In a nation where queuing is an art form and discussing the weather is a national pastime, the UK employee benefits landscape presents a uniquely British challenge. How does an employer stand out in a job market where statutory benefits are already more comprehensive than in many other countries? When everyone receives 28 days of paid leave and access to the NHS, the quest to sweeten the deal becomes increasingly complex.

The answer lies in a £3.7 billion market of perks, provisions, and packages that would make even the most comprehensive Swiss Army knife seem limited by comparison. From ‘pawternity’ leave for new pet owners to on-site mindfulness pods, UK companies are redefining the boundaries of employee care.

In a post-Brexit, post-pandemic world, the rules of engagement are evolving at a breakneck pace. The UK benefits market finds itself at a fascinating crossroads, balancing the weight of tradition with the pressing need for innovation. While American companies grapple with the intricacies of health insurance, UK employers can focus on supplementary health perks, thanks to the NHS. As many countries debate mandatory pension schemes, the UK has been quietly auto-enrolling employees into workplace pensions since 2012.

Yet, challenges abound. With five generations in the workplace for the first time in history, creating a benefits package that appeals to both digital-native Gen Z’ers and Baby Boomers eyeing retirement is no small feat. Balancing the demand for flexibility with the need for structure in a hybrid working world adds another layer of complexity. A 2023 survey by Willis Towers Watson revealed that 75% of UK employees would choose a job with benefits over an identical job with a higher salary and no benefits.

