this simple concept lies a complex web of pricing and risk management considerations.

Mechanics of Longevity Swaps

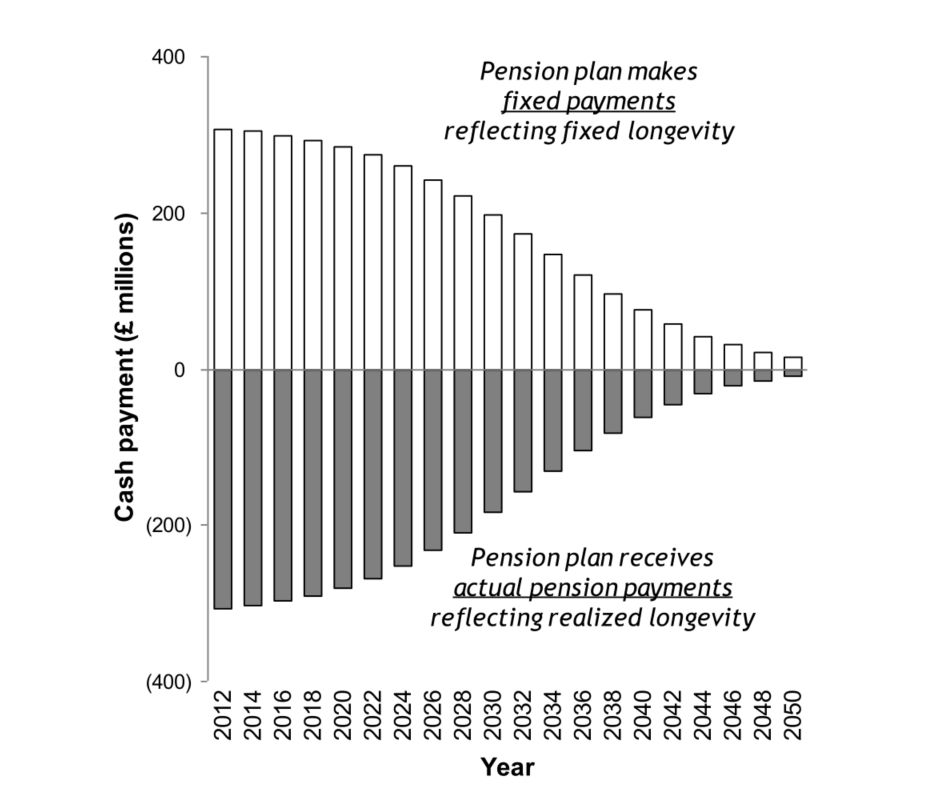

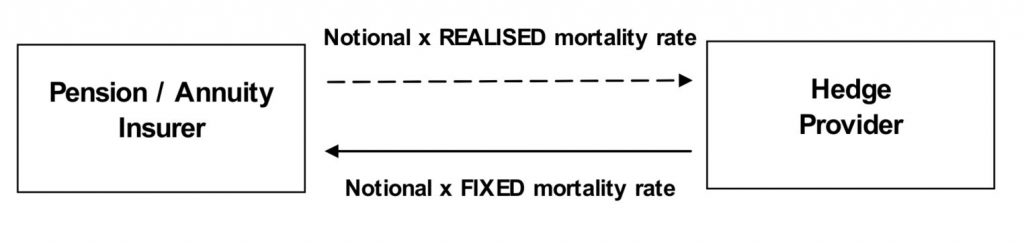

In a typical longevity swap, the hedger (usually a pension plan or insurer) agrees to make a series of fixed payments to the swap counterparty (often a reinsurer or investment bank). In return, the counterparty makes variable payments that are tied to the realized mortality experience of a specified reference population.

- If the reference population lives longer than expected, the variable payments will be higher, offsetting the increased costs faced by the hedger.

- If the population experiences higher mortality than anticipated, the variable payments will be lower, but the hedger will also face lower costs.

This structure is similar in some ways to an interest rate swap, where fixed payments are exchanged for variable payments linked to a floating interest rate. However, longevity swaps are more complex, as the variable payments are based on the uncertain future mortality of a specific population rather than a published interest rate index.

Longevity swaps also share some similarities with credit default swaps (CDS), in that both involve the transfer of risk from one party to another. However, while a CDS protects against the default of a specific borrower, a longevity swap protects against the “default” of a population (i.e., living longer than expected).

Pricing Longevity Swaps

Pricing longevity swaps is a complex and evolving area, reflecting the long-term nature of the risks involved and the lack of a deep, liquid market for these instruments. Two main approaches have emerged: the Wang transform method and the Sharpe ratio method.

- Wang Transform Method: This method adjusts a given probability distribution to account for risk. In the context of longevity swaps, the Wang transform is used to adjust the expected mortality rates of the reference population to reflect the market price of longevity risk.

- The fixed leg of the swap is priced based on the expected mortality rates.

- The variable leg is priced based on the risk-adjusted (or “risk-neutral”) mortality rates.

- The difference between these two sets of rates determines the swap premium, which is typically expressed as a percentage of the fixed leg payments.

- Sharpe Ratio Method: This method prices longevity swaps based on the expected excess return per unit of risk. It assumes that investors should be compensated for taking on longevity risk in proportion to the Sharpe ratio of the investment (i.e., the ratio of excess returns to volatility).

- The fixed leg of the swap is priced at a discount to the expected mortality rates, with the discount factor determined by the target Sharpe ratio.

- The variable leg is then priced at a premium to the expected mortality rates, reflecting the compensation required by investors for bearing longevity risk.

Sensitivity Analysis

Regardless of the pricing method used, longevity swap rates are sensitive to a range of underlying factors, including interest rates, the market price of risk, swap maturity, and assumptions about future mortality improvements.

- Interest Rates: Changes in interest rates can have a significant impact on swap pricing, as they affect the present value of both the fixed and variable payments. Generally, higher interest rates will lead to lower swap rates, as the present value of future payments decreases.

- Market Price of Risk: This reflects investors’ willingness to take on longevity risk. A higher market price of risk will generally lead to higher swap rates, as investors will demand greater compensation for bearing longevity risk.

- Swap Maturity: Longer-dated swaps typically command higher premiums due to the greater uncertainty associated with long-term mortality projections.

- Assumptions about Future Mortality Improvements: These are based on a range of demographic and medical factors and can have a material impact on swap pricing.

To illustrate these sensitivities, consider a hypothetical 20-year longevity swap based on a cohort of 65-year-old UK males. Using the Wang transform method with a market price of risk of 0.2, the swap rate might be set at 5% of the fixed leg payments. Here, the swap rate is the percentage of the fixed payments that the hedger needs to pay annually.

- If interest rates rise by 0.5% (50 basis points), the swap rate might decrease to 4.5%, reflecting the lower present value of the future payments. Basis points are simply a way to express percentage changes, where 100 basis points equal 1%.

- If the market price of risk increases to 0.3, the swap rate might rise to 6%, reflecting the higher compensation required by investors.

- If projected improvements in mortality rates increase by 10% relative to the base case, the swap rate might rise to 5.5%, reflecting the higher expected payouts on the variable leg.

Longevity Swap Case Studies

With the mechanics and pricing of longevity swaps in mind, let’s explore some of the most significant transactions in the market’s history.

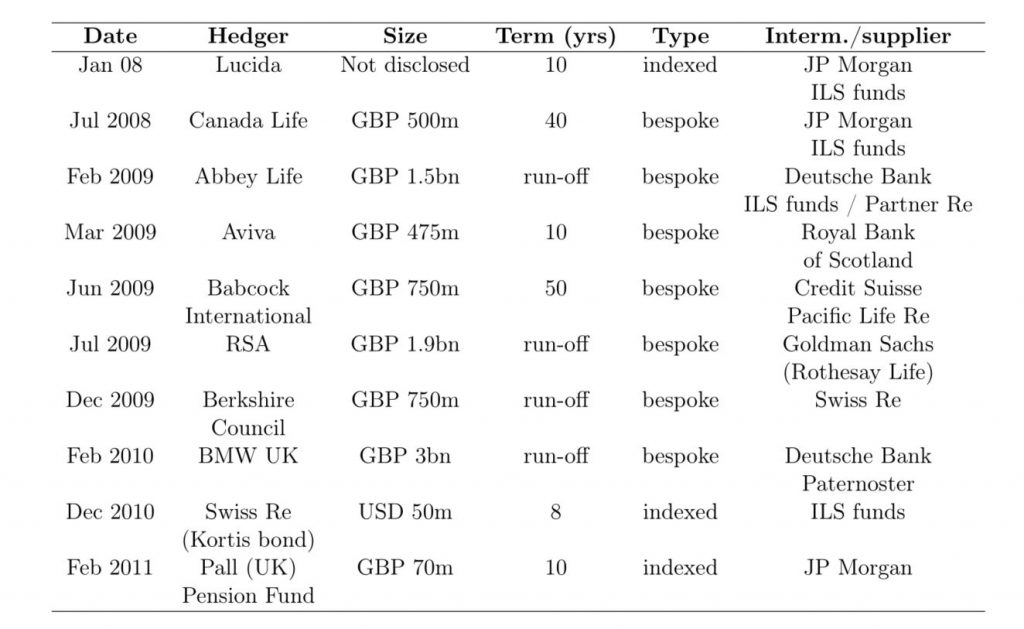

Publicly announced longevity swap transactions 2008-2011

J.P. Morgan – Canada Life Longevity Swap (2008)