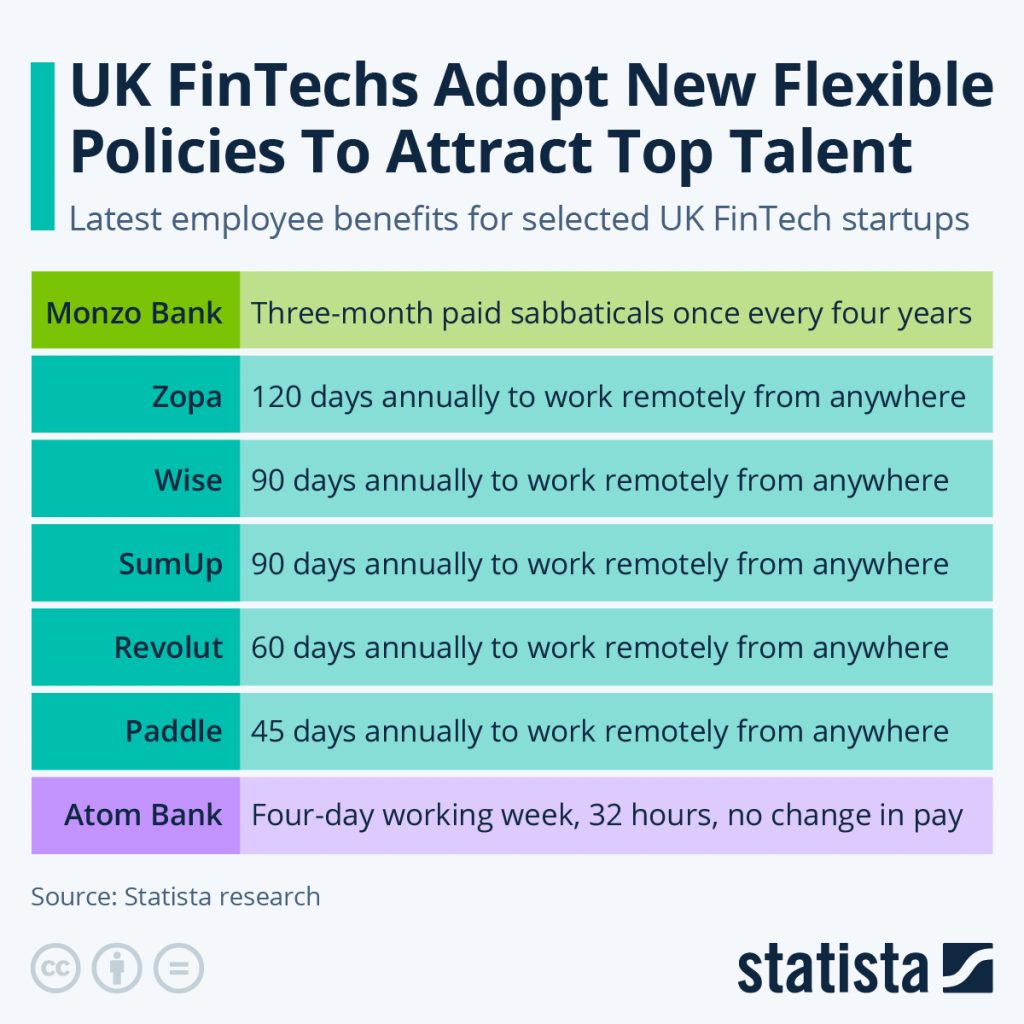

The right benefits strategy can be the difference between a company that merely survives and one that thrives. Startups have outmaneuvered industry giants by offering innovative benefits, while corporate behemoths have rejuvenated their culture through thoughtful benefits redesign.

So, let us embark on this exploration of UK employee benefits—a field where strategic thinking meets employee welfare, and where the right choices can lead to significant advantages in the war for talent.

The Evolution of UK Employee Benefits: From Safety Nets to Competitive Advantages

The journey of UK employee benefits began in the early 20th century, a time when social welfare was more a concept than reality. The National Insurance Act of 1911 marked a pivotal moment, introducing the first compulsory national unemployment and health insurance. This groundbreaking legislation covered 15 million workers, providing sickness, disability, and maternity benefits. It was a small but significant step, laying the groundwork for future developments.

The tumultuous years of World War I and II acted as catalysts for change. The need for a healthy workforce to support the war effort highlighted the importance of employee well-being. By 1942, the Beveridge Report proposed a social insurance system “from cradle to grave,” setting the stage for the modern welfare state.

Perhaps the most monumental development in UK benefits history was the creation of the National Health Service (NHS) in 1948. This revolutionary system provided free healthcare at the point of use for all UK residents. Suddenly, health wasn’t a privilege but a right. The impact on employee benefits was profound – companies could now focus on supplementary health perks rather than basic medical coverage.

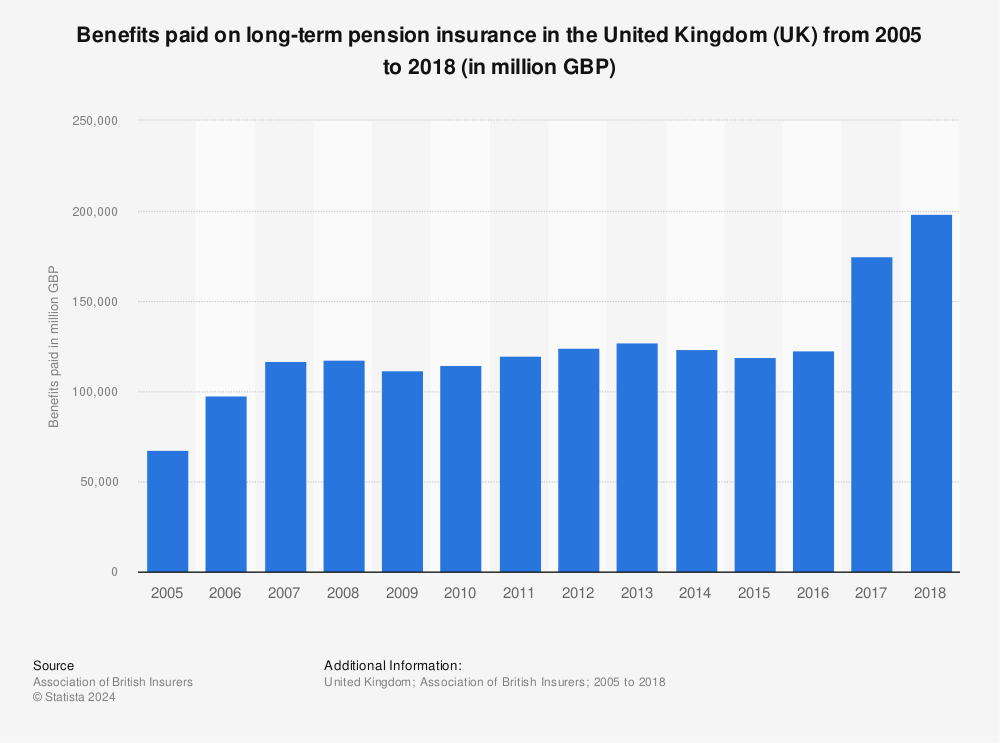

The evolution of the UK pension system tells a story of increasing complexity and coverage. The introduction of the State Earnings-Related Pension Scheme (SERPS) in 1978 was a significant milestone. It provided an additional pension on top of the basic state pension, based on an individual’s earnings. However, the system continued to evolve. By 1988, employees were given the option to opt out of SERPS in favor of private pension schemes, marking a shift towards individual responsibility for retirement planning.