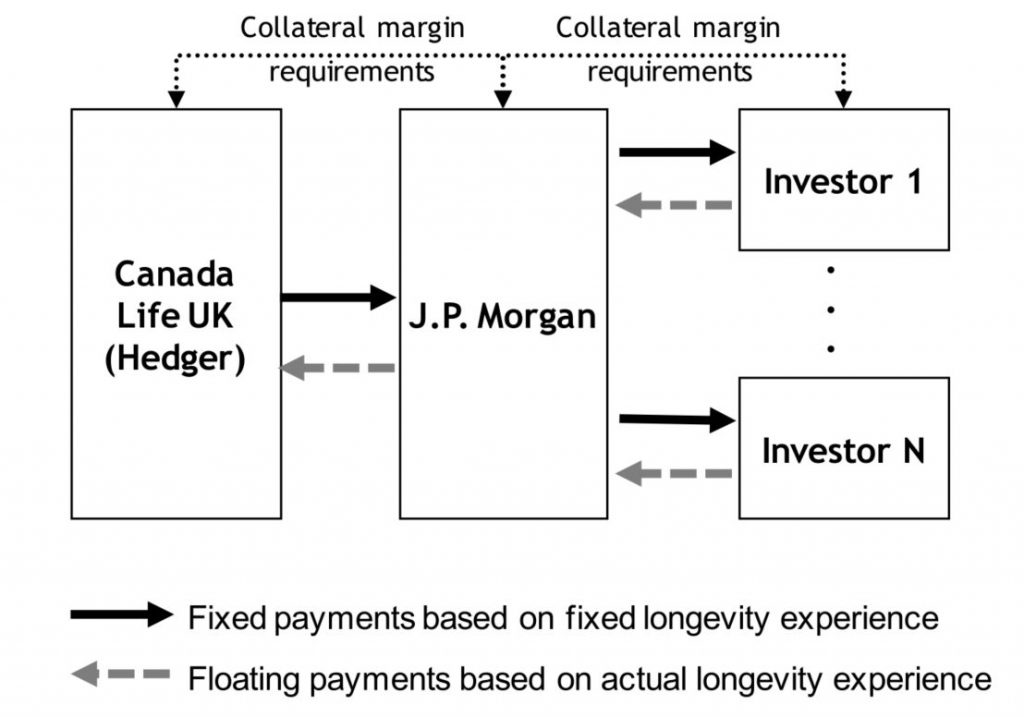

In a groundbreaking deal, Canada Life, a UK insurer, entered into a £500 million, 40-year longevity swap with J.P. Morgan in July 2008. This transaction marked the first time that capital markets investors took on direct exposure to longevity risk.

Canada Life agreed to make fixed payments to J.P. Morgan. In return, J.P. Morgan made variable payments based on the actual mortality experience of a cohort of 125,000 Canada Life policyholders.

The swap effectively transferred the longevity risk associated with these policies to J.P. Morgan, which then passed on the risk to capital markets investors.

Aviva – RBS Longevity Swap (2009)

In March 2009, UK insurer Aviva entered into a £475 million longevity swap with the Royal Bank of Scotland (RBS). The 10-year swap was designed to hedge the longevity risk associated with a subset of Aviva’s annuity book.

This transaction combined elements of both indemnity-based (where payments are based on the actual mortality experience of the hedger’s population) and index-based swaps (where payments are based on a general mortality index).

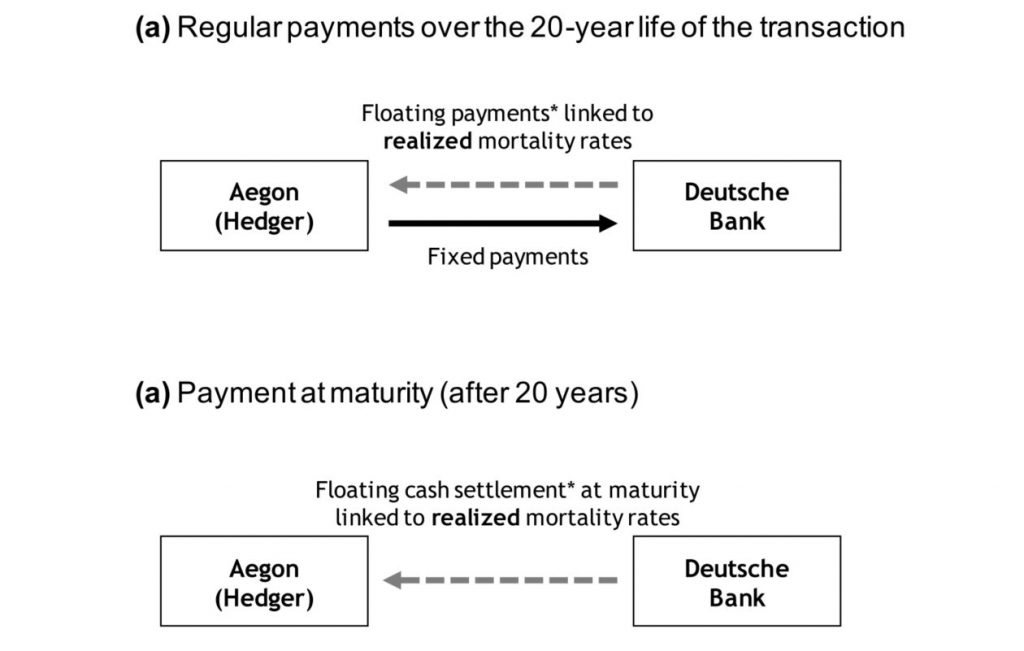

Aegon – Deutsche Bank Longevity Swap (2012)

Dutch insurer Aegon entered into a €12 billion longevity swap with Deutsche Bank in February 2012. The swap, which had a maturity of 20 years, was designed to hedge the longevity risk associated with a portion of Aegon’s Dutch annuity book.

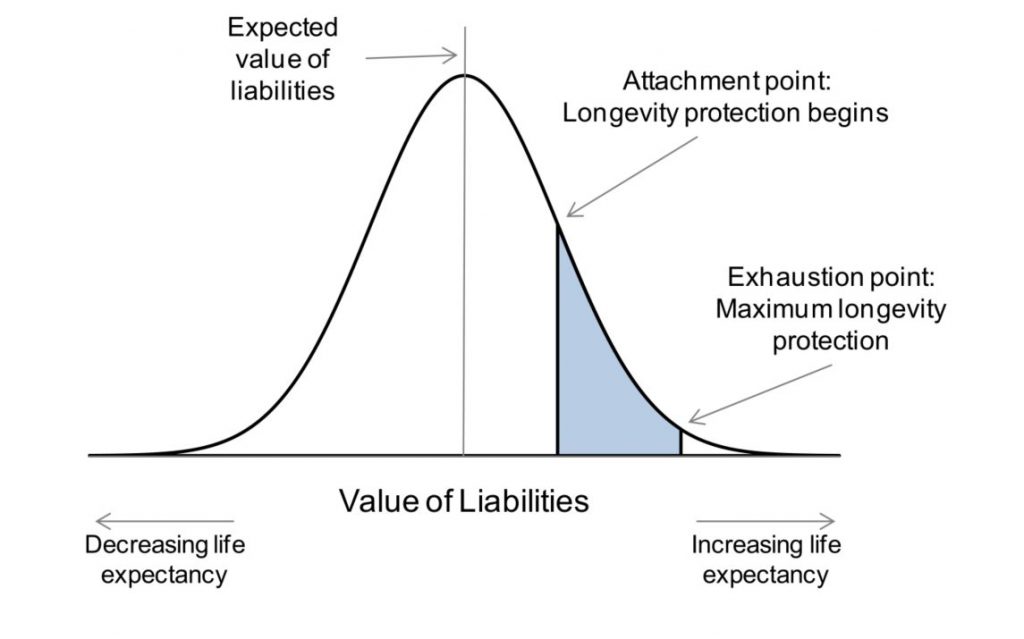

The transaction was notable for its innovative “out-of-the-money” structure. Under this structure, Aegon would only receive payments from Deutsche Bank if realized mortality rates fell below a predetermined threshold.

Key Takeaways

These case studies offer several key lessons for market participants:

- Customization is Key: Each longevity swap is unique, reflecting the specific needs and risk profile of the hedger.