The 1980s saw further expansions in statutory benefits. Statutory Sick Pay was introduced in 1983, ensuring employees received a minimum income during illness. Statutory Maternity Pay followed in 1987, providing financial support for new mothers. These changes reflected a growing recognition of the need to support employees through various life stages and challenges.

Perhaps one of the most significant recent developments in UK benefits has been the introduction of auto-enrollment for workplace pensions in 2012. This policy requires employers to automatically enroll eligible workers into a pension scheme. The impact has been substantial – workplace pension participation has risen from 55% in 2012 to 88% in 2019.

Recent years have seen a focus on equality and work-life balance. The introduction of shared parental leave in 2015 allowed parents to split up to 50 weeks of leave and up to 37 weeks of pay. In 2017, the UK government mandated gender pay gap reporting for companies with more than 250 employees, shining a spotlight on pay equality.

Comparing the UK system to its counterparts, we see distinct differences. Unlike the US, where healthcare is primarily employer-provided, the UK’s NHS provides a universal base level of care. Canada, with its provincial healthcare systems, sits somewhere between the two. In terms of paid leave, the UK’s statutory 28 days (including public holidays) outpaces the US’s lack of federally mandated paid leave but falls short of some European countries’ more generous allowances.

Looking ahead, the landscape of UK benefits continues to evolve. With an aging population, increasing focus on mental health, and the rise of the gig economy, the next chapter of UK benefits is set to be as dynamic and transformative as its past.

The Current UK Benefits Landscape: A Complex Ecosystem

Today’s UK landscape is an intricate blend of statutory requirements and innovative employer offerings, each designed to attract, retain, and support the modern workforce.

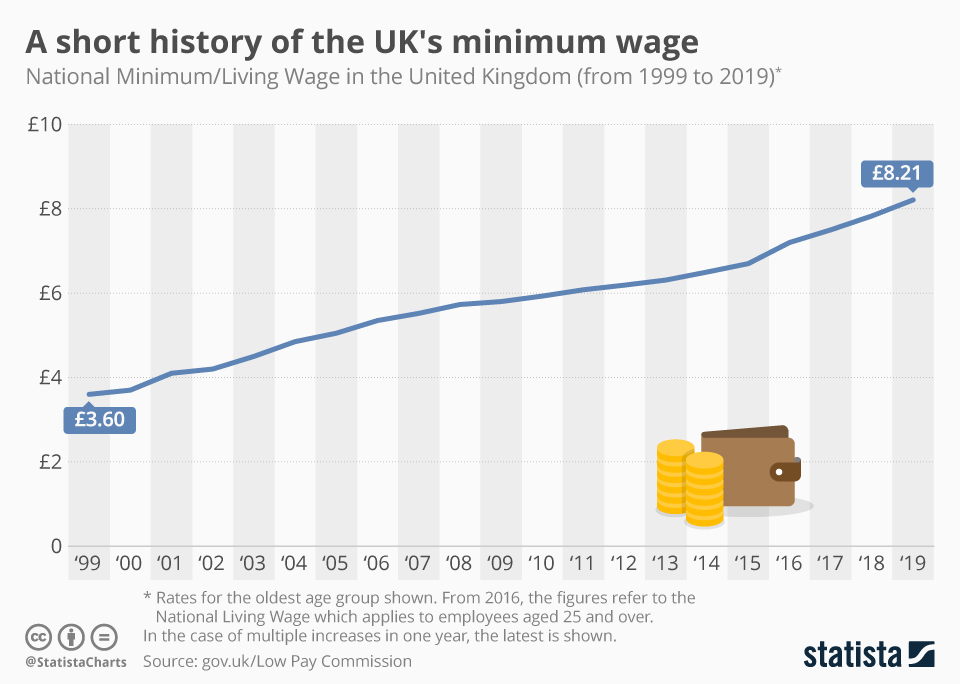

At the foundation of this complex system lie the statutory benefits, mandated by law and forming the bedrock upon which all other benefits are built. As of April 2024, the National Living Wage stands at £11.44 per hour for those 23 and over, ensuring a basic level of income for UK workers. This is complemented by Statutory Sick Pay, currently set at £109.40 per week for up to 28 weeks, providing a safety net for those unable to work due to illness.