- Basis Risk Matters: Basis risk arises from differences between the reference population and the hedger’s actual population.

- Counterparty Risk Must Be Managed: Longevity swaps are long-term contracts, and the creditworthiness of the swap counterparty is a critical consideration.

Innovation and Future Developments in the Longevity Market

As the longevity market has grown, so has the pace of innovation. From new product structures to advanced analytical techniques, market participants have continuously pushed the boundaries of what’s possible in longevity risk management.

Product Innovation

Significant innovation has occurred in the development of new longevity-linked securities:

- Q-forwards: Standardized contracts allowing participants to hedge the risk of changes in mortality rates at a specific future point.

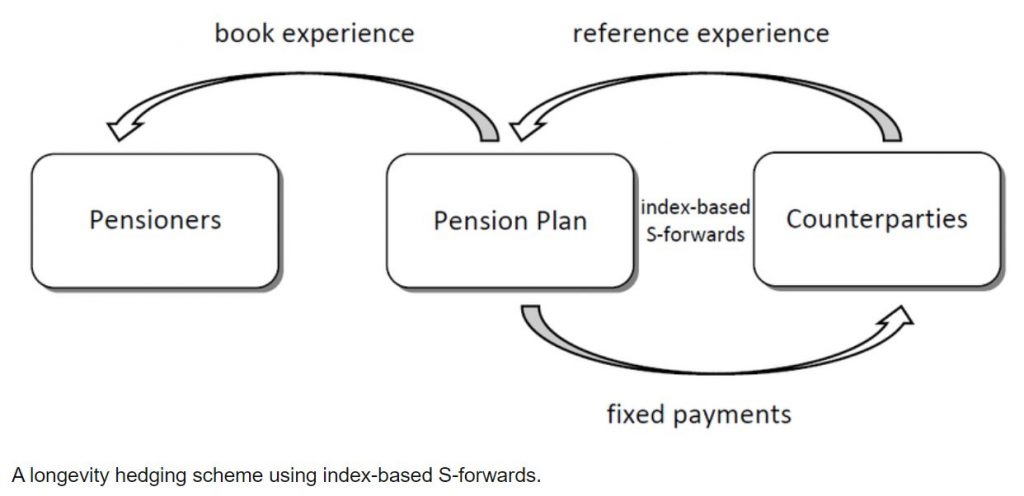

- S-forwards: Provide exposure to the risk of changes in survival rates over a specified period.

- Longevity Trend Bonds: Bonds paying a coupon linked to the difference in mortality improvements between two populations, allowing investors to speculate on relative longevity trends.

Conceptual Innovation

The longevity market has moved away from traditional insurance models that directly cover losses to using financial tools based on statistical measures or specific groups of people. This shift recognizes that longevity risk is systemic and cannot be fully diversified through traditional insurance mechanisms. Index-based hedges allow for more efficient risk transfer and spreading across a broader pool of investors.

Analytical Innovation

Advances in analytical techniques have significantly benefited the longevity market:

- Stochastic Mortality Models: Use statistical methods to project future mortality rates, leading to more accurate pricing and risk assessment.

- Measuring Basis Risk: New techniques, like the “hedge effectiveness analysis toolkit” developed by Guy Coughlan, help better understand and manage basis risk in longevity transactions.

Data Innovation

Data innovation has been a key driver of growth in the longevity market:

- Postcode Analysis: Uses granular geographic data to predict life expectancy, allowing insurers and pension plans to better understand the longevity risk in their portfolios.

- Longevity Indices: The development of indices such as the LifeMetrics index provides a standardized benchmark for longevity risk transfer, facilitating market growth.

- Club Vita: A longevity data pooling initiative launched in 2008 aggregates data from numerous pension plans to improve the accuracy and reliability of longevity projections, benefiting the market as a whole.

Conclusion

The longevity market is set to grow. Pension plans and insurers face the challenges of an aging population, increasing the demand for longevity risk transfer solutions.

The growing role of capital markets in risk transfer will drive this growth. As the market becomes more liquid and transparent, hedging costs will fall, making it accessible to more participants.

However, challenges remain. Modeling and pricing longevity risk is still evolving, and debates continue about the best assumptions and methods. The possibility of government involvement, such as issuing longevity bonds, is also uncertain.

The collaborative efforts of pension plans, insurers, reinsurers, investment banks, and regulators will be vital in navigating the complexities of longevity risk. The challenges are formidable, but the potential for creating a resilient and dynamic market that safeguards against longevity risk is greater than ever.