For new parents, the UK offers Statutory Maternity, Paternity, and Shared Parental Pay. Maternity and adoption pay begins at 90% of average weekly earnings for the first 6 weeks, then shifts to £184.03 or 90% of average weekly earnings (whichever is lower) for the next 33 weeks. This support allows parents to focus on their new arrivals without undue financial stress.

Looking towards the future, the State Pension provides a foundation for retirement. The full new State Pension is £203.85 per week for the 2023/24 tax year, available to those with 35 qualifying years of National Insurance contributions. While this forms a crucial part of many people’s retirement plans, it is often just the starting point.

Beyond these statutory requirements, UK employers have developed a smorgasbord of voluntary benefits to stand out in a competitive job market. Here is a snapshot of some key offerings:

- Private Medical Insurance

- Dental Insurance

- Group Life Insurance

- Income Protection

- Mental Health Support

Pensions remain a critical component of UK benefits packages. The introduction of auto-enrollment has been a game-changer, with pension participation skyrocketing from 55% in 2012 to 88% in 2021. Many employers go above and beyond the statutory minimum, with some matching employee contributions up to 10% or more.

Annual leave is another area where employers often exceed the statutory minimum of 28 days (including bank holidays). The UK average now stands at 33 days, reflecting the growing emphasis on work-life balance. This shift is particularly pronounced among younger workers, with 73% of millennials preferring enhanced work-life balance benefits over a pay raise, compared to 56% of baby boomers.

The most significant trend in recent years has been the rise of flexible benefit schemes. A whopping 76% of UK employers now offer some form of flexible benefits, allowing employees to tailor their packages to their individual needs. These schemes often include options like:

- Buying or selling annual leave

- Health screenings

- Gym memberships

- Technology purchases

- Travel insurance

The landscape is not uniform across all businesses, however. While large corporations often offer more extensive benefits packages, SMEs are rapidly catching up. SMEs often compensate for any shortfall in traditional benefits with more personalized, flexible working arrangements, which can be highly attractive to many employees.

Recent events have also left their mark on the benefits landscape. The COVID-19 pandemic has been a catalyst for change. A significant number of UK companies enhanced their well-being offerings in response to the pandemic. Flexible working has become the norm.

The rise of technology has also transformed the benefits landscape. Today, over 60% of UK employers use some form of benefits technology platform to administer and communicate their offerings. This shift has made it easier for employees to understand and engage with their benefits, addressing a longstanding issue where most UK employees did not fully understand their benefits package.

Financial wellbeing has emerged as a key focus area, with 24% of UK employers now offering financial education or guidance as part of their benefits package. This trend reflects a growing recognition of the link between financial stress and overall employee well-being and productivity.

Emerging trends are also shaping the benefits landscape. Green benefits, for instance, are gaining traction, with 35% of UK companies now offering some form of environmental or sustainability-focused benefit, such as electric car schemes or cycle-to-work programs. Meanwhile, 22% of UK employers offer eldercare support or benefits, recognizing the growing number of employees with caregiving responsibilities.

Regional variations add another layer of complexity to this landscape. London-based companies are 20% more likely to offer private medical insurance compared to the national average, while Scotland leads the way in offering enhanced pension contributions, with an average employer contribution of 7.2% compared to the UK average of 6.5%.

As we survey this complex and ever-changing landscape, it is clear that UK employee benefits have come a long way from the basic statutory provisions of the past. Today’s benefits packages reflect a delicate balance between meeting legal requirements and innovating to meet evolving employee needs. Looking ahead, the challenge for UK employers will be to continue adapting their benefits strategies to attract and retain talent in an increasingly competitive job market. One thing is for certain – just like British weather, the UK benefits landscape will continue to be a topic of endless fascination and discussion.

Healthcare – The NHS and Private Medical Insurance

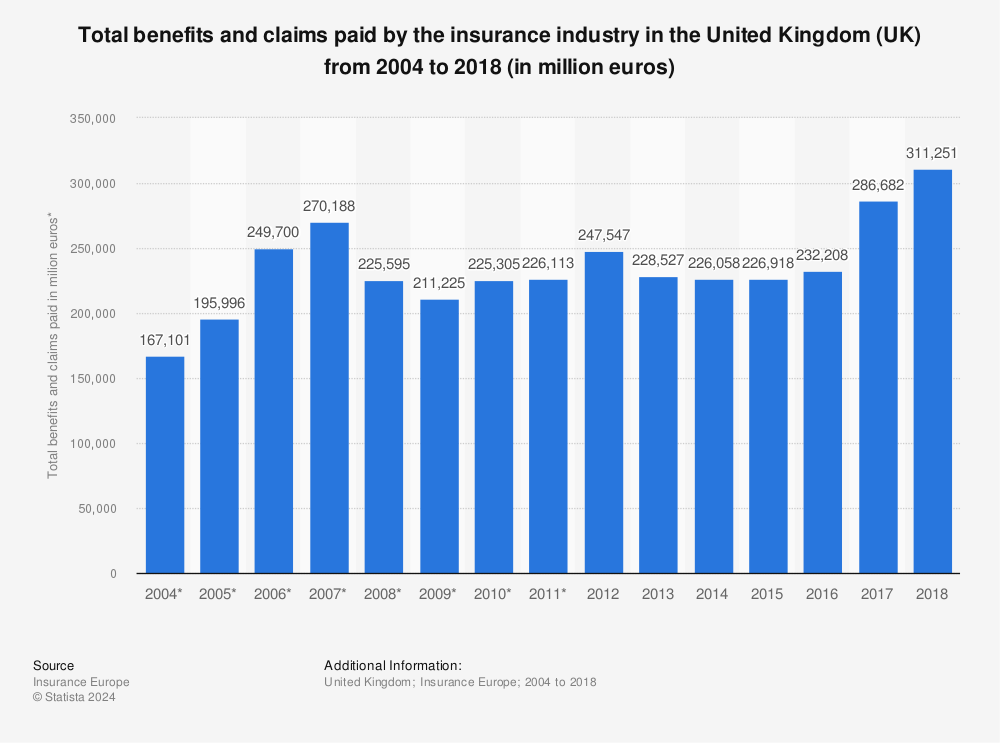

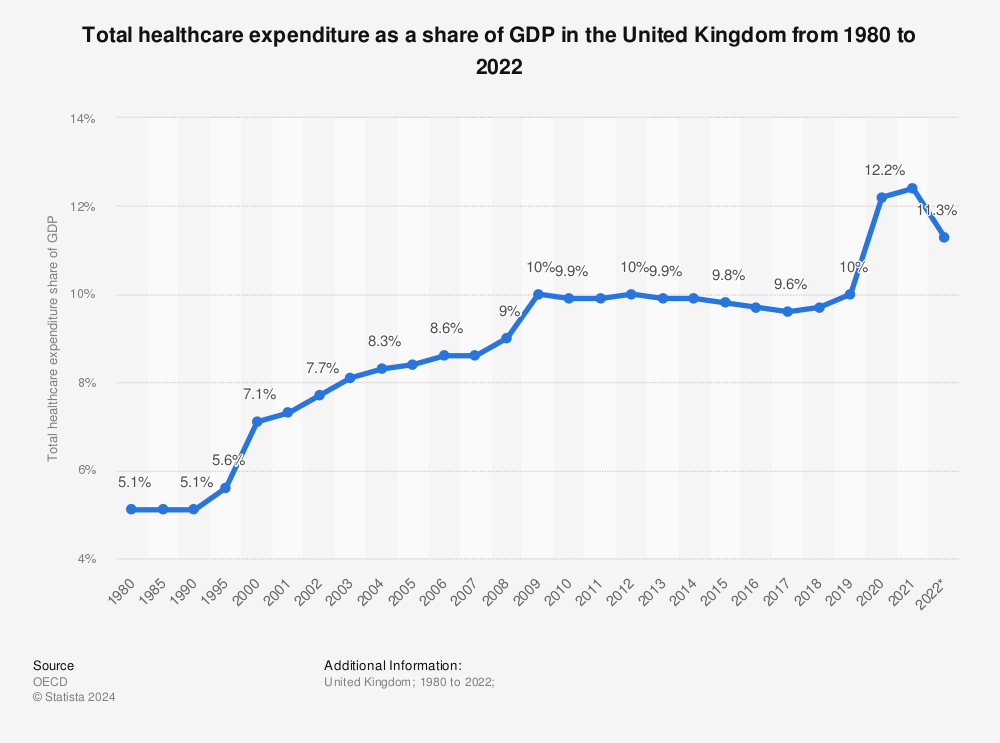

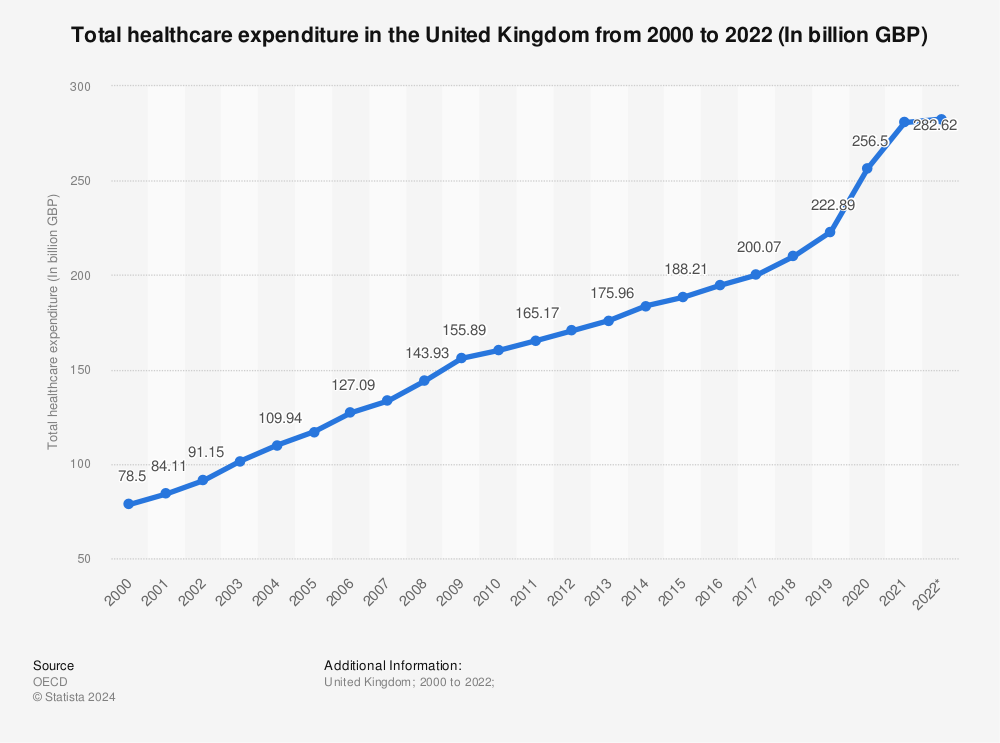

Established in 1948, the NHS provides comprehensive healthcare services to all UK residents, free at the point of use. It is funded primarily through taxation, with the 2023/24 budget reaching £192 billion, representing about 9.3% of UK GDP.

While the NHS is a source of national pride, it is not without challenges. As of October 2023, the average waiting time for routine operations stood at 14.5 weeks, with some specialties facing even longer delays. This has led many employers to offer Private Medical Insurance (PMI) as a complementary benefit.

Approximately 13% of the UK population has some form of PMI, with 67% of these policies provided through employers. PMI typically offers faster access to consultations and treatments, a choice of specialists, and private hospital rooms. However, it is important to note that PMI usually does not cover emergency care or chronic conditions, which remain under NHS purview.

Compared to the US system, where employer-provided health insurance is often the primary source of coverage, the UK’s dual system offers a safety net for all, with PMI providing additional options. Canada’s system, while also universal, is administered provincially, contrasting with the UK’s national approach.

Group Income Protection (GIP) has become an increasingly valued benefit, with 42% of UK employees now having access to some form of GIP. These policies typically pay out 65-75% of salary if an employee is unable to work due to long-term illness or injury. Group Life Insurance, often providing a lump sum of 3-4 times the annual salary in the event of an employee’s death, is offered by many UK employers.

Regulatory Framework and Compliance in The UK Benefits Ecosystem

The foundation of UK benefits regulation is built on several key pieces of legislation, each playing a vital role in shaping the landscape/

The Pensions Act 2008 introduced automatic enrolment, revolutionizing workplace pensions. The Equality Act 2010 ensures non-discrimination in benefits provision, covering protected characteristics such as age, gender, and disability. This act has been instrumental in promoting fairness.

The Finance Act, updated annually, governs the tax treatment of benefits. The Employment Rights Act 1996 sets out basic employment rights, including those related to leave and pay. It remains a cornerstone of UK employment law.

Several key bodies oversee benefits compliance, each with its own jurisdiction and powers.

The Pensions Regulator (TPR) is responsible for workplace pensions. The Financial Conduct Authority (FCA) regulates financial services firms providing pension and investment products. HM Revenue & Customs (HMRC) oversees the tax implications of benefits.

The UK’s approach to benefits regulation sits somewhere between the US and EU models. While less prescriptive than the EU’s comprehensive directives, it offers more standardized protections than the varied state-by-state approach seen in the US.

The Impact of Brexit on Employee Benefits

The reverberations of Brexit on the UK’s employee benefits landscape extend far beyond mere regulatory changes.

Geopolitical Considerations

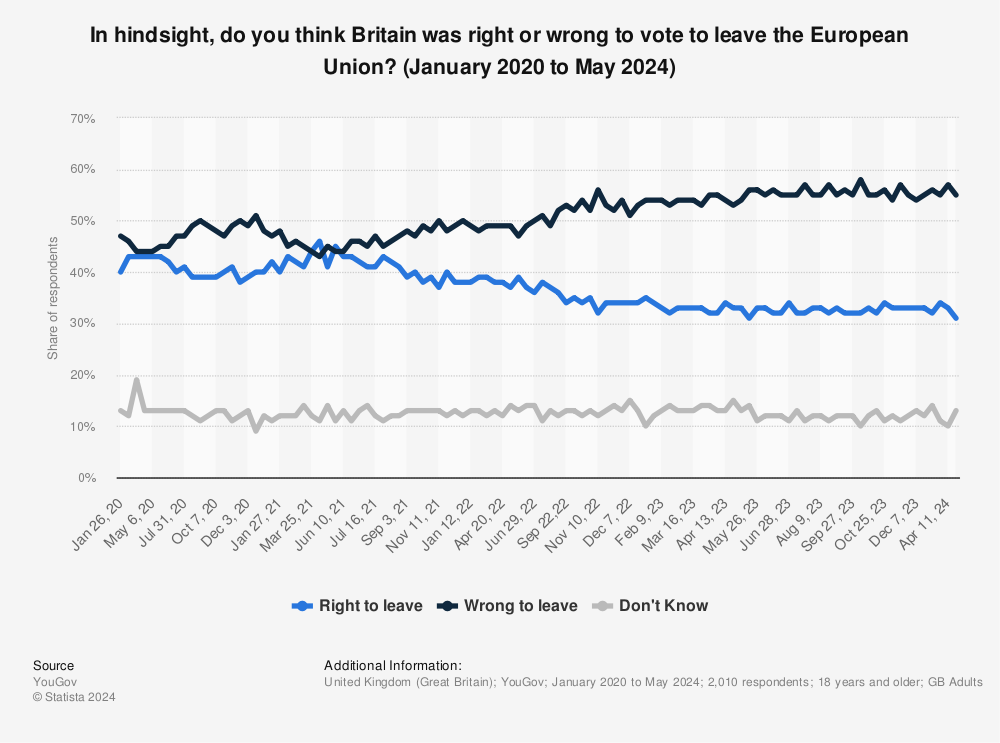

- Regulatory Divergence: While the UK initially retained most EU-derived employment laws under the European Union (Withdrawal) Act 2018, we are now witnessing a gradual ‘drift’ in regulatory approaches. The UK government’s “Brexit Freedoms Bill” signals an intent to more aggressively diverge from EU regulations. This could lead to a fundamental reshaping of core benefits structures, particularly in areas like working time regulations, agency workers’ rights, and TUPE (Transfer of Undertakings Protection of Employment) rules. For multinational companies, this divergence creates a complex compliance landscape.

- Cross-Border Talent Mobility: The end of free movement has profound implications for benefits portability. The UK’s points-based immigration system has made it more challenging for EU nationals to work in the UK, and vice versa. This has led to a reimagining of expatriate benefit packages. A significant number of UK companies have enhanced their international benefits offerings to attract scarce talent post-Brexit. These enhanced packages often include provisions for cross-border healthcare coverage, pension transferability, and cultural integration support.

Financial Implications:

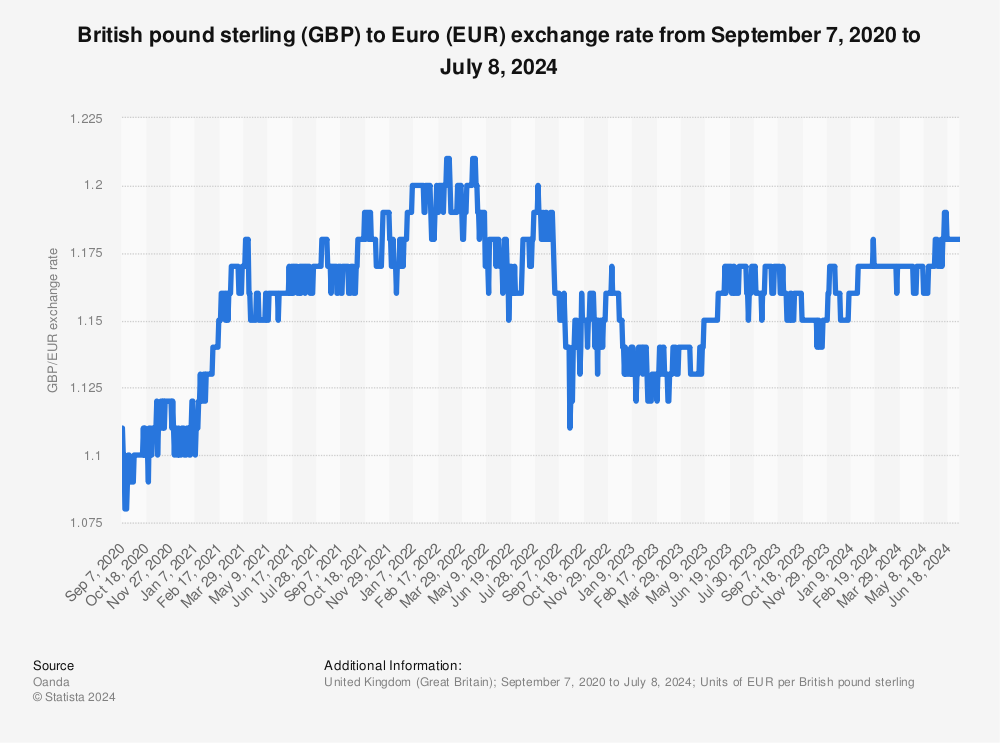

- Currency Fluctuations: The volatility of the pound sterling since the Brexit referendum has had far-reaching effects on benefits costs. For defined benefit pension schemes, currency fluctuations have impacted the value of overseas investments.

- Financial Services Passporting: The loss of passporting rights for UK financial services firms could complicate the provision of certain benefits, particularly for multinational companies.

Social Dynamics

- Workforce Composition: The changing demographics of the UK workforce post-Brexit have necessitated a reevaluation of benefits offerings. With a decrease in EU migrant workers, particularly in sectors like healthcare and hospitality, employers are enhancing benefits to attract and retain domestic talent.

- Health Tourism and Reciprocal Healthcare: The end of the European Health Insurance Card (EHIC) system for UK citizens (replaced by the UK Global Health Insurance Card) has implications for both employer-provided travel insurance and the structuring of health benefits for employees who frequently travel to the EU.

Conclusion

The UK’s approach to employee benefits stands at a pivotal juncture, shaped by the twin forces of Brexit and the global pandemic. This uniquely British landscape presents both challenges and opportunities that will define the future of work in the country.

Britain’s aging workforce, the rise of the gig economy, and the ongoing evolution of the NHS all contribute to a distinctly national context for benefits innovation. The coming years will likely see a reimagining of workplace support that goes beyond global trends, instead forging a path that reflects Britain’s particular values and aspirations.